Another month. More things. Much roundup.

Bad News

Jesse Smith writes in Asterisk that our HVAC workforce is both deeply incompetent and deeply corrupt. This certainly matches my own experience. Calculations are almost always flubbed when they are done at all, outright fraudulent paperwork is standard, no one has the necessary skills.

It certainly seems like the Biden Administration is doing its best to hurt Elon Musk? Claim here is that they cancelled a Starlink contract without justification, in order to award the contract to someone else for more than three times the price. This was on Twitter, but none of the replies seemed to offer a plausible justification.

Claim that Twitter traffic is increasingly fake, and secondary claim that this is because Musk fired those responsible for preventing it. Even if it is true that Twitter traffic is 75% fake, that does not mean that your experience will be 75% bots, or even 7.5% bots. Mine is more like 0.75%. As usual, the bots are mostly making zero attempt to not look like bots, and would be trivial to find and ban if people cared.

Nate Silver is correct that ‘misinformation experts’ are collectively making a mistake when they themselves spread highly partisan misinformation, and also that the game theory makes it impossible for them to collectively stop.

The word ‘genocide’ risks being watered down to the point where we will not have a word for what it used to mean, and this will make it much harder to maintain the taboo of Never Again.

Avatar: The Last Airbender’s live action Netflix version decides that some of the scenes in the original ‘are iffy’ and it needs to soften a cartoon show made for eight year olds, to exclude a character arc where a boy grows up and learns not to be sexist, because the character started off too sexist. Not that I was ever watching anyway. As one commenter notes, if that is an issue, in news related to the previous item, wait until you hear about the Fire Nation.

An essay correctly identifying some (but far from all) of the problems with modern (post-2017) Star Trek, and how things have shifted from Starfleet being fundamentally good and its officers as professionals committed to behaving as such and living up to its ideals, to Starfleet being more often than not the enemy institution to be critiqued and opposed morally and practically, although its rivals are still worse, and everyone standing up for personal morality and vibes rather than caring about principles, professionalism, discipline or truth.

Picard I see as doing this ‘on purpose’ as subject, while still embodying the ideals of old Star Trek and thus still being actual Star Trek, Picard falls back upon moral authority because this is a scenario in which he lacks chain of command, whereas Discovery is simply a distinct entity (also its imagined future pretty much ruins everything) and thus I do not treat it as canon.

(Strange New Worlds a lot of people I know think is great, but both I and my wife stuck with it for that reason and found it unwatchable and bad on pure quality grounds, the issues pointed at here didn’t seem to be the problem.)

More on the lying, cheating bathroom scales that have been imbued with memory. A vision of one form of nightmare awaiting us in a future full of things that have ‘intelligence.’ Good news is the replacement scale I bought lacks this ‘feature.’

Claim that the remote work is devastating to talent development in software engineers. As someone who has worked from home most of their various careers I am skeptical. Yes, I see the value of in-person contact for tech, but it would be so easy to also make the opposite case.

Another case against smartphones, this one that they obviate and eliminate the opportunities and finitudes in which those virtues are cultivated. And yes, ‘your pocket calculator’ and everyone else’s can radically alter dynamics to derail many who would otherwise be likely to accomplish great things. It is amazing that those terrified of the slightest regulation as the death of innovation will often deny that any other obstacle in someone worthy’s path could ever stop them. You can’t have it both ways.

To what extent is our continuing to cook our own food a regulatory issue? To what extent is it us not actually being all that rich?

I do not think it is lack of wealth. Cooking for yourself is not even obviously more efficient, since you give up mass production. The places that most economize on food, such as schools and armies and collectivist groups, very much do not have anyone cooking for themselves. Cooking for yourself can be a luxury. You get food exactly how you want it, when you want it, fresh and not (do not underestimate fresh and hot) and you get to do something many people enjoy and find rewarding. This does break at the extremes, but that is a long way from where we are, and the very fact we are rich makes the labor required expensive. Being richer won’t save you from cost disease.

So how much does the regulatory issue matter? What would happen if we did not charge extra taxes when food production was outsourced, as opposed to the current method where groceries are immune from taxation and also your labor preparing them is not taxed? What if we also allowed things like small-batch sales from whoever wanted to cook something that day, and enabled that marketplace to properly clear? How much would we then rely on others more?

My guess is there would be substantial movement but less than you might anticipate. There are real natural advantages to cooking for yourself and your family. People rightfully take joy in cooking, and it has its benefits.

One might even say that there is a strange curve, where one starts out so poor one cannot cook, gets rich enough to cook, then gets rich enough to not cook, then rich enough to start cooking again, then perhaps rich enough to have a personal chef.

$250 an hour empty nest coaches for parents who can’t handle it? I mean, sure, I guess, shrinks cost what they cost. I love my kids but do not anticipate having this problem. Oh no, suddenly I have lots of space and money and time.

Extensive guides are being offered to the puzzle that is Disney World, where the stress, planning, time and money costs seem to be spiraling out of control. I have no doubt there is much genuine magic to be had underneath it all, but none of this seems like something any sane person would subject themselves to on purpose, unless you placed very high story value on it. I suppose this was inevitable. People are bidding against each other for the Disney World experience using various currencies, there are a lot of Americans and only one park, so only those who get unusually high value from it will find it worth the price. Seems like there is a lot of winner’s curse going on, also toxic dynamics involving the expectations of children, where the existence of the park is for most people a net negative whether or not they go.

More on the Apple Vision Pro

Here is one good use case, showing giant reams of sheet music while playing piano.

Chris Velazco tries it out for the Washington Post. He concludes it has its uses, but that ultimately no you do not need it. The spacial computing as work plan continues to not look good at current margins versus using a desktop with multiple monitors.

Mark Zuckerberg strikes back, flat out calls Quest the better product even ignoring the price differential. Apple’s screen resolution is better, he says, but they had to make tons of compromises to get it, and for most purposes the Quest is better, because it is open and there is software for it and it supports more use cases and input devices.

Demos for the Quest were not available locally, but I tried one on and the difference in resolution was obvious right away.

Liron Shapira joins those returning their Vision Pro, as he was looking for productivity, and the mirroring DPI wasn’t good enough. He did find it promising otherwise as a relaxing work environment, and notes that ignoring his family can also be fun. I applaud him for running the experiment. He does note it might work for those who are already at lower resolutions due to poor vision.

Meanwhile reports are it will be at least 18 months before the second version is available.

Time is valuable and optionality is great. So it still simultaneously seems crazy to buy one, and also crazy to not buy one. I am leaning towards passing, but still not sure.

For Science

helicopterosaur: In a randomized controlled experiment, even if the difference you're measuring is not there, you can still get a statistically significant result if you roll a natural 20.

Ronny Fernandez: Of course, part of what's sad here is that scientists tend to think of this as rolling a natural 20 rather than as rolling a natural 1.

Another problem in science is that prestigious journals are now sufficiently gated that publishing in them actively interferes with scientific work.

Ethan Mollick: Evidence that academic publishing is now doing the exact opposite of what it did before the internet. It is now a massive gatekeeper to knowledge, rather than a way of distributing it. Publishing in an expensive journal can lower, rather than raise, citation counts.

Florian Ederer: Market power hinders the dissemination of knowledge.

+1% increase in journal price ➡️ -0.83% article’s citations and -1.07% citing author count with much larger effect for citations from lower-ranked institutions.

Immediate boost to citations when an article becomes free on JSTOR.

Most economics papers and other academic work is useless, everyone involved knows this, outside of the top quartile it is essentially a grift where nothing would survive critical review. Tyler Cowen retweeted and I too have come around to thinking this is basically correct.

Also here we see that the statistical results of economics papers are so frequently selected, and so excessive in their results as compared to their statistical power, that a majority of them are at best misleading.

