It’s that time again. This is everything that doesn’t fall into a category and isn’t worthy of its own post.

Bad News

Scam sophistication, especially against the most vulnerable like the mentally impaired, continues to ramp up as one would expect given current technology, and AI is only going to make this worse. Our systems are increasingly designed assuming one is willing and able to put a large cognitive load into navigating an endless stream of both bureaucratic requirements (governmental and otherwise) and also scammers and others that are fully Out To Get You. I don’t know what we could do about it.

Denny’s the Everyday Value T-Shirt sells below asking price of $474.99. This entitles you to a everyday value slam each day for all of 2023, so that means this went for less than about $1.25 per day. That seems too low to me. I once worked for a company where there was a Denny’s in their building and if I had been coming into the office back then and this was for sale I would have snapped it up. Their pancakes are pretty good, and the same person doesn’t always have to wear the t-shirt. Even if you only use it one day in four or so, you still get value.

Old masters art markets are in decline, perhaps terminal decline, with only the best of the best maintaining their value. The concentration at the top reflects the general trend in past relics and collectables, where whatever is considered the top, pristine thing goes crazy in price relative to mostly identical but slightly ‘worse’ similar things, no matter what happens prices in general. The premium for being a 10.0 condition, original packaging, first edition and so on goes up. Same applies here, highlighting the purely symbolic and positional nature of the value. If you think you’ve found tomorrow’s thing, either get what you expect people to think is the best possible version or don’t bother.

I do notice I am sad that the old masters are losing value relative to more modern pieces. The post says such art doesn’t ‘look cool’ or ‘fit into modern life’ or allow people to ‘connect with its themes’ and it requires you to ‘really look.’ In my arbitrary opinion, at least it is real art and real history in a way that the more modern stuff mostly isn’t, and also it fits into the kind of spaces and experiences that are pro-human in a way the recent stuff mostly doesn’t. Art at this level still isn’t, I would assume, about actually appreciating the painting.

I Declare Bankruptcy Authorized Transaction does not make banks not liable for fraud-related Zelle payments, potentially forcing smaller banks to withdraw from its use. I get why this is the rule, and why ‘sending money to someone instantly for free is a nice thing’ does not change the existing banking laws. I do think it should be sufficient to change the banking laws, and have Zelle be a crypto-style ‘here be dragons’ area where caveat emptor applies and banks severely limit available size if they don’t have reason to believe you can handle it.

A Dutch program requiring job seekers at risk of long-term unemployment to cast a wider net reduced chances of finding employment. This contrasts with previous studies that gentler pushes to encourage wider net casting were helpful, and strong evidence that such nets are often not cast wide enough. This error is blamed on ‘optimism bias.’ I am suspicious. My guess is that this is instead, or at least largely, due to people’s extreme dislike of accepting declines in status. The unemployed really don’t want a different worse job, and are willing to risk long term unemployment, in a way the unemployment office isn’t and that isn’t reflected in net earnings. Telling people to disregard their preferences in favor of maximizing yours instead is a hell of a thing, sometimes necessary. When you order people to do that, self-sabotage seems like a plausible response and explanation, on top of ‘people are not as legible as you think and telling them what job offers to respond to might not be a great idea.’

Face recognition used to bar woman and her daughter from Madison Square Garden, due to the woman’s law firm suing the parent company of MSG. So, more lawsuits, then.

Not exactly news, but ‘flexible’ ‘savings accounts’ continue to be terrible and I continue to refuse to use them. I too love Scott Sumner’s metaphor here, which is exactly how these accounts work.

Imagine a government that took 10% of each person’s income, and put in in a wooden box. The box was placed at the end of a 10-mile gravel road. Each citizen was given a knife, and told then could crawl on their hands and knees down the road, and then use the knife to cut a hole in the box, and retrieve their money.

It is actually worse than that, because the box can be difficult to open, and sometimes it gets moved to a different road, and you have to walk down the road on a particular day that isn’t announced in advance, and if you fail to open the box on time then the government keeps the money.

A ‘flexible savings account’ is neither flexible nor savings. It is, rather, an abomination. Kill it with fire.

Once again, TikTok is Chinese spyware (Forbes). Do not use.

Bloomberg offers ‘a national guide to pandemic innovation’ with an exemplar startup business from each of the 50 states. The lack of meaningful innovation is palpable. Connecticut is a literal donut shop (that I did admittedly bookmark on Google Maps, they look delicious and I’m curious in case I’m ever in the area.) Delaware is a place called ‘Books & Bagels.’ New York is a butcher shop that delivers mystery boxes.

We proved through experiment (their reaction at a football game to a banner saying ‘Stanford hates fun’ being decidedly no fun) that Stanford Hates Fun. Grumpy Economist notes, in gory detail, how much Stanford Hates Fun. You need to apply, two weeks in advance, with a full list of participants, to have a party. That is how much Stanford Hates Fun.

One can sympathize - look what happens when you have fun.

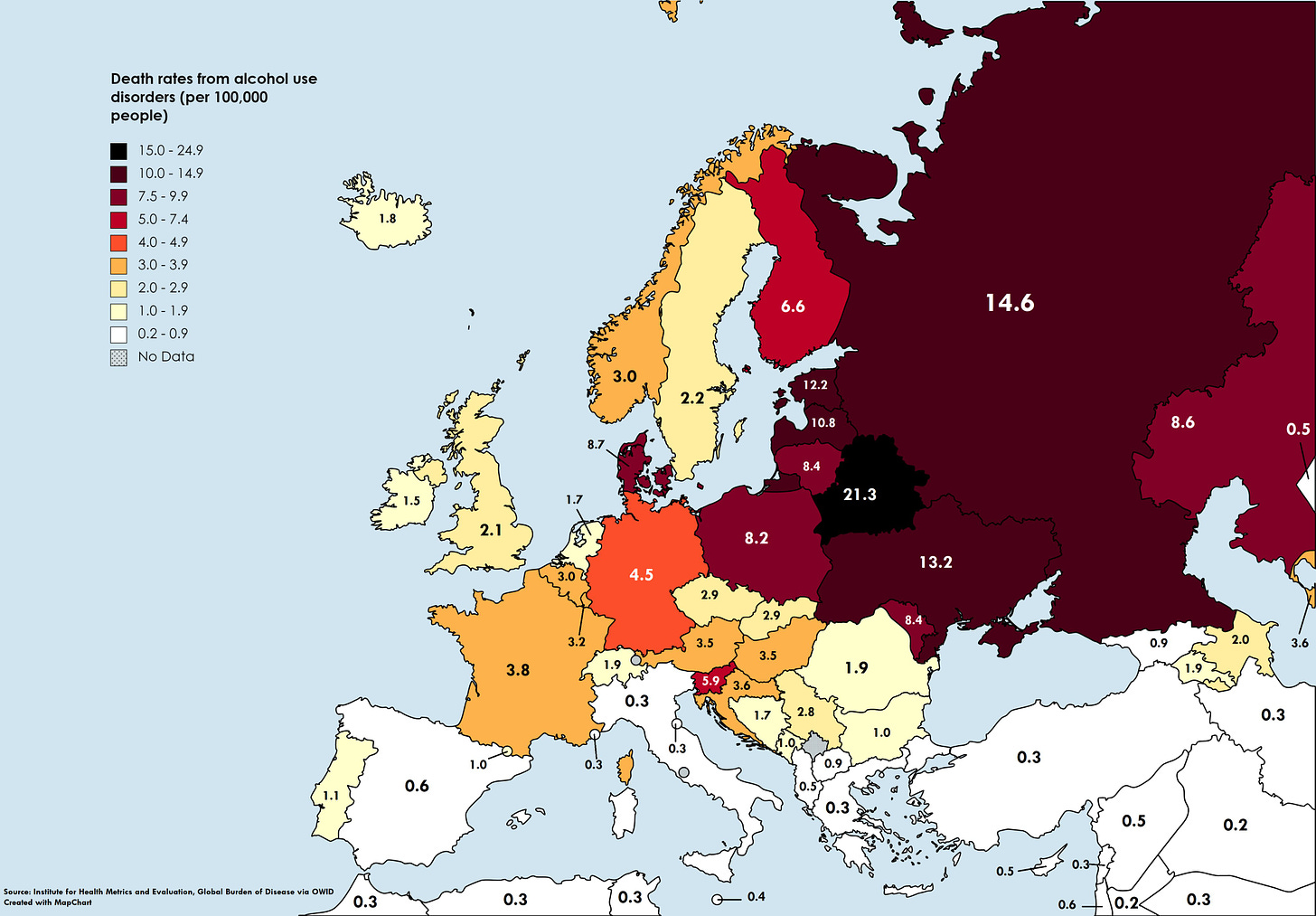

The problem of deaths is clearly about certain kinds of alcohol consumption, not about alcohol in general. I abstain entirely, given I don’t enjoy any aspect of it, but clearly there are ways to do it that only kill your intelligence, wallet, diet, behavior and self-respect.

