Many have already written about the events of the past week’s crisis.

If you want the basics of what happened, you have many options.

Your best bet, if available to you, is that this is Matt Levine’s wheelhouse. He did not disappoint, offering at least (1) (2) (3) (4) posts on the subject.

Then read Patrick McKenzie if you want the nuts and bolts of the underlying systems spelled out in plainer language and more detail, without judgment, along with the basics of what a responsible individual should do now, things he is better at explaining than I am.

Then read someone like Scott Sumner here if you need to get the necessary counterpoints on moral hazard.

I will do my best to cover all the necessary background in the What Happened section, to bring you up to speed. What I am not trying to do is duplicate Levine’s work. I am also going to skip the explainers of things like ‘what is a bank run,’ since they are well-covered by many others - choose one of these ungated linked summaries, or better yet Matt Levine, to read first if you need that level of info.

Instead, I am asking the questions, and looking at the things, that I found most interesting, or most important for understanding the world going forward.

What did I find most interesting? Here are some of my top questions.

What exactly would have happened without an intervention?

What changes for banking in the age of instant electronic banking and social networks?

How much money have our banks lost exactly? What might happen anyway?

How much does talk of ‘bailout’ and laws we’ve passed constrain potential future interventions if something else threatens to go wrong? Ut oh.

Is Hold to Maturity accounting utter bullshit and a main suspect here? Yes.

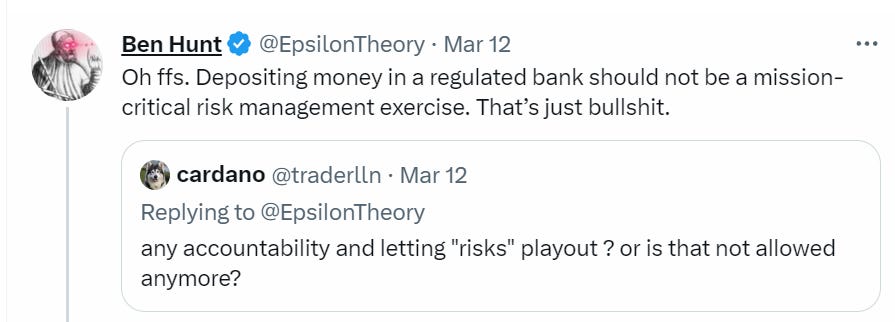

What should depositing businesses be responsible for?

What stories are people telling about what happened, and why?

How do we deal with all the problems of moral hazard? What is enough?

More generally, what the hell do we do about all this?

I also wonder about a variety of other things, such as what happened with USDC trading so low, to what extent people really do hate big tech, and more.

What Happened

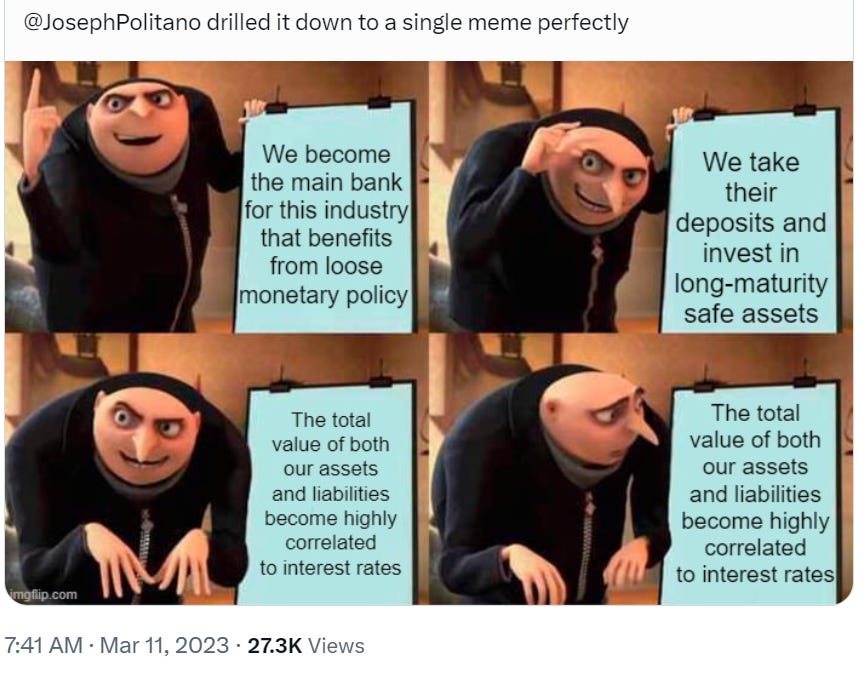

Silicon Valley Bank had a ton of deposits that didn’t pay interest, largely from start-ups flush with cash. They attracted that cash by offering high-touch bespoke services. The problem is that those services cost money, and there was no actually safe way to make that money back using their deposits.