A large majority of empirical evidence reported in leading economics journals is potentially misleading. Results reported to be statistically significant are about as likely to be misleading as not (falsely positive) and statistically nonsignificant results are much more likely to be misleading (falsely negative). We also compare observational to experimental research and find that the quality of experimental economic evidence is notably higher.

I have done my best to be skeptical, both of each result and of academia in general.

It seems I need to up my game.

Climate

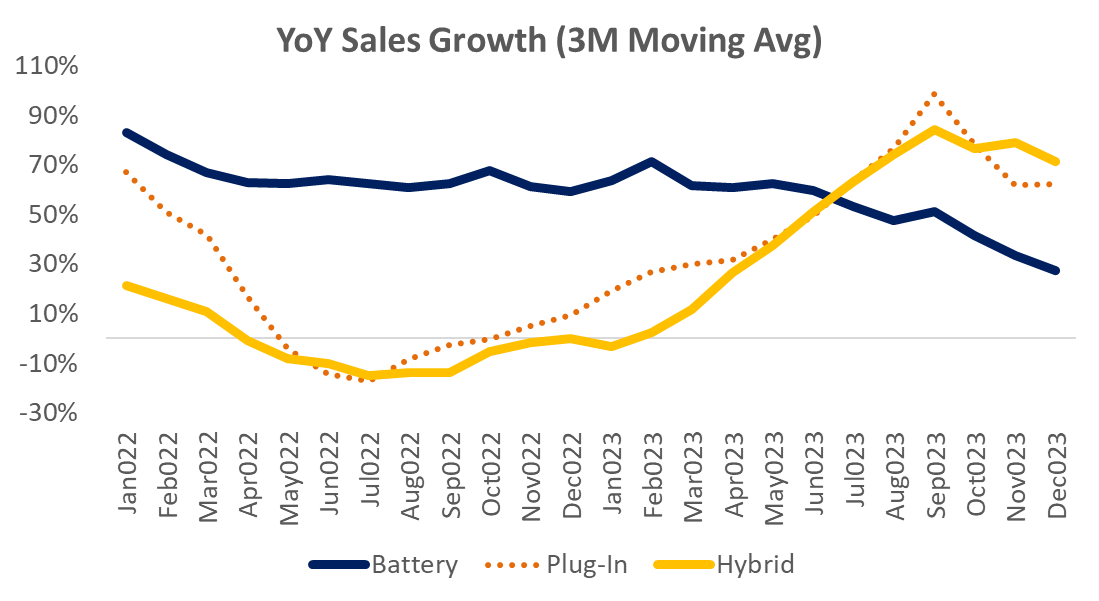

Technically bad news, the growth rate of EV sales has slowed? Everyone remember how exponentials work?

Those are growth rates, so the complaint is that we aren’t selling enough more than we were before in relative terms. Oh, no.

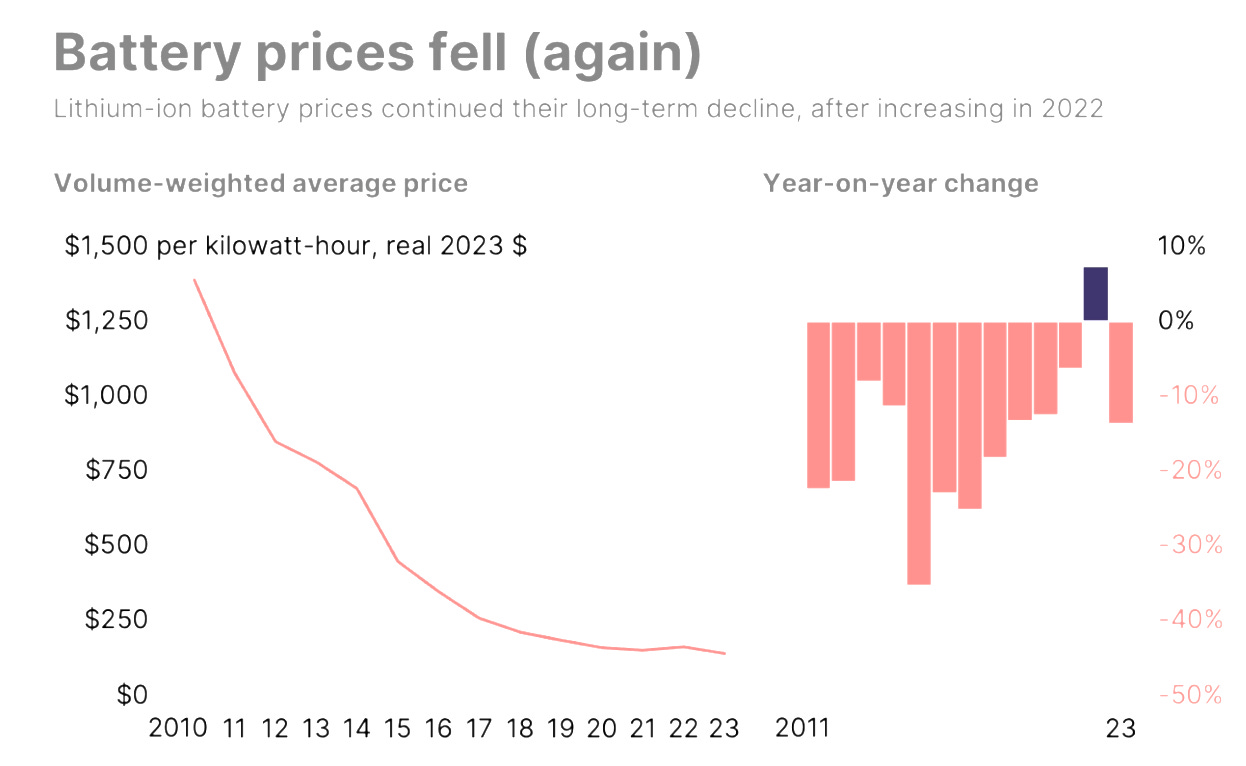

Lithium prices are declining once again.

Variously Effective Altruism

Billionaires commit a lot of crime and fraud. That is how I would summarize the key findings of Ben West in Rates of Criminality Amongst Giving Pledge Signatories, where roughly 200 non-EA billionaires pledged to give most of their money away, and we find 25% have been accused of financial misconduct, 10% or so have been convicted of financial misconduct, 4% have spent some time in prison and 41% have at least one misconduct allegation against them.

It is of course possible that signing a pledge saying you will give all your money away correlates highly with willingness to do crime and be deceptive, for various reasons, along with the obvious reasons to suspect the opposite. My guess is this is representative.

My presumption is also that the rate of actually doing the crime vastly exceeds the rate of doing the time. Most crimes of almost all types are not punished, most perpetrators not caught let alone convicted. White collar crimes of billionaires seem unlikely to be an exception. You could say that they bring greater scrutiny and have more enemies. They also have much better tools to avoid consequences.

Why? My model says that the acts required to become a billionaire make you willing to engage in such conduct if you weren’t already, and those winning to engage in such conduct are much less likely to become billionaires. Also the world has a lot of fraud and crime in it. I still think it is important to draw the distinction between ‘ordinary decent fraud’ versus aggressive fraud versus outright fraud, and how much we expect of each one. As the post notes, our intuitions for such situations are often poor.

The discussion section is disappointingly mostly about how much to expect there to be scandals from those giving to charity, rather than learning important facts about the world.

I continue to have the point of view that if someone wants to donate their money to a good cause, that money should be used for the good cause.

I don’t get this either, and consider it evidence against the broader EMH that companies generally do reasonable things:

Gordo: there is no way it is good marketing practice for a company to email you 9 times within 2 days of purchasing a product how on earth are we justifying these actions.

There is no question in my mind that many companies massively over-email you when you buy their products. I presume this is a simple case of each email having clear benefits where sometimes people respond and buy something or give you traffic, and they impose costs on users that those users then punish you for gradually over time. In general, if something has this form, where you burn goodwill for benefits now, I expect massive overuse.