Good News, Everyone

Everything Tom Lehrer ever made is in the public domain and you can download it all for free for a limited time. Sweet.

Rock Paper Shotgun lists all of its Bestest Bets reviews. I’ve found these to be an excellent source for new quirky little games, along with a few confirmations of standard games (e.g. Elden Ring and Marvel’s Midnight Suns). They also offer their Games of the Year.

Reid Duke offers a list of 23 historical Magic matches to watch.

Rob Henderson year end roundup. Razib Khan year end roundup. Spenser Greenberg year end roundup. Good to see various people’s reading lists and top stuff.

Barnes and Noble net opening stores in 2023.

Only 70% of crypto volume could be identified as wash trading in study. I would not have believed much lower, while I would have believed substantially higher.

Only 2% of Americans are Jewish, but 7% celebrate Hanukkah. The War on Christmas welcomes any and all allies until the music can be sufficiently contained.

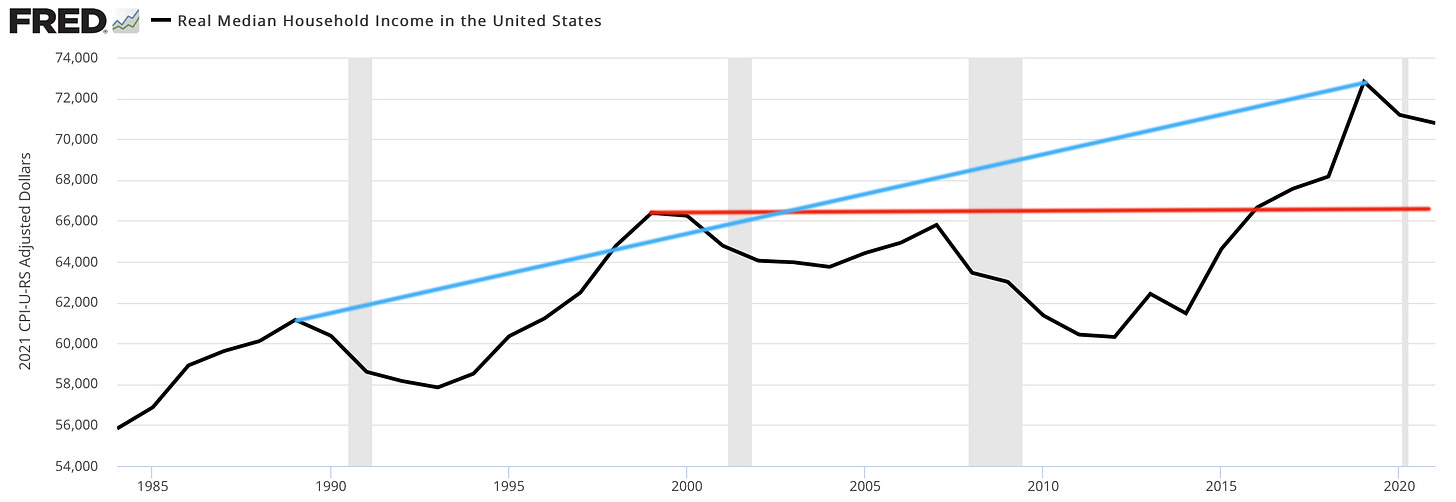

The measures of inequality usually cited to claim that inequality is up ignore taxes and transfers, and thus are entirely meaningless. Matt Yglesias notes that even traditional inequality measures that don’t include taxes and transfers have been falling since 2007, and pre-tax, pre-transfer median income has been rising since the 1980s, while taxes and transfers continue to become more inequality reducing than before.

This is on top of the worldwide inequality numbers falling the whole time. I do think there is a real problem in which it is becoming harder to live well on relatively low incomes. I am adding ‘explain what I think is going on there’ to my post debt list.

Thought I’d share, since I didn’t know about this either (direct link to form).

Cuckolding is rare, consistently around only 1% of children. Thread links to many papers. Our instincts about when this might be happening are also very good - the base rate is 1%, and when someone is suspicious and checks the rate is ~33%.

Economist finds a natural experiment showing that banning prostitution does not reduce prostitution but does increase dangers like sexually transmitted disease, violence and robbery. This potentially offers us a free policy win. Alas, I do not believe the headline finding that bans and crackdowns have zero medium-term impact on quantity supplied, that seems unlikely to be a thing.

MIT faculty votes to adopt MIT Statement on Freedom of Expression and Academic Freedom. This has been suggested as a potential turning point. I’d also love to see them return to their Open Campus.

Remote work greatly diminishes our pervasive height-based discrimination, as it is not easily observable on zoom calls. What other things fall into this category?

Oberlin pays up to the bakery that won a lawsuit against it. I notice that, while this took a long time to actually be paid, I saw many predictions that implied it would take far longer, and they ended up collecting the full amount plus interest. An update in favor of it being actually possible to sue and collect from large stubborn organizations.

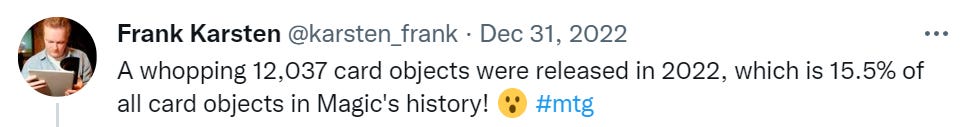

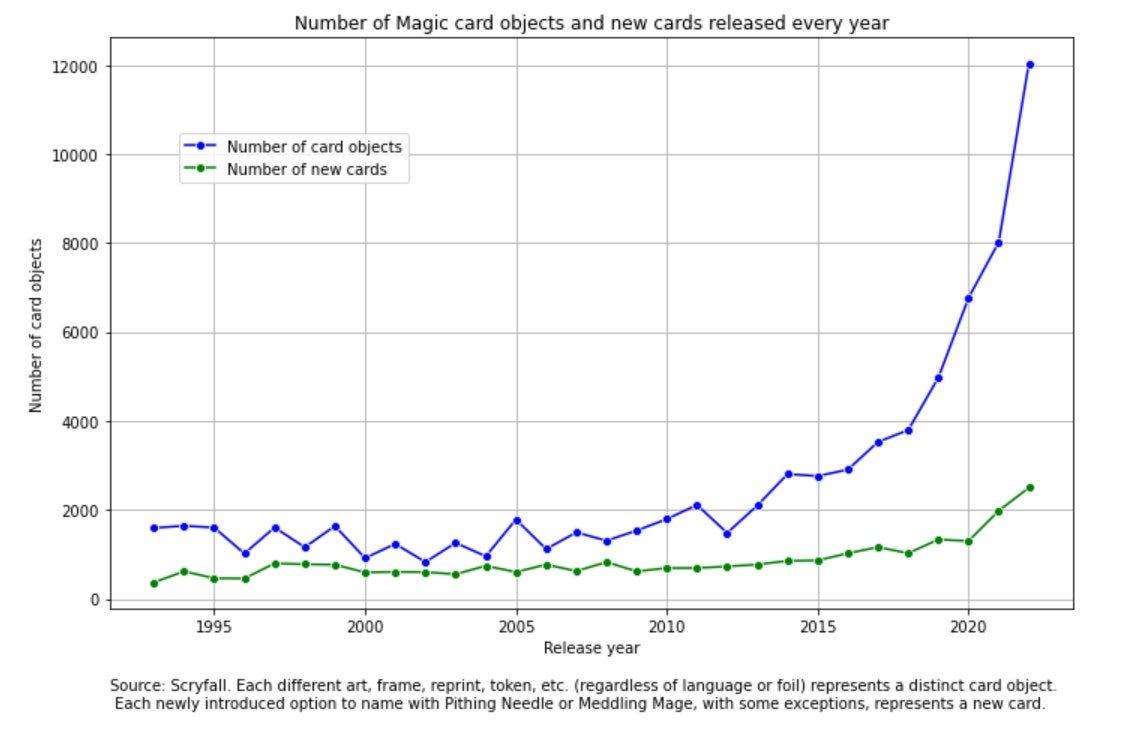

Classic Law of No Evidence citing in the wild - '“There is no evidence that Magic is overprinted, and that sentiment is a misunderstanding of our business and our customers.”