SVB could have said ‘our business is not profitable right now, but it is helping us build a future highly profitable business’ and used that value to raise equity capital, perhaps from some of their venture fund clients who are used to these types of moves.

They decided to go a different way. Rather than accept that their business was unprofitable, they bought a ton of very low-yielding assets that were highly exposed to interest rate hikes. That way they looked profitable, in exchange for taking on huge interest rate risk on top of their existing interest rate risk from their customer base.

Interest rates went up. Those assets lost $15 billion in value, while customers vulnerable to high interest rates become cash poor.

Also SVB was in the business of providing venture debt to its clients. I have never understood venture debt. Why would you lend money to a start-up, what are you hoping for? If they pay you back you should have invested instead, if they don’t pay you don’t get paid, and if you get warrants as part of the deal it looks a lot like investing in the start-up with strange and confusing terms. Or if we look at this thread, perhaps there is no catch, it is simply a bribe to get people to bank with you so you can bet their deposits on low interest rates?

So maybe I do understand it. Either way, more interest rate risk, more losses.

SVB hoped that regulators would mostly overlook the $15 billion in losses, which they would make up over time by not paying money on deposits. Which those supervisors did, because bank supervision in practice no longer does ‘safety and soundness’ supervision that asks the question ‘is your bank doing risky things?’ and instead asks ‘did you have the right names of your procedures in place to stop the risky things?’ The thing has once again been replaced by the symbolic representation of the thing. For more details on that, see the Dan Davies episode of the Odd Lots podcast.

So they got away with it from a regulatory standpoint. No one cared.

Except, then, bank run.