Political charitable donations and apolitical charitable donations are functional substitutes, increasing donations to the Red Cross in the wake of a natural disaster and increasing political donations in the wake of campaign adds come partly at each others’ expense. It seems odd to think that it would be otherwise. Do people forget that giving to politics is giving to charity? If you are familiar with Effective Altruism, you understand the core insight that a lot of charitable donations have zero or negative net impact, so there’s nothing weird here.

Rules for cults from Ben Landau-Taylor’s mother. If the group members are in contact with their families and people who don’t share the group’s ideology, and old members are welcome at parties, then proceed, you will be fine. If not, then no, do not proceed, you will likely not be fine.

I strongly agree with Sarah Constantin that the old school Patron model of ‘rich person decides to fund this and funds it’ model is highly underrated, including that it is very much working for me. There are major obvious flaws, you cannot fully systematize it and would not want to. But I love it because it lets everyone involved focus on what matters and actually do the valuable thing. You can create something far more valuable, or do much better scientific work, if you do not need to constantly be checking your incentives and dealing with various forms of fundraising or revenue.

The Plan

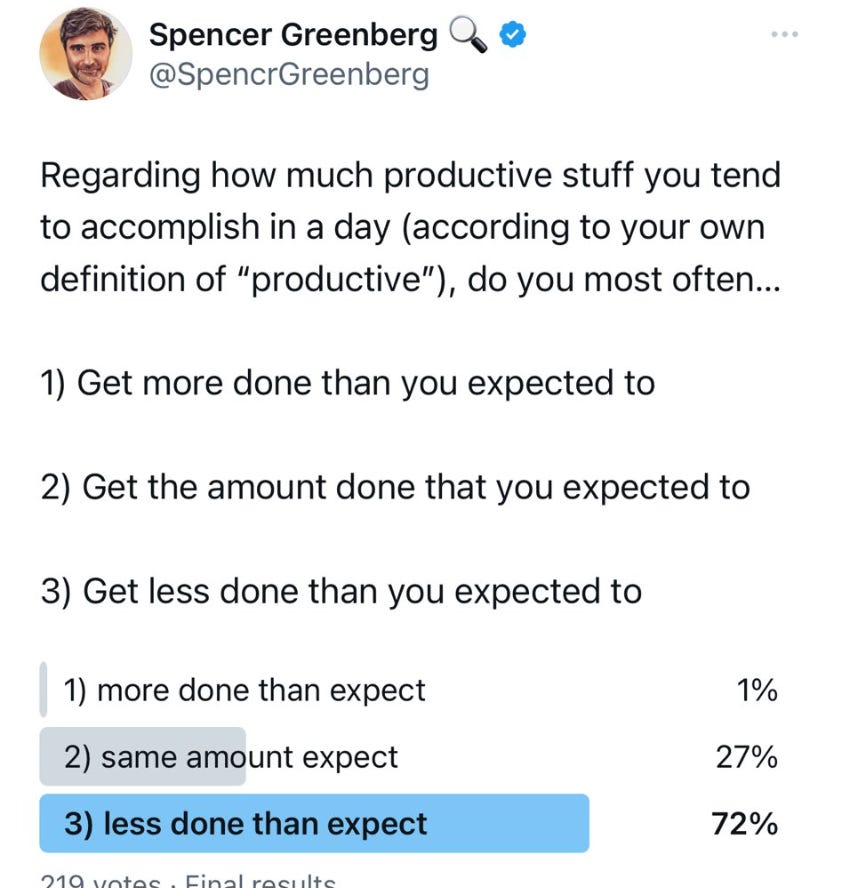

Spencer Greenberg notes that most often people end up getting less done than they expect, and it is very not close.

Spencer Greenberg: The results of this poll are wild. Given that this is about daily activity, why don’t people’s anticipations adjust for how much they can get done??? I have this same problem, so I’m also wondering this about myself.

Anna Salamon: I made my predictions more pessimistic until accurate. This made my output worse (couldn't not take predictions as targets). Eventually decoupled predictions from targets by practicing in taxing, success-unlikely games until I could fully try while ~20% likely to succeed.

Warlock: Cool! What games?

Anna Salamon: Mostly: 20 questions (modified to be harder by picking random, difficult words), and difficult rounds of the "clicker game" (a game where group picks an action while I'm out of room, then "clicks" when person comes closer to it). Also consciously practiced porting to life tasks.

In practice my observation is that ‘what one expects to accomplish’ ends up being the same as ‘what one plans on accomplishing’ or even ‘what one aims to accomplish, if things go well.’ Then the median might end up being that you accomplish what you expected, but often you will fail, whereas it will be rarer for you to accomplish substantially more than that. Indeed, if you accomplish it all, you likely stop.

My solution, I think in practice, to this is to recognize that this is what I am doing by default, and notice that I should not conflate these two things, and to be fine with often ending the day disappointed. Indeed, I frequently end the day disappointed, asking why it was not more productive. Yet still, the productivity does happen.

Agency, Cate Hall and Finkel’s Law

Cate Hall offers an excellent post that is nominally about how to cultivate agency.

It is about that. It is also more general. It is about how to accomplish things in general. How to be effective.

The central theme is what I call Finkel’s Law: Focus Only on What Matters.

Most people think agency is largely about grinding through tons of hours. It isn’t. It is about buckling down and doing the real work that determines outcomes.

Cate Hall: These days I set boundaries that would have made me ashamed at earlier points in my life: I’m offline at 6 p.m. almost every night, and rigorously observe a Sunday Sabbath where nothing with the flavor of effort is tolerated. These will seem like small things to some people, but like a mortal sin to others in the communities I run in.

My rule is never to take instructions on how hard I should work from someone who hasn’t burned out before. Very few people take this seriously enough.

I do not follow as strictly, I prefer to be more flexible with time and often not writing feels less relaxing than writing, but I am very much with Cate on setting limits.

Her other specific advice, all of which I endorse:

Court Rejection. Practice making unreasonable asks. Aim high.

Seek Real Feedback, especially anonymous feedback.

Increase Your Surface Area For Luck. Talk to as many people as possible, see what happens, even when you’re not sure why or if the person is worthwhile.

Assume Everything is Learnable. Not only skills, also many attributes. You have to be willing to do the boring work, but it can pretty much all be done.

Learn to Love the Moat of Low Status, when you are acquiring new skills and you need to mess around trying but still suck at the skill.

This is all the service of Focus Only on What Matters. Look for the big edges, the things that make a big difference. That does not mean you get to neglect the fundamentals. Everyone needs to be blocking and tackling. That matters too. Then you need to also put the focus on other things that matter.

Here is her example:

Cate Hall: Two friends and I maniacally studied reads together, and we all had out-of-distribution results. But when we’d tell other pros what we were doing, the response from most was “nuh-uh, that’s not a thing.” They weren’t willing to consider the possibility that reads were valuable, maybe because they didn’t want to feel obligated to study them.

All of my agency hacks are kind of like this, in my opinion -- big, glaring edges that people might rather ignore.

I think pros have largely come around since then on the value of live reads. You can still try to ignore that to avoid ‘getting leveled’ in such games, trying to rely on reads makes you exploitable, but the competitors on the amazing Game of Gold made it clear that live reads are a huge deal even among pros.

Certainly in Magic: The Gathering reads have always been huge. I would constantly fret that someone who paid enough attention could notice various things, and try to make it harder on them. I also made a lot of effort to get good at reading people in various ways, and to develop a talking game that helped me get good reads and also to get opponents to relax, while hiding information that mattered.

An even better parallel might be Fact or Fiction splits. When you play Fact or Fiction, the opponent must divide five cards into two piles, and then you choose one to keep. When the card came out, it was clearly going to get played a lot. My testing partner Seth and I realized that good divisions would be very high leverage, and we spent a lot of time going deep analyzing various splits and situations. That work directly let me steal at least one win by tricking the opponent into taking the wrong pile, getting me into the final day.