Perhaps there might be a bit of evidence?

Also in the ‘we need to fix that’ column:

FBI agent reports that ‘demand for white supremacy vastly outstrips the supply of white supremacy,’ in the sense that there is no one left to investigate. The worry is that this leads to reclassification of more people and things as white supremacy.

We are repurchasing oil for the strategic oil reserve. I am confident we are missing out on more profitable versions of the trade. I’ll still take the win.

The O-1 visa is a wonderful thing, if you have the highly extraordinary abilities of ‘consult with a lawyer about doing weird and unusual thing that seems like it shouldn’t work but could anyway, and actually follow through.’

Here are some practical hints on how one might do this.

Also the note the strategic option that you can consult lawyers and generally they will advise you of the basics before asking for their gigantic hourly rates. This has been my experience as well, and that when you need them to navigate something for you a good one is worth every penny.

While I Cannot Condone This

Wellesley College students who are not being graded do not maximize as much for the grades that no longer exist (paper).

In Fall 2014, Wellesley College began mandating pass/fail grading for courses taken by first-year, first-semester students, although instructors continued to record letter grades. We identify the causal effect of the policy on course choice and performance, using a regression-discontinuity-in-time design. Students shifted to lower-grading STEM courses in the first semester, but did not increase their engagement with STEM in later semesters. Letter grades of first-semester students declined by 0.13 grade points, or 23% of a standard deviation. We evaluate causal channels of the grade effect—including sorting into lower-grading STEM courses and declining instructional quality—and conclude that the effect is consistent with declining student effort.

Notice that the headline says ‘caused future grades to drop’ yet this does not cause grades in subsequent courses to drop. The grade that drops is the grade for the class that is not graded. And, well, yes. Of course. It’s kind of weird it dropped so little. Before this was your explicit ‘please maximize this’ number. Now it’s not, and you’re saying it went down? I sure hope so.

The ‘declining student effort’ here is effort to optimize for grades, rather than learning.

The real result is the null result. There was no significant effect on student performance in later classes, where old style grades persist, and while it says student engagement ‘did not increase’ later, that means engagement stayed about the same. So we have similar engagement for similar grades. To me, that says that to the extent that student effort decreased, that effort was previously wasted effort in terms of learning anything worthwhile. Score one for pass/fail grading.

Potential massive wave of car loan defaults coming in 2023. Tell me if this reminds you of anything (say, I don’t know, crypto). Briefly, we had super inflated prices for cars in 2020-21. Consumers bought cars largely on credit, and were left owing far more than the car is worth - this is a normal situation to some extent because new cars lose a lot of value quickly, but things got ridiculous. Consumers can’t trade in their old cars because they are too far upside down. As a result, dealers are waiving the requirement to resolve old car loans before giving out a new one. Consumers are given a second loan on top of the first one, despite this often leading to defaults, because the dealer knows they won’t default on the new loan, they’d much rather default on the old loan. Then a bank ends up with a car that it does not want, that is worth far less than it was owed. Whoops.

If there are no systemic risks here, I do not have much sympathy for the banks. Giving out what is effectively a non-recourse loan, on collateral that is expected to lose much of its value, requires building in an appropriate buffer. It wasn’t certain that prices would decline 30% year over year for many models. It also shouldn’t come as a surprise, everyone knew that a temporary supply shortage and a bunch of temporary demand had driven prices rather crazy in a way that wasn’t likely to get sustained. If you are giving out loans and did not respond by building in a buffer, then that is a risk you chose to take and which must now be paid for. If this gets some banks in a lot of trouble? I am completely fine with that.

Reporter speaks truth to power (short video). The truth in question is that it is cold outside, and they are making him, the sports guy, stand outside for hours for no good reason in order to tell other people not to do this. The only way to improve this would have been to point out that this is not a blizzard. The screen says ‘blizzard watch’ and there is almost no snow on the ground.

MLB used three different types of baseballs in 2022. Mostly they used a deadened ball. For big game situations like the all-star game and postseason they used what this article calls a Goldilocks ball. Then there were also some number of ‘juiced’ balls, likely left over from past seasons in a non-intentional way. The core intentional thing here is that MLB wanted less offense in general, while providing a higher level of offense in highly prominent games.

As someone who has previously gambled on the number of runs in various baseball games, I was not even a little bit surprised to see MLB differentially using different baseballs based on when they would benefit from having more exciting games.

I also mostly do not mind it, especially with regard to the postseason. Thanks to various dynamics of teams, incentives and scheduling, and the ability to run your pitchers in an unsustainable way because there is no tomorrow, postseason baseball games do not have enough offense in them. It is not good for the game. You want the opposite, where the games the diehards watch can be quick pitchers’ duals that true fans appreciate and then you put a more superficially exciting face forward for the public, and those who don’t care about either team still playing, at the finish line. I’d prefer that they not pretend they are not doing it, but I understand why they can’t come out and say it.

It all has to be fair, of course, the same way that some umpires have their own unique strike zones, and this is mostly fine so long as they treat both teams the same way give or take a small home field advantage. Keeps things fresh and exciting, and I’d like to see umps tighten up their strike zones a bit for the playoffs to help out. There is a lot to be said for Robot Umps Now, yet I do not think they are a slam dunk. Some amount of uncertainty, where some pitches are probabilistic strikes, is arguably good for the game, as is making different games use slightly different strike zones to help keep things fresh. It’s a long summer, and it gives everyone more to talk and think about.

There is a more general meditation there about AI and its interaction with rules that in practice are different from the rules we all agree to write down.

Tyler Cowen warns in Bloomberg against raising the inflation target to ~4%, arguing the change would not be politically stable and would hurt workers, causing many to quit. Tyler notes that we have simultaneously high inflation, a labor shortage in part from falling labor force participation, and falling real wages.

We economists cannot fully explain these circumstances. But they may suggest that employers simply are not willing to agree to higher wages, perhaps due to business uncertainty. And if a labor shortage won’t push them to increase real wages, perhaps a higher rate of inflation won’t either.

My explanation for this continues to be widely held strong preferences about relative pay and status in the workplace. If you raise wages for new hires, you have to raise them for everyone else as well, whereas existing employees include many people you’d have fired if firing wasn’t so risky and unpleasant, and others who will (at least for a time) put up with lowered real pay. Inflation gives employers that opportunity.

This model agrees that inflation hurts workers. It also likely widens the gender gap in pay and rewards to status seeking in general, since it rewards assertiveness and risk taking while punishing those who remain quiet. It also seems to, as Tyler notes, make people very unhappy and unstable, which Tyler talks about as a political consideration and I think matters more as a this is bad for people consideration. The reaction hurts them and we should assume it largely happens for a good reason. There are counterarguments to be sure, and I’ve gone back and forth on this in the past but currently I’m strongly in the at most 2% inflation camp.

A question that seems worth asking is, if there is someone who is currently employed who the employer would prefer that they quit, are we (as a society) happy to keep them employed? If someone is doing something productive, should we worry that they are overpaid for it such that the employer is worse off, or that only a transfer from business to the less productive, which is a lot of what government does anyway?

Gift giving is declining, which Tyler Cowen thinks is a good thing, he offers theories on why, noting that in the era of online shopping it is more puzzling. Perhaps it is less puzzling, and online shopping is the answer.

Here’s a theory. Gifts previously allowed us to leverage our comparative advantage. Each of us had different knowledge of different products and stores and creators (including ourselves). Reviews were less reliable and harder to find. Each of us went to different places, and buying things was a pain. Everyone had a decent shot of identifying something that someone would appreciate or benefit from that they didn’t buy themselves, combining your knowledge of the person with your other information. Even if you didn’t have new information, you could always give the gift of ‘go to the trouble of finding the right version of this at the best price.’

In an era of online shopping, where you can get most anything at Amazon and we are all doing the same searches and relying on the same reviews, where does that leave us? With current technology, if something is Worth It, chances are that much higher it was already purchased. It is not a coincidence that the one Christmas present I knew I wanted was a shipment of local jams I love, that is not so easy to get online. There are plenty of other physical things I want, but I already bought those.

Thus, gift giving declining should warm an economist’s heart even more. Not only does it mean people are not buying others as many gifts the recipient does not value, it also means that people are responding properly to changing incentives, and it reflects an improvement in market information and a decrease in transaction costs.

Does Krysten Sinema have a side hustle on Facebook Marketplace? This is one of those cases where I kind of want to throw the book into the fireplace rather than find out either too many details or whether it is real.