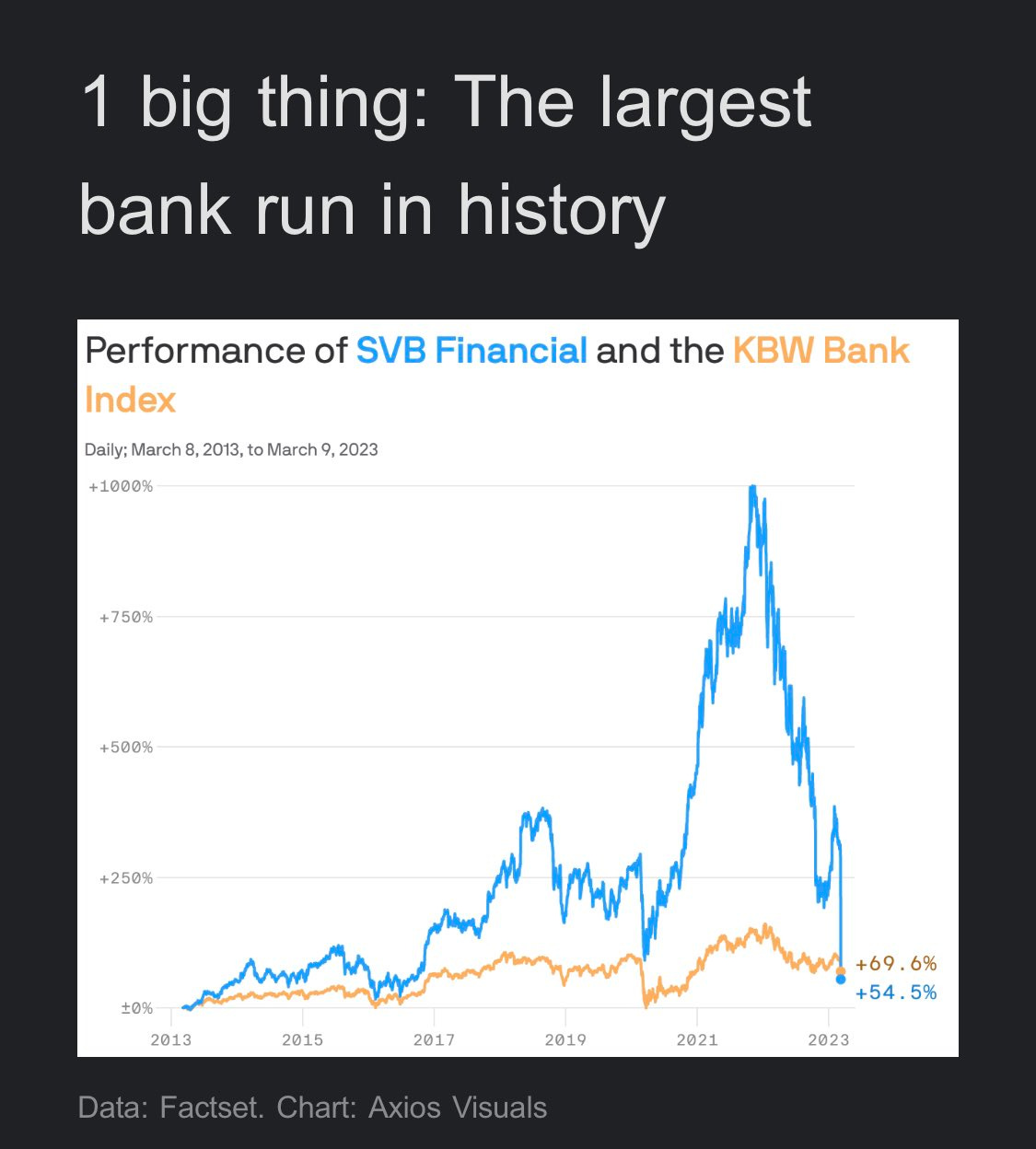

Largest bank run in history, even, $42 billion on Thursday alone.

The parallel to 2008: In the run-up to 2008, banks bet that house prices would never go down. House prices went down. There was a crisis. In the run-up to 2023, banks bet that interest rates would never go up. Interest rates went up. There was a crisis.

They tried to hold an auction to sell SVB. The auction failed. Part of this is that the US government seems not to have treated buyers from the 2008 crisis especially well, and Jamie Dimon in particular has made it clear that JP Morgan is out of the bank buying business. It turns out that if the bank you buy is fine they raise the price on you after the fact, if the bank you buy is not fine they sue you for the bad things it did, most unfair.

Another problem, if you are big enough to buy SVB the government probably doesn’t want you buying them. This led to the biggest banks initially being shut out of the bidding for SVB, and by the time they got their waiver to start working on a bid, it was too late and they ran out of time. This is, as Megan McArdle points out, completely insane and irresponsible, you let them bid and then use those bids to assess your other bids, and perhaps accept a slightly lower bid from a smaller bank if you prefer that.

It looked increasingly like there was going to be a crisis on Monday as people fled the mid-sized banks. Then the government stepped in.

March 12, 2023

Joint Statement by Treasury, Federal Reserve, and FDIC Department of the Treasury Board of Governors of the Federal Reserve System Federal Deposit Insurance Corporation

For release at 6:15 p.m. EDT Washington, DC

-- The following statement was released by Secretary of the Treasury Janet L. Yellen, Federal Reserve Board Chair Jerome H. Powell, and FDIC Chairman Martin J. Gruenberg:

Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system. This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth.

After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.

Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.

Finally, the Federal Reserve Board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.

The U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry. Those reforms combined with today's actions demonstrate our commitment to take the necessary steps to ensure that depositors' savings remain safe.