I do not do anything like enough of the things Cate is talking about here.

I don’t make big asks often. When I do, I scarily often get them.

I don’t sufficiently actively seek out feedback, and don’t provide a way to give it anonymously, although I do prefer to get it non-anonymously.

I don’t sufficiently actively seek out meetings with others, despite high returns.

I don’t devote much time to intentional skill development.

I don’t like sucking at things. I do like the feeling of rapid improvement and the expectation of getting better. But I don’t appreciate it enough.

Loop de Loop

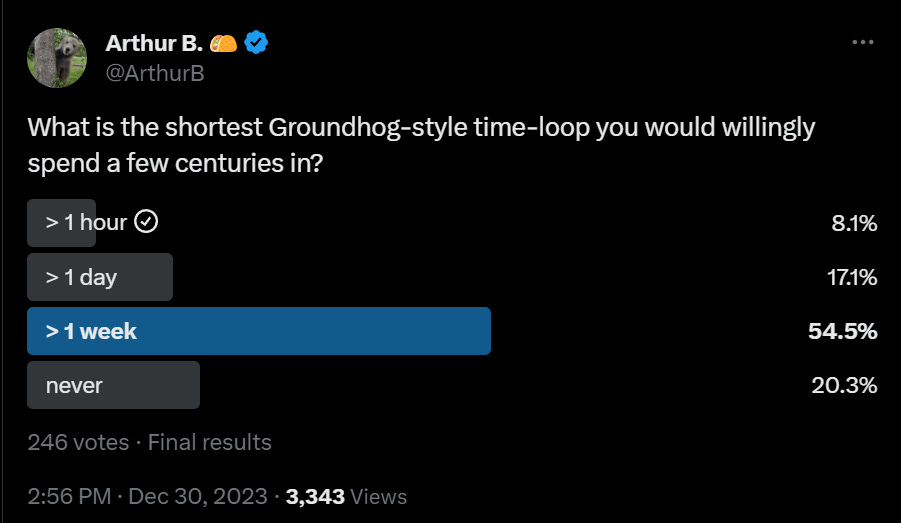

People do not appreciate true opportunity.

In the standard setup, you would retain knowledge of previous loops, your memories, experiences and skills, but everything else resets, including your physical state, no matter what.

To answer the question completely, one must ask what are the starting conditions and other rules.

If you are starting from a sufficiently terrible position with no good options, such as locked in a prison or in the middle of nowhere, you might need to spend substantial time fixing that each loop if you want to do much. It might even be impossible with perfect play.

Keeping your sanity is going to be a crucial problem if you are locked in a room or something. If you can handle that, there is a lot out there to think about, and I still think it’s a clear yes, but I do realize reasonable people could disagree. That is, however, a highly extreme case.

If you are starting from a normal position, with your usual resources, and you live in a city or even a town, you can do a hell of a lot in an hour even on the first or second loop.

Once you know the landscape, you can do quite a lot. And that’s locally. If you also have a phone or a computer? You can access all the world’s knowledge.

Consider this loop: A fully secured room, you can’t get out and no one can come in, one hour, but you have a desktop computer with internet access.

With that loop, you can watch every movie and show, read every book, study every intellectual discipline and non-physical skill, speak to a large percentage of the world’s people.

I don’t know how long I would choose to stay in that loop, but only centuries seems clearly like a massive punt. If you gave me a perfect (or good enough) memory that my knowledge and skills didn’t atrophy, I’d want a very, very long time. On the other hand, if you gave me a highly imperfect memory where I forget things, it’s very possible there is no upper bound, because I’d forget things faster than I could enjoy them, so the loop is permanently positive.

If you’re talking about loops of over a week in a normal situation, the whole thing is madness. Now you can go anywhere, do almost anything, learn almost anything to help you do it. I’d want to come out of the loop with the code for an aligned AGI.

There is also all the hedonic value. Every loop you get to eat anything you want and not face the consequences, along with every other available experience. Even if you have deep ethical qualms there are so many options, and in so many ways there is plenty of time to do the research.

Also note that if you get the last run of the loop on your way out, as is traditional, and it is not very short, then you also get almost unlimited funds, because you are the ultimate insider trader holding a full Sports Almanac, and you can do trial runs on that, and should. If you have a day out in the open and don’t leave with at least billions that’s on you.

So while Arthur initially meant to demonstrate that beyond some time frame it is a blessing, and I mostly agree with that, I think that time frame is very short.

Government Working

NBER working paper claims that scientific advancement is much less a public good than we think, that the best and most useful science is done in private industry, and therefore that government funding of academic science is plausibly an active negative.

Patrick McKenzie takes his shot at explaining that the USA is on the verge of effectively forcing many companies that hire engineers to have tax rates over 100% due to forced amortization over five or even fifteen years, that many engineers are going to have to be fired if this isn’t fixed, no one wants that outcome, yet it remains unfixed.

You assume that no one wants public toilets to cost $1.7 million and not even be finished, that this must be incompetence. Do not be so confident.

Alec Stapp: "Under city law, for example, installing the Noe Valley toilet — even the free one — requires that the Recreation and Parks Department coordinate with or seek approval from San Francisco Public Works, the Planning Department, the Department of Building Inspection, the Arts Commission, the Public Utilities Commission, the Mayor’s Office on Disability, and Pacific Gas and Electric."

Paul Graham: The people currently running San Francisco are not merely politically extreme. They're also just plain incompetent. $1.7 million to build one public toilet isn't a liberal vs conservative thing. Nobody wants that.

Patrick McKenzie: Do you know the Spider-Man panel with “But I don’t want to cure cancer. I want to turn people into dinosaurs.” ?

I have had some meetings with people who passionately believe in values systems that I would not have predicted would be ones someone could expouse except as a bit.

And while I wouldn’t predict someone would say “Oh toilets must cost $1.5 million that’s just science” in a meeting I would also not have predicted “Saving lives is a bad thing actually if doing so has bad distributional effects and so I will oppose it on the margin.”

Patrick is not speaking metaphorically. He is talking about vaccine distribution. Similarly, I do not think anyone actively wants to spend the extra money. However, I do think key people believe that cost is essentially irrelevant compared to being responsible and inclusive and equitable and so on, and think the status quo is righteous.

Can the government mandate a pause? Maybe not for foundation models, but for long term projects to facilitate LNG exporting that would improve the climate and our economy while helping our allies, but that sound like something they might dislike, the Biden Administration says yes.

New Jersey bans plastic bags, alternative bags people then use instead have 500% bigger carbon footprint, as the ‘reusable’ bags people use instead, in addition to being a royal pain in the ass, are a lot worse as used in practice, since the average number of uses is about two and a half.

Sar Haribhakti: "This ought to be the motto of the climate lobby: We don’t help the environment, but we feel good about it anyway."

I worry the actual motto is ‘We actively hurt the environment, but we make people visibly suffer and hurt the economy while doing so, and that makes it all worthwhile.’

I am all for doing things that actually help the environment and actually fight climate change, provided the cost-benefit analysis is reasonable. There have been some very good programs. Increasingly, alas, the dominant mode has been otherwise.

Airfares are halved (!?) when three competitors fly a route versus a monopoly provider, and more competition drops fares further. My guess is this is overstated quite a bit due to selection effects, as the profitable routes are the ones where other airlines push to provide that competition, but I have little doubt the effect size is large. We could substantially reduce airfares while improving quality and quantity by allowing foreign airlines to compete. The arguments against doing so are Obvious Nonsense.

Government actually working, California bans ‘drip pricing,’ forces advertising of goods and services to quote final price up front. This is a clear collective action problem where it makes sense to intervene, since customers are sadly fooled by such nonsense.