Donald Trump definitely does have lots of side hustles. His recent Major Announcement was that he is selling NFTs of… Donald Trump. As superman, an astronaut, and such. Has to be seen to be believed, except that it really doesn’t at this point. Only $99 each while supplies last! Merry Christmas, joy to the world.

Japanese monetary policy continues to show that ‘liquidity traps’ mostly don’t exist. There has been no serious attempt to create 2% inflation in Japan. No major central bank has come anywhere close to running out of options, only political capital.

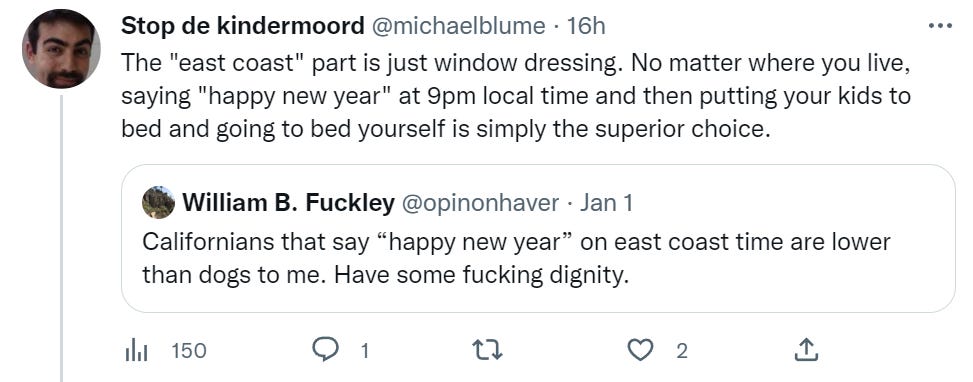

What is proper New Year Declaration Protocol?

I place supreme importance on words having meaning. On being precise. On arguing the technical details of ceremonial rites. A culture that goes around declaring new years when it is not, yet, a new year, is going to go around not believing words need to have meaning, agreements and rules need not be followed, and reality need not be cut at its joints.

So first off, absolutely not, you cannot declare Happy New Year at the wrong time.

So the question is, can you make a good (theological, essentially) argument that the New Year begins at the time that your country’s media capital celebrates the New Year, regardless of your own time zone? Does this hold up? I think the answer is clearly that it does not.

Leah wins the thread. It is fine to simply not mention the new year until morning. It is fine not to stay up until midnight. You are not obligated, unless perhaps you are a single young adult, to perform the rites of New Year’s Eve. It is at most supererogatory, and not sufficiently so to mess up everyone’s sleep. You have a way to do this without breaking the covenants, so you should do that.

The ‘we (Russia) are so f***ed right now’ thread from Denis Zakharov. He cites already dramatically rising rates of crimes with weapons as they are smuggled back home, and predicts a wave of violence and breakdowns as soldiers return home, their money runs out and any hopes of being treated well are dashed, and that this will cause the state to lose control.

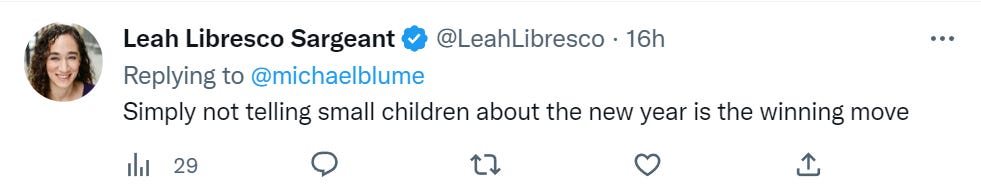

I Should Read More Books But Not Like That

Of all The Lex Fridmans, Lex Fridman is the most Lex Fridmanist. Observe.

Much of the internet was not pleased. The problem should be obvious.

This is not how one actually acquires knowledge or understanding, or gets value from books. That kind of thing can’t be scheduled and planned like this, especially not in such dramatically uneven fashion. The algorithm choosing the books almost has to be ‘check off things from a list’ or ‘be able to have read the book in context of a conversation or podcast, as one might on a very undemanding exam’ rather than satisfying Lex’s curiosity, building his world models or indulging his excitement.

(There’s also some other Internet Drama here, which I don’t care about.)

Do I listen to Lex’s podcast sometimes, and think it provides value? Yes. I absolutely think it can provide value. That value comes from letting people talk.

What Lex does, in a way that few others do, is read a person’s stuff, get that person to come on air for several hours, and then use that as a framework to give people a chance to talk at length. I can’t remember Lex providing a big insight, and he spends too much time on background. He avoids derailments and keeps people talking.

I skip most episodes. Occasionally he’ll have someone unique on that interests me. I’m then tolerate a lot of You Should Know This Already to get to the parts that I don’t know how to get anywhere else.

I do intend to Read More Books in 2023, as part of my shift to longer time horizon things. If anyone I respect wants to make a high bid for one, I will probably ignore it but listen often enough that it is worth making the bid.

Sports Betting Lines are Relatively Efficient

Scott Alexander’s links post had one about sports betting, comparing Nate Silver’s predictions to the betting markets using Brier scores. For NFL and NBA games it is clear you should ignore Nate’s projections. The differences may not look like a lot, but in sports predictions these levels of differences are everything. You are expected to have ‘done your homework.’

In baseball Nate’s performance here looks surprisingly good, which given their methodology is rather baffling. The market can see Nate’s predictions and methods, and has information (and modeling insights) Nate’s model doesn’t. If Nate had found a superior method, the market would adjust to it. Do the see odds move towards Nate’s numbers when he releases them?

I am going to presume the issue lies in the data set, both that it represents casual books with imprecise lines, and also there are data errors in that source (or at least there were in a previous version, which I know from personal experience). It is very important to find all errors in your data when using things like Brier scores. Even a tiny number of them can quickly overwhelm all the real differences in these spots.

If Nate’s stuff was good enough to win on its own, you could do much better than that by using common sense. That would mean there’s tons of free money available here and plenty of people capable of recognizing this and taking advantage that would totally do that. Which would move the odds until this all went away. Even if Nate’s numbers were as good as the odds, the odds would quickly become better.

That is not to say these markets are fully efficient or cannot be beaten. They absolutely can be beaten, if you do the work both to get superior odds that incorporate all known information, and also the work to get around the issue that if you are a winner sites will attempt to kick you out, and have a solid bankroll and discipline. Could I do this if I put my mind to it? I could. It would be a waste of my mind to do so.

In theory, I could still perhaps be tempted back by the right offer to run an American legal sportsbook that welcomes sharp accounts and uses that to build a robust marketplace that treats all customers right, and where I would have substantial equity, while working from home. And if someone wants to pay my commercial happy price I am happy to consult. Otherwise, it is important that I continue not to wager or otherwise get involved.

At The Movies

One of my goals for 2023 is to watch more movies.

The only movie I’ve actually seen at the movies recently was Glass Onion, which Netflix deemed worthy of a few days at theaters. I went back and forth on it as I watched it. While it wasn’t perfect or anything like as good as the original Knives Out, that is a high bar.

Ultimately I decided I liked it a lot and declared Worth It. This was a fun time.

I have seen a bunch of takes from smart people I respect that the movie was superficially clever, and perhaps fun, but was actually stupid and dumb. The ending was enraging. Other things like that. Also it was Very Too Online in ways that were painful.

All of that is fair. The whole thing is indeed kind of dumb and the ending was not great. The thing is, I mostly don’t care? The actors had a great time, the director had a great time, the writer had a great time and as a result (minus a few moments of Very Online cringe, and being disappointed by what could have been) I had a great time.

Seeing it in a theater likely helped. I am sad that we didn’t get the masterpiece version of this film. I am still far better off for having seen it.

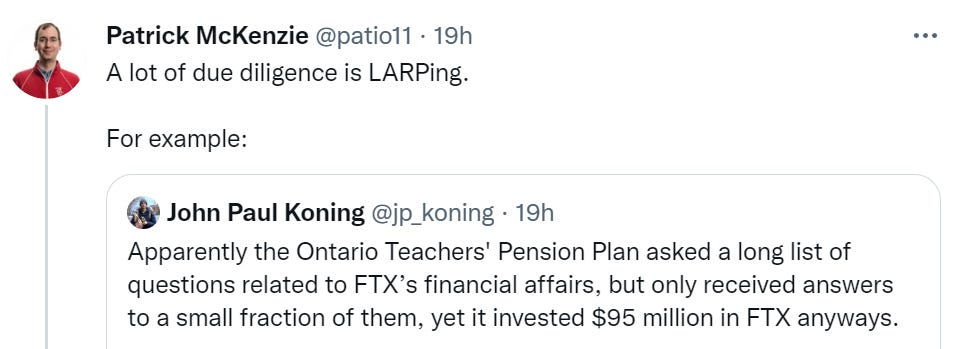

I also saw Emily the Criminal, which was also worth my time. Here is Patrick McKenzie’s take. I am not as high on it as he was. It didn’t grab me, so squarely in the Watchable or Meets Expectations categories, while providing food for thought.