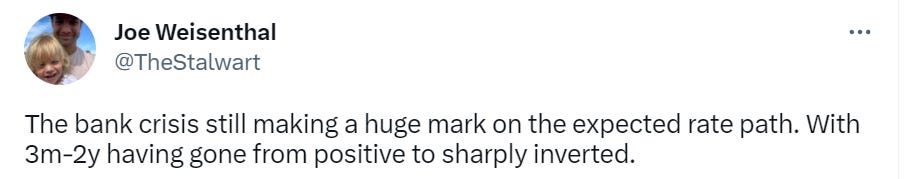

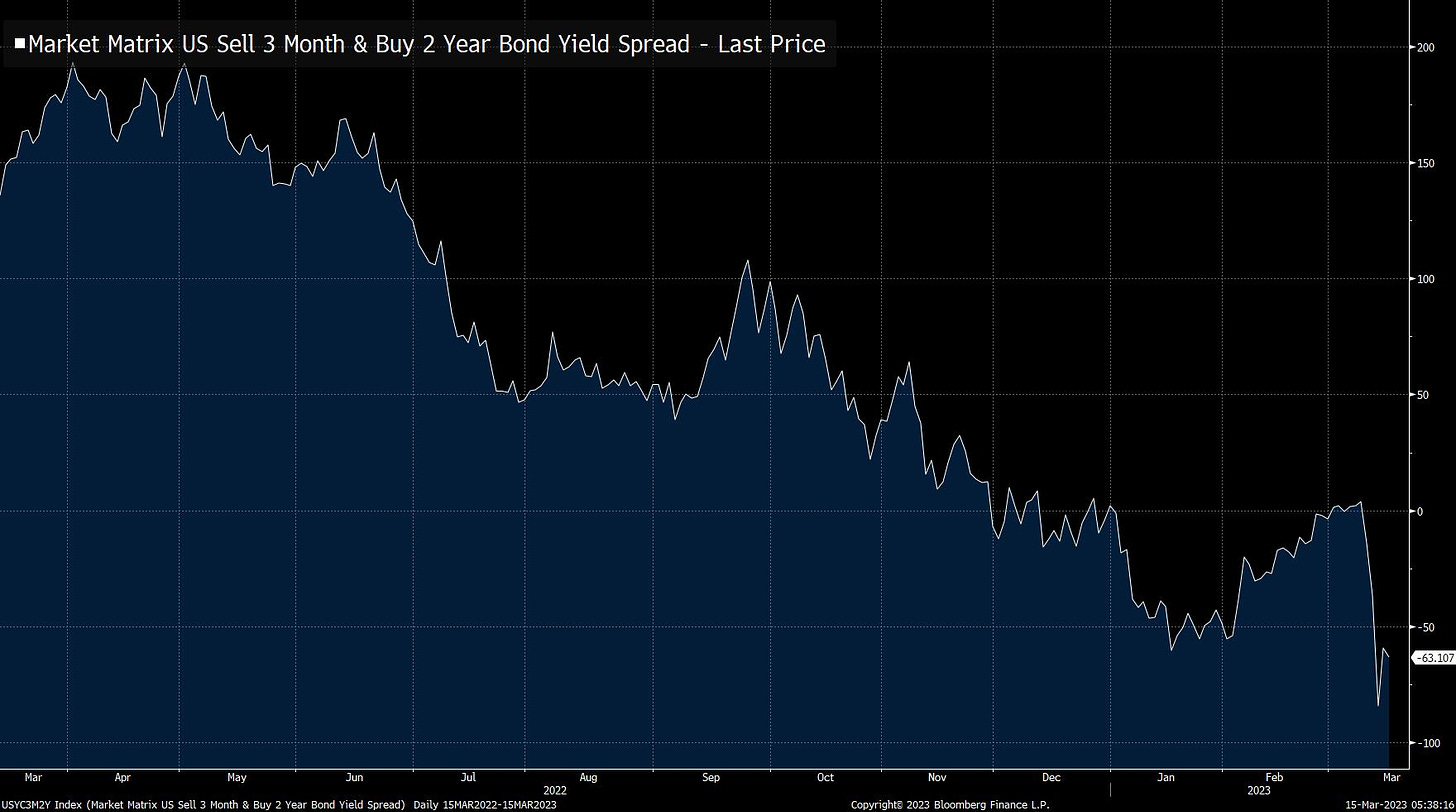

The acute phase of the crisis ended. The impact lingers on, as the expected path of future interest rates is much lower than it was a week ago.

The thing that I am still fully processing here is that the assets will be valued at par. In other words, the Fed will look at an asset with a nominal value of $100, that is actually worth $70, and will loan out more than $70 against it, because this is a bank, which magically means this somehow makes any sense. We are, even more than before, going to enshrine the habit of simultaneously demanding banks be seen as solvent, and also pretending that insolvent banks are not insolvent by saying their losses don’t count.

Noah Smith summarized the story so far on March 10. Covers the basics for those who need that, and gives us a view into how it looked back then like things might play out.

Marc Rubinstein at Net Interest summarizes here, good in-depth coverage of the numbers of exactly how things went south with the portfolio and the ability to dodge mark-to-market accounting.

David Sacks summarizes on Twitter here. SVB sold all of is for-sale securities before raising new capital, unable to realize additional losses by marking its remaining securities to market. Nothing that happened was hard to see coming, if you start making the ‘everything is fine’ calls after selling your assets and before securing your equity raise, we all know what happens next.