Good news, I guess, San Francisco has managed to lower its $1.7 million per public toilet budget down to $725k.

Seattle implements a mandatory $5 fee on delivery apps to compensate drivers to ‘cove their living wage.’ It has now (as of the article linked) been two weeks. Sales fall by almost half, drivers are suffering.

Corie Whalen: WHO COULD HAVE PREDICTED THIS? 🥴

Seizure Salad: I've been following this in the Seattle subreddit. Someone ordered an $18 bowl of clam chowder and with taxes and fees (before gratuity) the total was $41.

K5: "It was three items of, you know, Thai takeout food for $122, without the delivery tip," recalled Pettit.

She continued, "I ordered like a $12 sandwich. But then the $12 grew to $32."

At these prices, delivery is not quite banned, but it is damn close, and instead of using such apps often I would use the apps essentially never. Of course, who is to say that was not the intention.

New York City took the opposite approach of banning outsized fees, and as a result I use delivery substantially more than under the previous regime.

IRS does not expect that many to use its direct filing option, although still enough to make it worthwhile. The system still fails to offer taxpayers the information the IRS already knows. Why shouldn’t it pre-fill the information, saving everyone time and effort and minimizing error? Seems to be more rent seeking from the tax preparers, also I suppose you could say that ‘tipping their hand’ could tell taxpayers what they could try to ‘get away with,’ someone ought to do a study, it should statistically be very easy to tell if there is an impact here. They also note that California tried pre-filled tax forms 20 years ago, but it was a failure as 80% of taxpayers did not use it. To which I say, what? That means 20% did use it. Sounds great to me.

You can have a substantial effect by calling your Congressman about a particular piece of legislation, and it only takes a few minutes. What happens with AI?

California Scrolling

A law has been introduced in California that would impose several rules on social media platforms.

All the rules apply only to defaults. Users are free to change the settings, but as they note the defaults are powerful. Most people do not bother to change them. Here are the proposals:

The default feed must be chronological, not algorithmic.

The default notification settings must mute between midnight at 6am.

The default settings must cap usage at one hour per day.

The default settings must hide like counts.

The first two seem like clear wins. Chronological feeds are healthier. This is also a great way to target TikTok without doing something insane like the Restrict Act, making users do some work to get hit with the secret sauce.

The one hour usage cap is an odd one. I would expect the user to often remove this the first time they hit it, but perhaps many would instead take the hint as being helpful. It also would strongly help parents, as they would have a much stronger case for leaving such a restriction in place. Of course I say this as someone who has Twitter open all day every day, and is actively on it for more than an hour often.

I see what they are trying to do by hiding like counts, but I think this is a losing battle. Like and view counts are important context and provide key feedback. Yes, Scott Alexander can pull off removing them entirely, but he is the exception that proves the rule.

You do not want to push too far with such proposals. A lot of what you are counting on is that people never change their default settings.

If you push the user too far, they will essentially be forced into digging into the settings. Once they do that, they will also be far more likely to change other settings. So if you want to set good defaults, you want a set of defaults people can live with.

In general, the government mostly should not be sticking its nose in such business, especially when it is California trying to set rules for the whole world. I happen to like many of these changes, but that will often not be the case. So I would not be so sad if this particular bill passes, but in general we’d be better off leaving things alone.

California also has a new law that bans ‘drip pricing’ where the advertised price does not include all mandatory charges and fees. That one seems plainly good. The market failure being fixed here is clear. It has been such a relief that ticket sales to events use all-in pricing now.

Crime and Punishment

In Soviet Oakland, when your small business is broken into, City bills You.

A crowd in San Francisco surrounded and vandalized the a fully autonomous Waymo vehicle, throwing a firework inside that lit the car on fire. Tyler Cowen says ‘In some alternate univsere, a small drone would emerge from the burning vehicle and strike them all down.' I am happy we instead live in the opposite universe, where the vehicle lets the crowd do this, but also we have full camera footage and I very much hope that the police apprehend and punish everyone involved.

Zac Hill notes the strange economics of semi-organized theft:

Zac Hill: Things I tried and failed to get at my local @Walgreens just now due to (what I assume to be) the retail theft epidemic:

-> Deodorant

-> Toilet Paper

-> Toothpaste

Things apparently left untouched by this terrible blight/scourge:

-> A *staggering* variety of “dual vibrating massagers”

Zac Hill: I was talking with someone on Twitter who was insisting to me that the wild shit I personally saw at my local Walgreens didn’t happen. It now appears we’ve figured out the root cause!

Peter Hermann: A shocking twist in a series of Walgreens robberies in Chinatown: 'An inside actor [was] helping to orchestrate the entire robbery conspiracy.'

Thief rips out all the phones on the ground floor of an Apple store one by one, then walks out casually past a police car and drives away. A response says Apple responds by bricking all the phones and even any phone that later uses their component parts, so people buy used phones that are bricked on Facebook marketplace, as if that makes this acceptable. The cost to Apple must be very large, that loss is fully a deadweight loss, and people buying the phones get scammed and have no useful phone. So arguably this makes the situation even worse.

Once again, I am left to wonder how the store is still there at all? How does our civilization not collapse, if there is zero risk of enforcement of laws against theft?

Our civilization also needs to figure out that it is not a victimless crime to steal a car.

Occupational licensing regimes greatly contribute to recidivism. At minimum, we could do more to mitigate the damage here, but much better not to throw up the barriers in the first place. A reform proposal is linked here.

Wayne Hall: There are many cases where people are released from prison without the nessassary documents to work. It can take 90 days to get these in order and to not be a burden. It seem it would be an easy win to ensure they are ready to work on release with a copy of their social security card and a state issued id.

Good News, Everyone

Anna Salamon on the concept of ‘Believing In’ something or someone, considering that as something worth counting on, acting as if, investing in, championing and such, as distinct from believing a fact about the world or the probability of an outcome. I believe there is much wisdom here. Also see the concept of Steam.

Neal Stephenson to release Polostan on October 15, which sounds very Stephenson, potentially the start of an early 20th century version of the Baroque Cycle. I notice haven’t read his last few novels, despite enjoying his earlier ones a lot. I wonder if I am making a mistake.

Dan Wang’s 2023 letter. Almost odd to see thoughtful musing about the future that mentions offhand but essentially ignores both AI and fertility collapse as key elements. It is hard not to be pessimistic about China after reading. How can a country so profoundly unfree compete on AI or anything else? Its people seem, based on this, to have rejected the idea of having a future.

Dan also makes the claim that in Asia you can get spectacular food prepared for you everywhere dirt cheap, it is around each corner, whereas in America you can only get excellent food at a premium, and he feels compelled to cook. I am skeptical that things are so good elsewhere, but also the premium here is not so high. Even when it is not cheap, great food is still remarkably cheap, so long as you do not ‘go nuts.’ I do agree with Dan that New York City has gotten more expensive across the board over the last several years and service reliability is a little bit worse. I see this as the market correcting itself. An important point when living here is that you are buying location at a premium because it is worth a lot to have access to all the things, so skimping on other things to save relatively little (including on food quality) likely does not make sense.

Adaobi publishes a sneaky post called ‘How to do things if you’re not that smart and don’t have any talent,’ which is actually telling you how to accomplish things no matter who you are. As in, a lot of what determines success of a person or project has very little to do with talent or intelligence, it is grit and moving fast and hard work and doing the boring stuff and improving things when you see an opportunity and not being afraid of mild social awkwardness and asking stupid questions and cold emailing and learning unnamed skills and showing up at hard times and figuring out the first step and finishing what you start and so on.

Andrew Biggs makes the case for eliminating the tax preference for retirement accounts. This mostly benefits the rich, does not obviously increase net savings values, causes lots of hoops to be jumped through, and we can use the money to shore up social security instead, or I would add to cut income tax rates. This would be obviously great on the pure economics, assuming it did not retroactively confiscate existing savings and only applied going forward. But as Matthew Yglesias says, political nonstarter, so much so that not even I support doing it.