I wonder about his view that the movie depicts credit card fraud as a victimless crime. The one scene where someone catches Emily in the act, the person doing so acts very much like there is a victim. The criminals don’t seem to care about the fact that what they steal has to ultimately come from somewhere and someone, but that is a statement about the criminals rather than the crime: They don’t care.

Emily in particular really doesn’t care and oh my is everyone in the other story right not to hire her for exactly the reasons they won’t hire her.

Bullet Train was a rip roaring good time. If you’re sad that Quentin Tarantino hasn’t been doing enough Quentin Tarantinoing, watch this.

I also watched some older movies recently: Man on a Ledge, Annihilation and when I wanted to give my brain a break, my second viewing of Mr. and Mrs. Smith. All three gave me exactly what I was expecting. No more, no less.

Sadly, FTX

A few postscript notes from the last few weeks.

After spending a little time in a Bahaman prison, SBF ceased opposing extradition to the USA. Which, consistent with other events, was a surprise to his lawyer. This seems like a clear case of Did Not Do the Research. Why not either flee to a non-extradition country or at least hang out in San Francisco from the start? I don’t see how being physically in the Bahamas helped with anything.

He is now in America. He has been released on what is called a $250 million dollar bond and told to stay with his parents, which effectively means ‘four people agreed to be wiped out if he flees including his parents and their four million dollar house’ rather than that someone paid $25 million to a bail bond consortium or that anyone put up $250 million in assets. You know how much money was put up? None.

I don’t expect SBF to flee. One must still recognize how absurd this is, and what it says about our bail system. By the time you read this he will have presumably pled Not Guilty in New York.

Caroline Ellison and Dan Wong both pled guilty and are cooperating with prosecutors. Caroline Ellison’s father’s second most cited academic work is called ‘Cooperation in the prisoner’s dilemma with anonymous random matching.’

Spreadsheet of Alameda’s venture investments. Sum total is $5.2 billion. Current value is presumably much less than that.

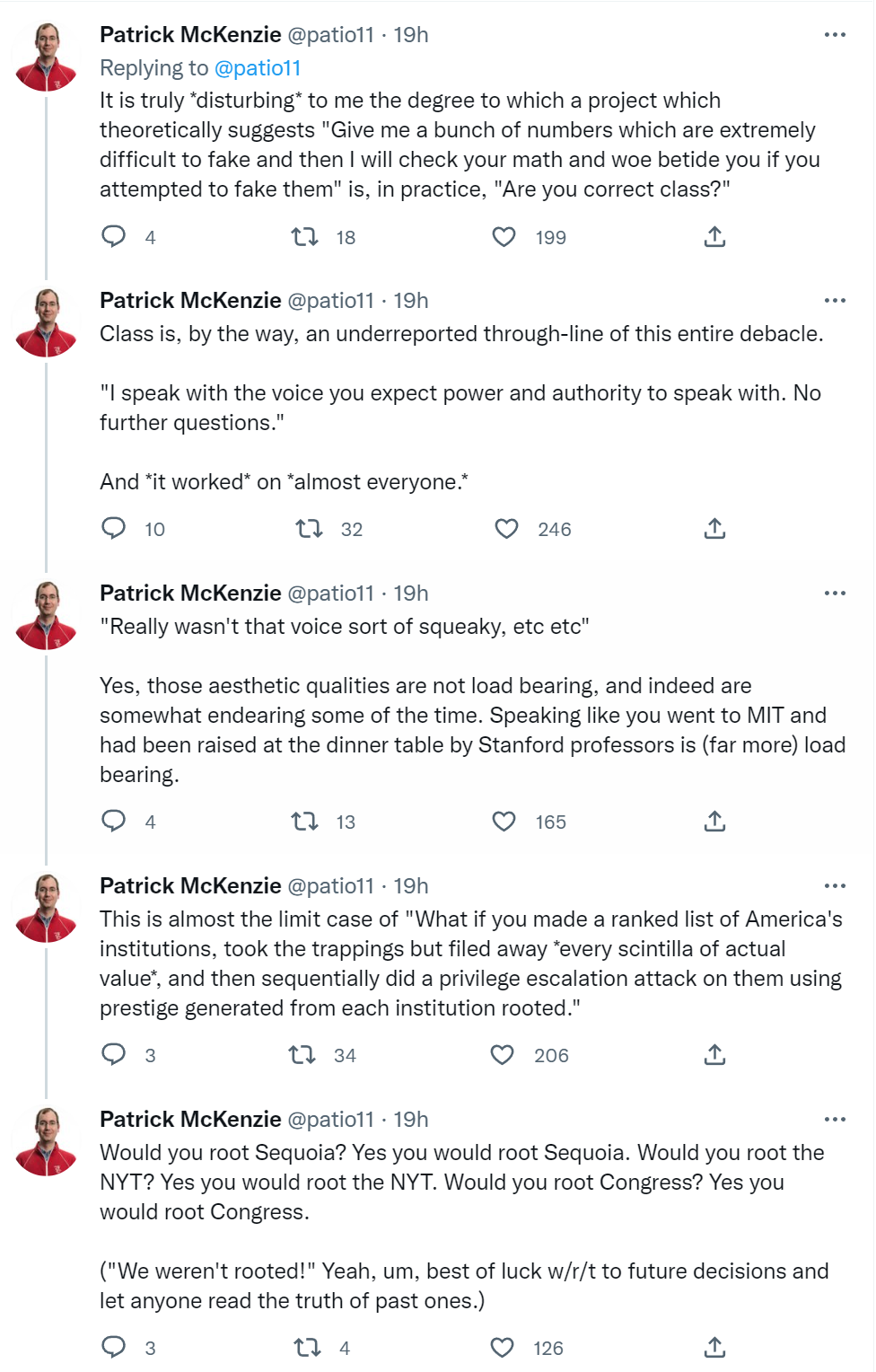

What is due diligence exactly? Often, it seems, a LARP. The Ontario Teachers Union claims to have done (over?) due diligence on FTX. FTX simply declined to provide answers, and then the union simply invested anyway. The rest of the thread is worth thinking about, as well, in more general terms.

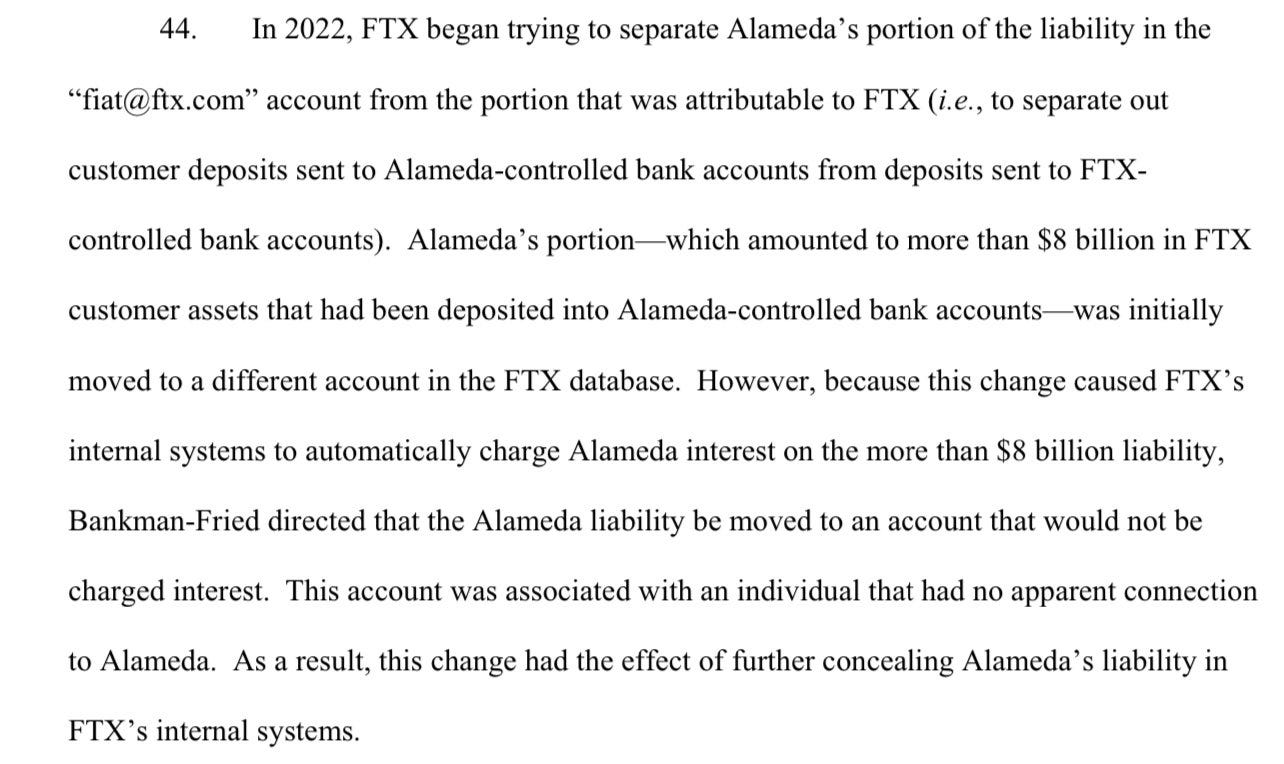

SBF was arrested on December 12. Here is the official complaint and a short thread discussing why it is a delight. Here is thee SEC blowing away any suggestion this could have all been an ‘innocent mistake.’