Nate Silver: Just for me personally it feels like with math tasks there's a ~10% performance boost from being well-rested but with verbal tasks like writing it's maybe literally 100%.

As several commenters suggested, it is largely about deep versus shallow, focus versus autopilot, at least for me. There are certain types of thinking that require being fully on, where lack of sleep makes me largely or entirely useless. Then there are other things that can mostly run on autopilot. What I can’t do without sleep is in some (but not all!) ways very similar to what I can’t do when dealing with kids. Much of the writing process is now in the autopilot phase, especially scanning firehoses and picking out sources. Then there are effort posts, or effort sections, where you have to be on.

Often, when a policy is overwhelmingly good, one must sell it based on a quantification of a tiny portion of its benefits. That is still often good enough.

Parth Ahya: Properly accounted for, lifting the green card limit for STEM master's and PhD graduates would reduce the federal budget deficit by $129 billion over 10 years and $634 billion over 20 years. Great work by @heidilwilliams_, Doug Elmendorf, @BudgetModel and others.

Daniel Eth: This feels like people who talk about how anti-aging tech would reduce Medicare costs. Like, yeah, probably true, but this is such small potatoes compared to the other benefits - why are we even talking about this?

In both cases this is less crazy than it sounds, because it turns a talking point against you of increased costs into a talking point in your favor. Being able to demonstrate direct profitability is very strong evidence that such a policy is a great idea. If bringing in more STEM graduates would hurt the budget, that would be a sign it was not a great idea, whereas it helping is evidence it is indeed a great idea.

Your CEO needs to be out there communicating how great the company is. Many do not do this well, or even at all. I consider this a version of the Leaders of Men issue. There are only so many good CEOs out there. You need to hire to get the important stuff right, so if this kind of communicating is not a top priority it will often suffer.

Greg Brockman (President OpenAI): better work often comes from those striving for excellence than from those who have already achieved it.

Greg undoubtedly has achieved excellence and is also continuing to strive for it. That is the common pattern. If someone has excellence, the chances are very good they are striving for more of it. That is the best of both worlds, and the same inner drives are usually causing both. If you have to choose one or the other, it depends on your task which one is more important.

Emmett Shear asks a month ago, what are the best techniques against procrastination?

Malcolm Ocean: "chill out in a chair or on a couch, with no phone or anything to read/do/etc, until you feel like getting up and doing the thing or you get clear that you'd rather do something else"

Aaron Slodov: the yc group method is unmatched tbh, frequent check ins, progress reports, press them on metrics, etc etc mega accountability.

Visakan Veerasamy: ask em questions. whatcha (not) doin? why u wanna/gotta do it? whats hard or unpleasant about it? what r u worried about? can you make tiny progress on it, what would that look like? etc etc

kaiwan: 1) Mirroring (doing our separate things separately but in a shared space like a cafe or video call) 2) Doing the first step for them or with them

Suhail: Ask them for $1000 and you’ll pay it back in 2w or keep it depending on whether they did the task.

I find the right solutions depend on the person. For me, one key is to get rid of distractions. Another is to set it up so that your procrastination is productive, if you are procrastinating about X with Y and about Y with X then that’s the dream. I also like to gate things, as in ‘I am not doing Z until I finish this.’ Also I’ve learned to hate it when I’m procrastinating, so it feels better to do the thing.

But also I still procrastinate a lot.

Universal Music Group pulls its music from TikTok, saying TikTok only accounted for 1% of total revenue. Josh Constine says TikTok has them over a barrel, they should give away their music essentially ‘for the exposure’:

Josh Constine: Sounds boring, but actually a big deal. Top record label Univeral Music is ceasing to license music to TikTok and says the app bullied it in negotiations...

...But music popularity is dictated by TikTok, whose trends were behind 13 or the top 18 songs last year.

So either all videos using Universal artist songs muted, which sucks for users and musicians, it convinces other labels to fight alongside it for a better deal, or it caves.

Honestly, each label needs TikTok more than it needs them, given it's become the primary music discovery mechanism. And I'd argue the tickets, merch, and streaming royalties it drives more than make up for the licensing costs.

Citation needed. Yes, hit songs will end up in TikTok videos, and songs from TikTok videos will end up as hit songs. That does not provide causation.

As usual, basically everyone will always tell every creator that on the margin that participation will be good for them long term, think of the exposure and reputational benefits, so they should work for free or almost free. And technically they are right, but also of course screw that, f*** you, pay me.

Universal says that the new deal they were offered was actively worse than the old one.

Variety: With respect to the issue of artist and songwriter compensation, TikTok “proposed paying our artists and songwriters at a rate that is a fraction of the rate that similarly situated major social platforms pay,” according to UMG’s letter.

…

Regarding the issue of artificial intelligence, TikTok “is allowing the platform to be flooded with AI-generated recordings — as well as developing tools to enable, promote and encourage AI music creation on the platform itself — and then demanding a contractual right which would allow this content to massively dilute the royalty pool for human artists, in a move that is nothing short of sponsoring artist replacement by AI,” UMG said.

In addition, according to Universal Music, TikTok “makes little effort to deal with the vast amounts of content on its platform that infringe our artists’ music and it has offered no meaningful solutions to the rising tide of content adjacency issues, let alone the tidal wave of hate speech, bigotry, bullying and harassment on the platform.”

I am not one to believe the claims of a music label or of a social network. Here my gut strongly tells me Universal is mostly telling the truth, that TikTok is indeed doing all these things, and that they are right to pull the content.

A Difference of Opinion

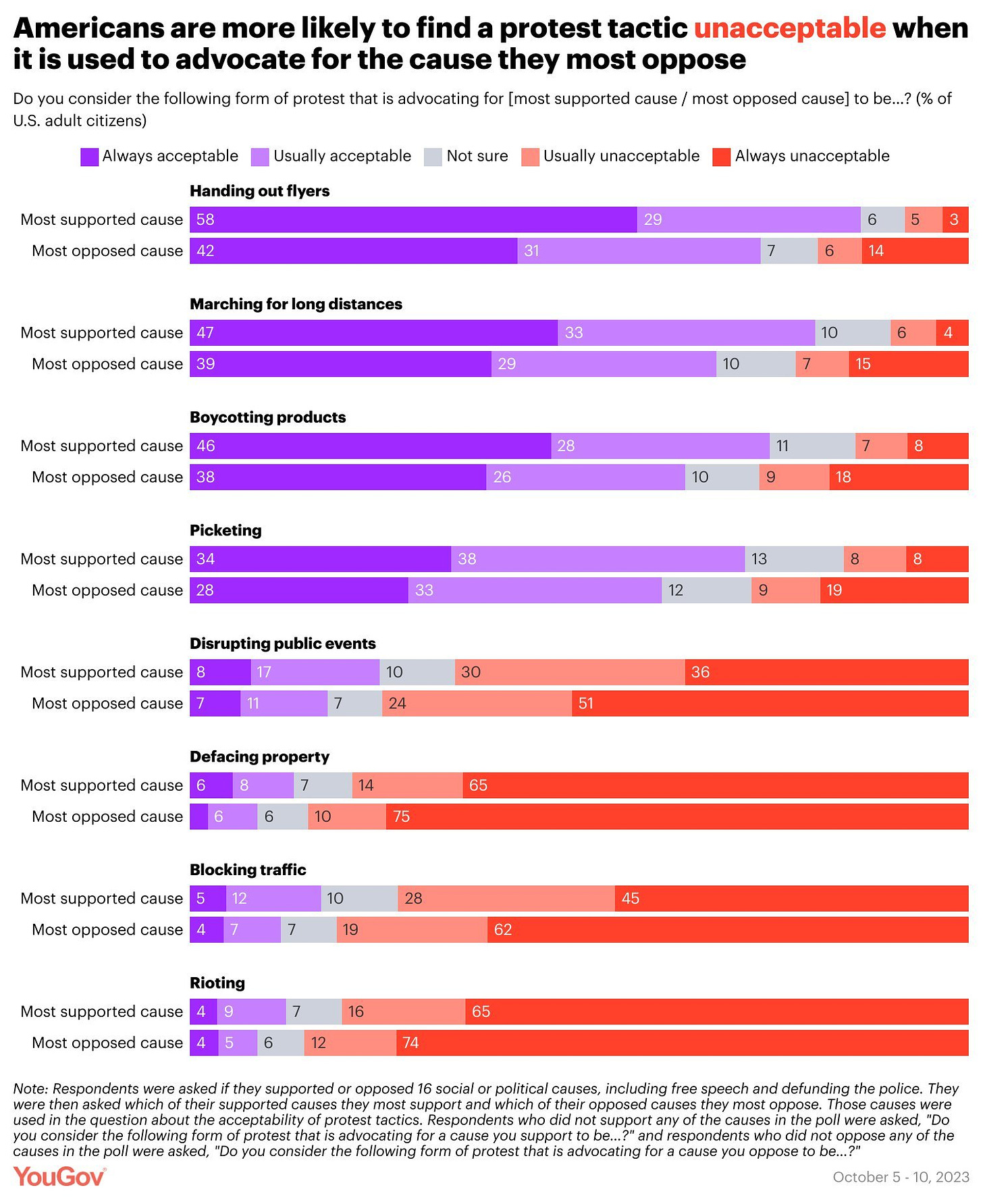

I agree with Daniel Eth here, the news is not that Americans are inconsistent about which tactics are acceptable and favor the causes they find just, it is that Americans mostly do not do this, and are remarkably consistent and honorable here.

YouGov America: Americans' views of protest tactics such as picketing or blocking traffic aren't fixed: Acceptance of tactics depends on support of the cause that protesters are advocating

I would love to see a breakdown of how much of this is a gradual shift in everyone’s views, versus a few people who radically shift their views. For handing out fliers, for example, consider two possible worlds:

Most people have a mostly consistent view, but 12% are fundamentally against free speech, so they think that a flier saying ‘apple pie is good’ is always acceptable because apple pie is good, and one saying ‘apple pie is bad’ is never acceptable because apple pie is good.

Many people are slightly less approving of the other perspective.

As usual this is doubtless a mix, my guess is a more of #1 is going on, there is a fixed pool of ~10% of people who essentially think the other side is always wrong.

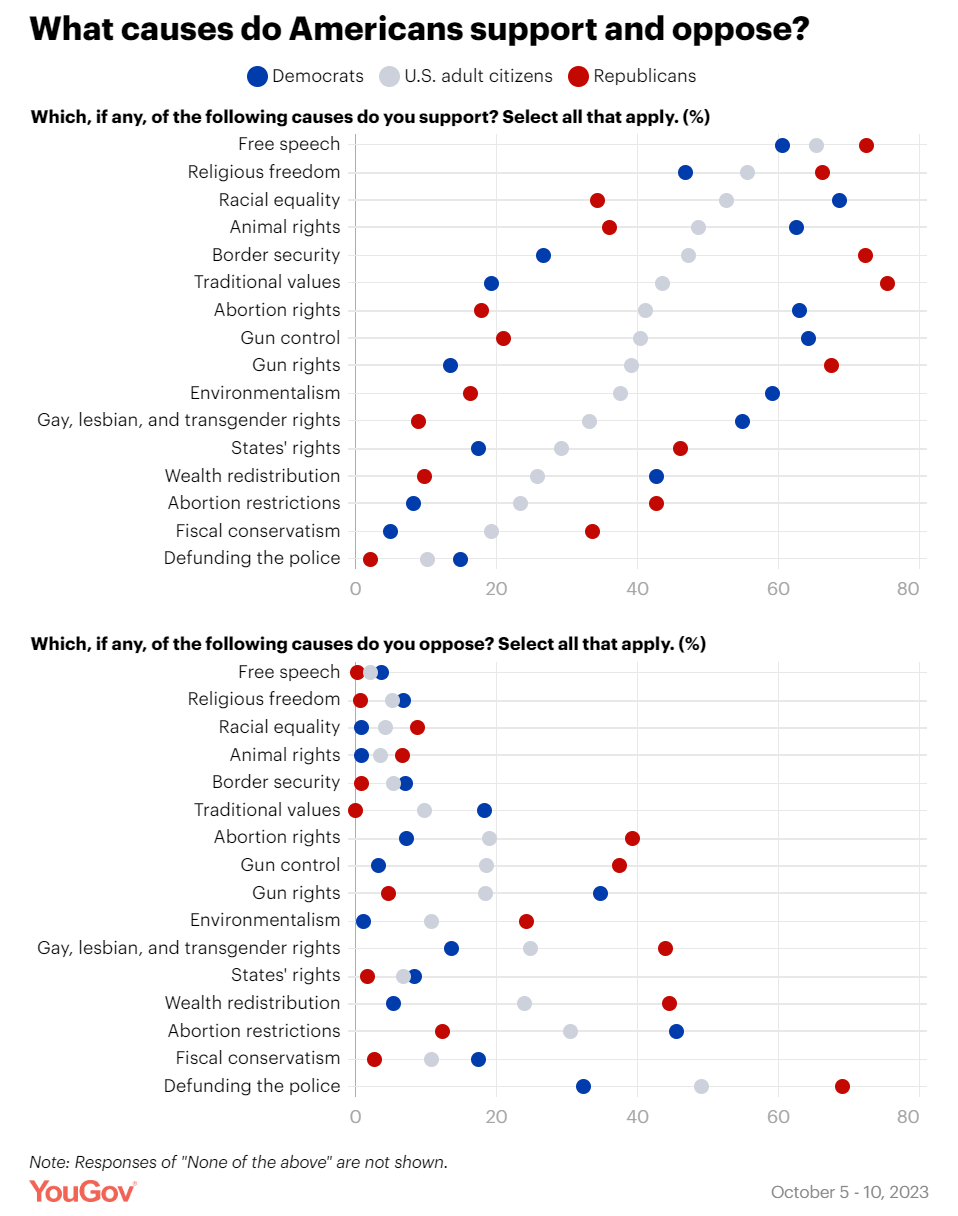

We also get some issue opinions, free speech nominally remains super popular.

The obvious question is, if you do not actively oppose free speech, then how can you say that your opponents handing out fliers is never acceptable? Yet that second group is substantially bigger.

I would also add that these responses show highly good sense overall.

We have, essentially, two categories of things.

In the first we have handing out flyers, marching long distances, boycotting products and picketing. These are all at core clear forms of free expression, rather than attempts to inflict damage and make the lives of others worse, so long as one is not using violence to stop someone who attempts to cross a picket line.

Americans find all these broadly acceptable, with at most 28% opposition (with 65%+ actively in favor) even for opponents. I agree, all of these are always acceptable.

Then there is the second group: Disrupting public events, defacing property, blocking traffic and rioting. These are all centrally about causing harm and inflicting damage. Give us what we want, or else we will make your lives worse. Disrupting events is the least unacceptable because it at least plausibly targets the particular thing you are objecting to. Defacing property and blocking traffic are lashing out at random, forms of collective punishment, and rioting is that but violent.

Americans find all these broadly unacceptable, with at most 25% approving even for favored causes, and at least 66% opposed, and the latter three correctly considered substantially worse than that.

So this is the exact right order from most acceptable to least acceptable, and the majority broadly is right in each case.

I am curious about the 4% of people are who think that rioting is always acceptable, and how they think that works. Presumably they simply want to watch the world burn.