So, yeah.

There was a congressional hearing on December 13. SBF was scheduled to appear before the whole ‘being arrested’ incident, here was his prepared testimony (Forbes).

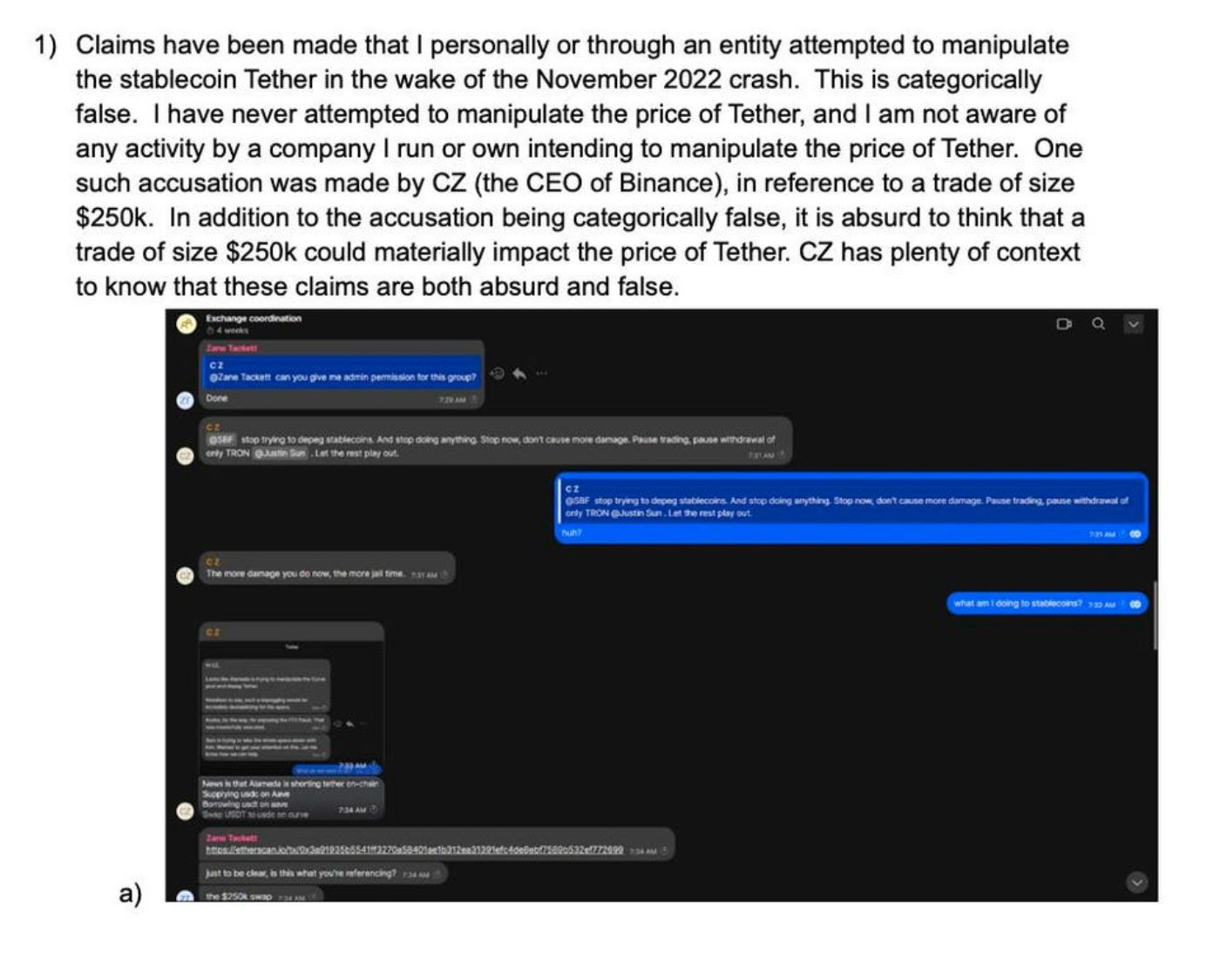

Some highlights: No risk management team. No transparency, even to themselves internally. The FTT getting to Binance in order to buy them out of FTX was due to complications of seeking a license in Gibraltar, which does not seem worth much trouble. He’s still harping on bankruptcy filing being a mistake. Oh, and screenshots from the ‘exchange coordination group.’

The hearing went about how congressional hearings usually go, which is to say mostly grandstanding and people who have no idea what they are talking about.

I am not saying this is because he had a chat room called ‘wire fraud’ but perhaps it did not help?

Readers of Matt Levine will not be so surprised by those engaging in fraud having a group chat called ‘fraud’ in which they say ‘here are some of the frauds we are doing, let’s plan how we are going to keep doing fraud, also isn’t it great how we are doing all this fraud?’

That happens all the time. There is remarkably little distance between ‘does not realize to not do massive fraud’ and ‘does not realize to not talk about it brazenly in chats’ unless your model is ‘it is so difficult to find fraud that anyone who does know better than to brazenly talk about it reliably gets away with it.’

I do not consider that hypothesis impossible, there’s something to that, yet not to the extent that seems like it would explain the data we’ve been observing.

If anything, this incident seems like it should score those involved points because they did think to use a Signal chat, presumably with vanishing messages. That clears the bar I have at this point, no matter how admittedly low that bar might be.

One thing you could do on FTX was to trade their leveraged synthetic products. This was not a good idea, because like most such products they constantly make bad trades in order to stay in balance and thus continuously bleed money. What made FTX’s versions different from many other similar crypto products was that they only balanced once a day, in highly predictable fashion, which means you could front-run the predictable bad trades, and play a cat-and-mouse game to keep doing this over time. Fun stuff. These products were another sign that all well, on several fronts, at FTX. I do still understand why they were done this way, it allows FTX to bleed the customers more aggressively.

An employee’s personal observations from working at FTX for a year, notable for how exactly it matches what you would expect from other sources. If anything, the surprise is that it matches too well.