If you are considering protesting, this provides clear guidance. You should go ahead and hand out fliers, go on marches, boycott and picket. Have your rallies, do active expression.

You should not, however, disrupt events, deface property, block traffic or riot. This mainly serves to piss people off. If I learn that you are blocking traffic in order to demand the government change its actions, or even worse that overseas governments or corporations magically change their actions, then you are not going to win hearts and minds.

Emmett Shear reads Christopher Alexander’s A Pattern Language, notes the vast overconfidence throughout and that many claims seem false, wonders what all the fuss is about. Turns out the answer is that he correctly noticed the early macro assertions on urban design and land use were Obvious Nonsense. I noticed that too, but thing improve, and Shear notices he got trapped in a cynical perspective. What confuses me is that he still made it through the full thousand pages. One day, architecture sequence of posts. One day.

The Lighter Side

We made it weird at the planet reunion (1 min video).

Good question.

Sarah Constantin: I do notice a lot of people whose story is “I got sick of the shallow hedonists who just wanna hang out” and I’m always like “hey…I would LOVE to hang out…where are these people? can I meet them?”

The problem is that when we ‘just want to hang out’ we want to do that with people who aren’t so shallow that all they want to do is hang out. That gets boring. Then we end up not having people with which to just hang out. Whoops.

Anton: to a medieval peasant this would be exactly backwards makes you think

The Golden Sir (2019): Me sowing: Haha fuck yeah!!! Yes!!

Me reaping: Well this fucking sucks. What the fuck.

Yep. That’s right.

Vivek Ramaswamy: On Day 1, *instantly* fire 50% of federal bureaucrats. Here’s how: if your SSN ends in an odd number, you’re fired. That downsizes government by half. Absolutely *nothing* will break as a result. It doesn’t violate civil service rules because mass layoffs are exempt. SHUT IT DOWN.

Matt Darling: Vivek, don't announce the randomization assignment a year before treatment!

McSweeney’s nails it: Son, you will not binge-watch LOST - you’ll watch one episode a week and be frustrated like mom and I did.

In addition to being funny this take is correct. Binging anything actively good or interesting is a mistake. Sure, if you want to binge a cooking show or procedural go right ahead. Law & Order marathons exist for a reason. But with shows that are actively good you want to pace yourself. You get diminishing marginal returns, and then the show is gone.

Once a week is still a little extreme, even for me. And we get to test this out even today, with shows like Loki, where a full week is long enough I forget details.

I would suggest the following rules, keep in mind these are upper limits not requirements:

Unlimited Binge: Procedurals, sports.

Two episodes per day: Pulpy stuff, semi-procedural genre shows, 4+ seasons minimum.

One episode per day: Everything else that has no social aspect.

One episode per week: Only do this if you are actively discussing it with others.

Exception: You can always watch 2 episodes in a night, or an episode of twice-normal length, if doing so finishes a season.

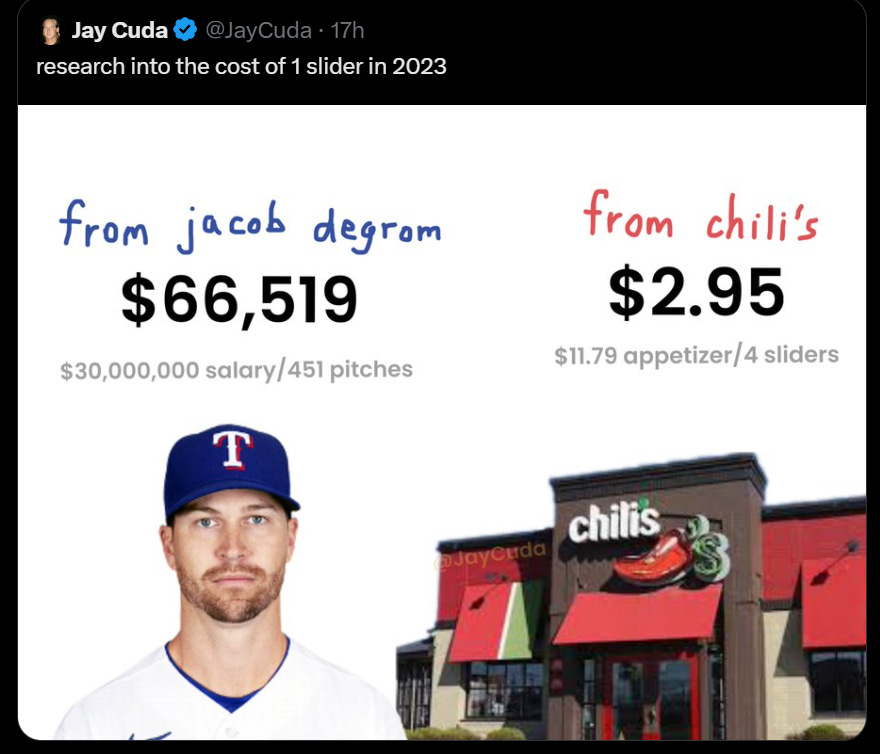

For a second we got this right, then we failed again, but remember the good times.

Scott Lincicome: Quality matters.

I Lim: Overpaid.

Scott Lincicome: Chilli’s is fine, actually.

Mike Chase: I went to Chili’s and the waiter instantly blew his elbow out and said he’d come back in like 12-16 months.

Scott Lincicome: and yet they STILL won Restaurant of the Year. Amazing.

Mike Chase: Well duh. Max Scherzer was also drunk at this Chilis.

Scott Lincicome: Sounds like an awesome Chili's.

Autodesk Hate Account: there is this chinese place we like to get takeout from and incredibly it is called "wok! you want". when you call them they answer the phone with "wok you want?" and i would always reply "wok you got?" but they never laugh.

Kane: my childhood chinese takeout was called “Wok 22” but every time they shut down for health/fire/tax reasons it would reopen under a new name and I just checked and they’re on “Wok 28”

Reference books on the retirement shelf. And the autocorrect problem.

Probably costs more in New York, but also would work even better.

Brooks Otterlake: I looked into it and it would only cost $20 or $30 to rent a stall at a farmers market and put out a bunch of empty crates and if someone makes eye contact you smile sheepishly and say “Forgot to farm”

Elle Cordova presents fonts hanging out.

Walter Hickey: hey remember all the parts of Oppenheimer where a heroic innovator is completely unprepared for the brutal implications their life's work? and years later must reconcile with the devastating wreckage left after they unintentionally created a materially worse world? no reason.

Matthew Belloni: Big news: JON MF STEWART is returning to host The Daily Show on Mondays through the election, with a deal to EP all nights and possibly stay through 2025. A big test of his appeal in a media landscape that’s changed A LOT since 2015, but for me this news is:

A little late now, well a lot late now, but yes, obviously, although it doesn’t quite work as well as this:

I have a friend who does Disney travel stuff who I paid $100 for help the first time we went just to make sure I understood what had changed in the dozen+ years since I had last gone, but I wouldn't say any of it was particularly complex. Though in some sense is does reward the general "ability to google/read the documentation/understand how to optimize on the fly" upper-middle class sorta digital DIY'ism that a lot of things seem to require more and more of these days...

I think the biggest thing is just not going during peak times of the year to ensure an enjoyable time.

Regarding taxes and retirement accounts, absolutely the tax preference should be removed. But it should be removed by removing all capital gains taxes. Why on earth would we want to extend capital gains taxes even more?

I am probably not a standard person here, but my financial goals are focused around moving as much money into tax-advantaged accounts as possible, to the extent that I juggle a HELOC loan, credit card balance transfers, etc., to have as little cash in my checking account as possible. (My income is essentially quarterly and varies quite a bit, so I can't just count on the same amount of cash available each month.) Ideally I could just invest money in an index fund and withdraw it as needed instead of playing these personal cashflow games, but capital gains make that a non-starter.