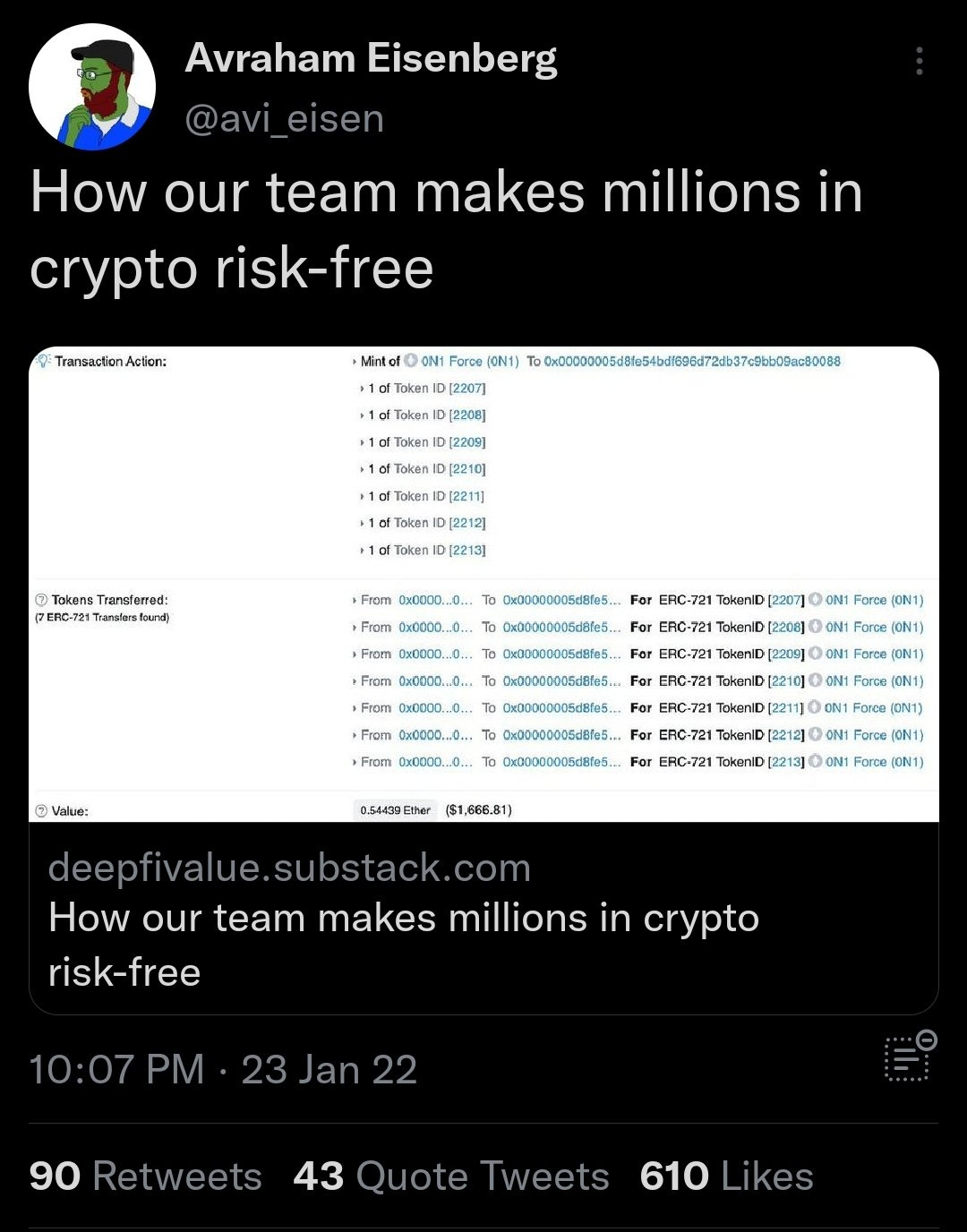

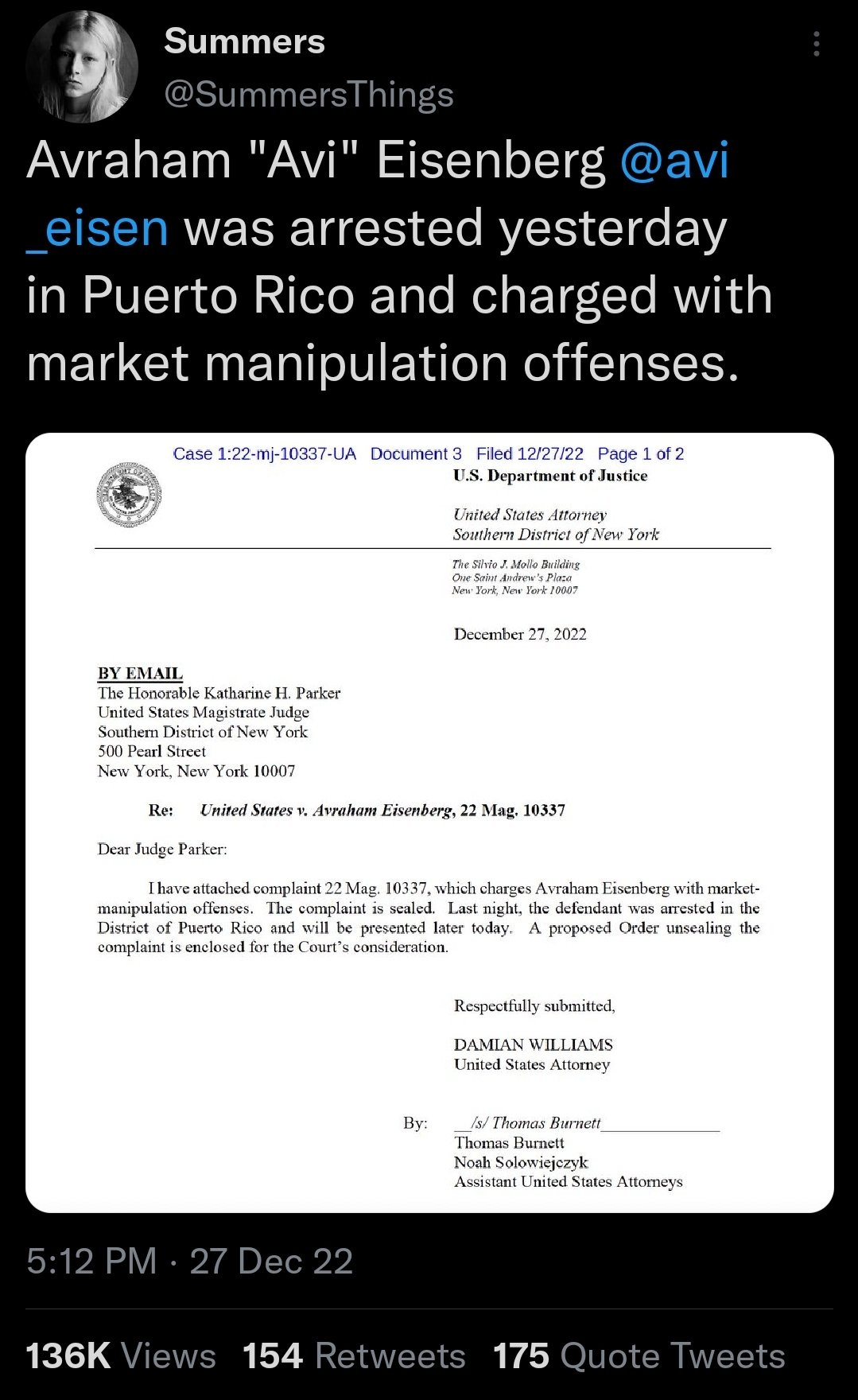

Then there’s the story of Avraham Eisenberg. He exploited no good very bad mechanism designs to manipulate reference prices and make quite a lot of money. It turns out certain legal authorities consider it market manipulation when you manipulate the market.

Oh Southwest Airlines

Southwest Airlines had a no good, very bad Christmas. Most of their flights got cancelled for several days. Their stock declined by 6%.

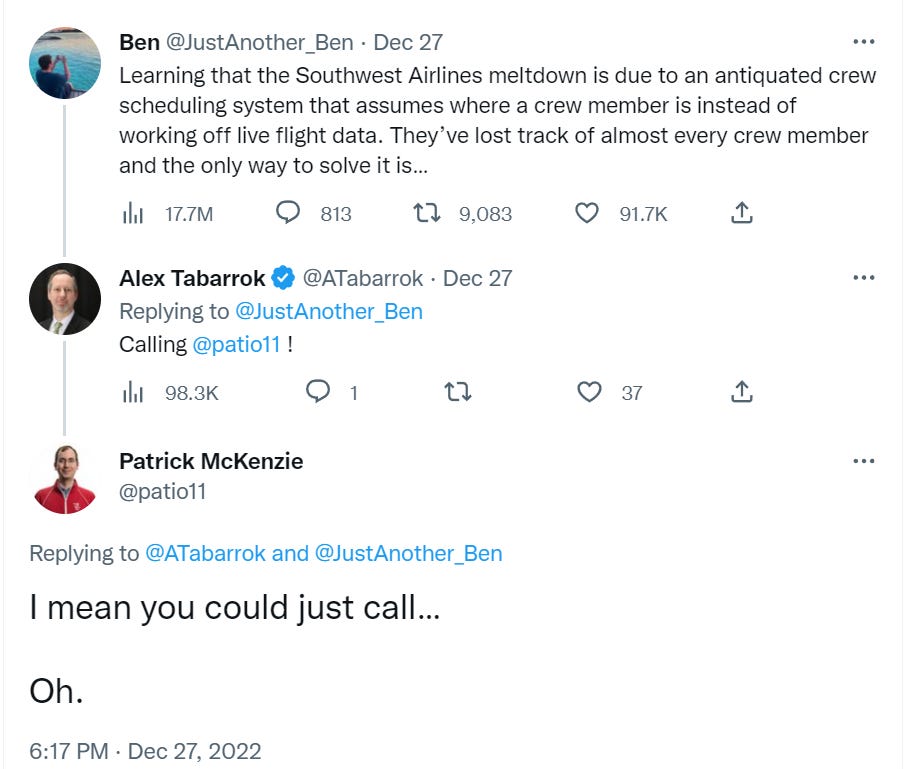

It seems there were some problems with their systems.

Calling all 20,000 employees one at a time is indeed how they manage them, or fail to.

(They also are responsible for killing at least one high speed rail project.)

What to do about this?

One solution is to say ‘this damaged the reputation of Southwest Airlines, airlines will work to avoid this happening to them. Capitalism solves this.’

Can we do better than that? The default assumption should be ‘no, in practice any intervention will probably make things worse’ but airlines are a place where various dynamics and existing distortions make this less obvious.

One possible intervention is to require prompt refunds for cancelled or significantly-changed flights.

I’ll let Megan McArdle give the standard microeconomic response.

This highlights a general problem when there is the option to Sort by Price, while differentiating features are less easy to track and value.

When one shops for flights, the standard and most common way to do that is to go to sites like Kayak or Orbitz. You’ll enter criteria, and then everything will be sorted by price. Many features, including hidden fees, don’t become clear until later. Being $1 cheaper and having the top rank in that is a huge deal.

Those who understand the differences value them on average correctly, yet still the ordering effect means they are still more likely to choose a cheaper flight if value is similar. Those who don’t understand things like ‘this airline will charge a bag fee’ or ‘this airline has actual zero leg room’ will value such things even less.

Thus, there is a race to the bottom to find ways to misrepresent the sticker price and also a race to the bottom to sacrifice features that create value, often well in excess of their cost, to lower costs so you can lower prices and fight for relative position.

Consider what would happen if you couldn’t tell which flights were non-stop until you were halfway through booking them, and it was easy to be unable to tell, and what this would do to the percentage of flights that were non-stop. Consider how important it is that there is an easy button to only show non-stop flights.

Given this situation, there is reason to suspect that mandating costly features - despite this in general being a horrible idea that destroys lots of value - might actually be welfare increasing.

The case here is especially strong for refunds, effectively providing flight insurance. The airline providing flight insurance correctly aligns their incentive to not cancel flights. On average yes it gets baked into the sticker price, then returned to customers with cancelled flights, which seems fair and equitable and also efficient, with no deadweight loss.

It is also common sense. If you can’t provide me the service I was sold, I deserve a prompt refund for that. We already have such requirements for some aspects of air travel. The extension here seems natural and logical.

What is more confused are the calls, by Porter and also of course by Warren, to use this as an excuse to tackle ‘consolidation’ in the industry.

One could reasonably say that consolidation reduces competition and thus makes air travel worse. The counterargument is that economies of scale here are very real, that reputations are easier to track and more valuable when there are fewer competitors, and also margins are thin and no one is making any money so it doesn’t look all that anti-competitive.

Notice that the calls are not in favor of competition. They are against consolidation. Why is this a big difference?

Because if we wanted more competition, the thing we could plausibly want, there is a very easy and free way to get that. The world’s biggest airlines would be happy to get involved in the domestic air travel market. They are not American, so we ban them.

If you ban the world’s biggest market participants from your market, out of pure protectionism, it is pretty rich to complain about consolidation.

Language Models Offer Mundane Utility

Thread of ChatGPT variants out there: Poe (talks normal), Jasper (long term prose, but hallucinates a lot), You (up to date, although not super reliable) and Ghostwriter Chat from Replit.

I also saw EmailTriager.com. I can’t see this saving me time, perhaps for others?

How to use GPT to scrape websites. Not obvious how much of the work this saves, and I wouldn’t rely on it for the purposes I’ve needed scraping for in the past.

Timeless Diffusion, trained from old photographs.

I too hate FSA's. They way to get rid of them is simple. Medical expenses/insurance are paid for after taxes and not before. This makes insurance more expensive, but it's also the logical thing to do.

(probably I should break up long comments? I don't know, constantly wish Substack had better formatting options for legibility and organization...)

The Bad:

*Declining value of old masters is maybe partially due to increasing risks of eco-terrorism, either directly or by lowering the relative status of such goods?

*TikTok - I continue to notice deep confusion that there's seemingly Nothing To Be Done about this Obvious Nonsense. Can't help but think that Trump jumped the gun by trying to go after this during his tenure; TikTok criticism has become right-coded, and also inconveniently deflected by pivoting back to comfortable racial territory. (Echoes of "worrying about covid is Racist, actually".) Hopefully it won't take some really dramatic Khashoggi-level consequences before Something Is Done. Sometimes wish Elon had bought ByteDance instead of Twitter...

The Good:

*This was the first year of my current career where we got through the holiday season with Zero Christmas Music whatsoever. (I'm pretty sure because management didn't know how to order the holiday CD. Yes, it's a literal physical CD that must be inserted in a disk drive to "install" the terrible-timely-tunes "station". Digital radio? Never heard of it...) I notice that employee morale was at record highs, customers largely didn't complain about the dearth - this is always the excuse given for Why It Must Be Done - and it's one of the very few winter seasons I've had that didn't leave me feeling bitter and resentful about majoritarian aesthetic preference tyranny. Talk about Holiday Magic.

*Magic inflation - one of the recent commanders was a cheap 2-drop that copies your artifact spells for {3}. I think one consequence of putting out so many new cards so quickly is...even worse power creep compared to the baseline necessary to maintain franchise interest. Like I only got interested about half a year ago, and just in that short time the new releases have been like..."wow, really, how is that okay?" I still think it's good to attract new players - like with the recent revival of TTRPG - but over the long term it's not sustainable. Only so many ways to design cards like Ruxa that make old shitty cards halfway viable.

The Condoned:

*I wonder if the grades thing works in reverse? That is, tell students all classes are letter graded, but secretly record (and actually value) only pass-fail. Would this get people to work unnecessarily harder? Also seems like one more confirmation of Goodharting - deadweight loss from optimizing for proxy of The Thing instead of The Thing. (And this is exacerbated by college admissions caring so heavily about GPAs. It's Goodharting all the way down. At least standardized tests had somewhat better correlation to the intended Thing.)

*Car loans - score one for public transit. It's been a shitty few years in many regards, but I'm quite happy to still regularly get entire train cars to myself. All for the minor cost of pre-tax-dollars-subsidized $2.50 fare, which is also not-uncommonly actually $0 due to fare readers being broken. Gas prices went up, you say? Huh, hadn't noticed...More relevantly, I wonder when the other shoe is going to drop on all the long-delayed pandemic evictions. Or maybe it already did and there wasn't actually much fuss, so it didn't show up in the news? Longer time horizon still, of course, is the looming troubles from Grand Theft Education. Which, as you made clear, depend actually very little on whether the direct debt jubilee happens or not. Lots of market shocks still to come, maybe, news at 11.

*Inflation - dunno about other labour markets, but in SF it really does seem like businesses aren't willing to raise wages much above sector "norms"...everyone everywhere is hiring, and yet no one's showing up to apply. Totally definitely coincidentally, the current crop of university students is said to be historically large, including lots of "non-traditional" students that aren't fresh off HS. Just like during the GR, lotsa folks that would normally participate in the labour force are deciding to put things on hold and pursue degrees...I sorta understand the reluctance to incentivize hiring though. Where I work, the total range of compensation for bottom-tier employees is less than $10 difference between new hire and salary-capped. Which takes around 4-6 years to achieve, assuming one gets every single possible raise. Bennies also largely don't improve with seniority. So raising the floor without raising the ceiling would ruffle __a lot__ of feathers. (We already had lots of acrimony over sudden pay rises from local minimum wage jumps, back in the #FightFor15 days. It just feels bad and wrong when someone who's got years more experience ends up earning __less__ than a newercomer, purely due to fortuitous timing...for both people involved.)

*Gifting - am reminded of Robin Hanson's claims on healthcare, that the primary function is to signal caring rather than actually cure ill health. The pervasiveness of gifting gift cards remains a head-scratcher to me...especially in comparison to just gifting actual cash. Money is fungible, and all that. But even though less gifting is probably an economic win...I think it also bodes ill for the social fabric, in that one of the few remaining easy ways to bond with people has become a confusing black box of misinterpreted signals. What does it say about how well we know our friends, family, partners, that we can't even model an acceptable gift anymore, nevermind a True Winner? There really does seem to be some magic lost by buying something off someone's Amazon Wish List. Some tension between world models, where "the point of gift giving is the gift" and "the point of gift giving is the giving". There's value and truth in both, I'd assert.