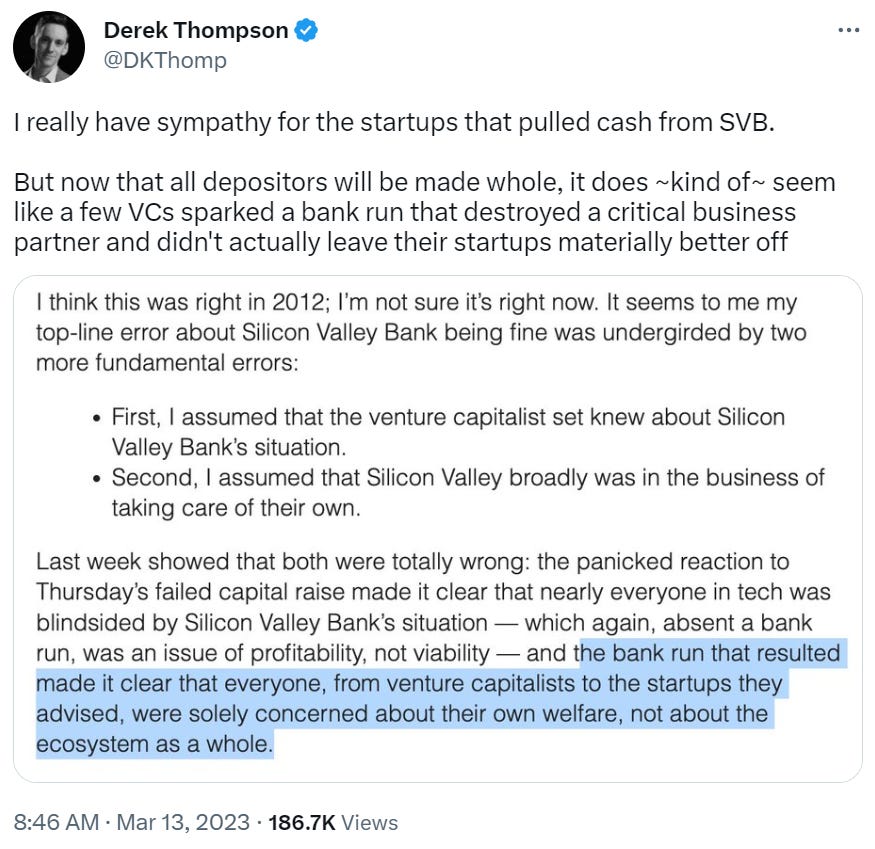

The always excellent Stratechery summarizes here, expressing surprise that Silicon Valley both (1) did not previously share common knowledge that SVB was insolvent, and (2) that SV, broadly construed, utterly failed to take care of its own. These things should not have been surprising. No one knows anything, ever, with notably rare exceptions. SV takes care of its own when it suits people’s individual agendas, not when it doesn’t, as is the case most other places, and when you are on the outs that’s that.

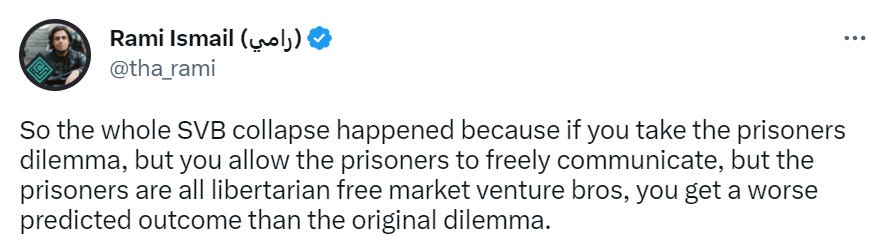

Everything happened very quickly. As Professor Stam says in this thread, with electronic banking and social media information cascades, bank runs can now manifest far quicker, move faster, and be set off by less dangerous events than ever before. What should have been a reasonable capital raise can turn into a disaster before it can close, as it did here. In future, I’d get the raise done privately, then announce after paperwork is signed. Also I’d do it a month earlier. One weird thing about that thread is that equity holders sold when the raise was announced, worried about dilution, rather than buying because they would be sensibly recapitalized. This tells you that the market was highly inefficient and many things were not priced in.

Moody’s downgrade of SVB stock on Wednesday might have been a contributing factor.

Final phase was started by, how is the answer this unsurprising, Peter Thiel.

According to some reports, the bank was within twenty minutes of raising new equity financing when this call went out.

When did it start? We have the VC firm Greenoaks warning founders about SVB as early as November 2022, a source says over 12 portfolio companies withdraw ~$1bb.

Washington Post reports on what happened inside the Biden Administration. They were monitoring the situation closely. They concluded correctly by Saturday that the situation posed systemic risk to the broader banking system and economy, observing spikes in cash requests across the banking system. The decision was made to protect all depositors at SVB, and to extend additional protections throughout the banking system to avoid further contagion.

Yes, But Is It a Bailout?

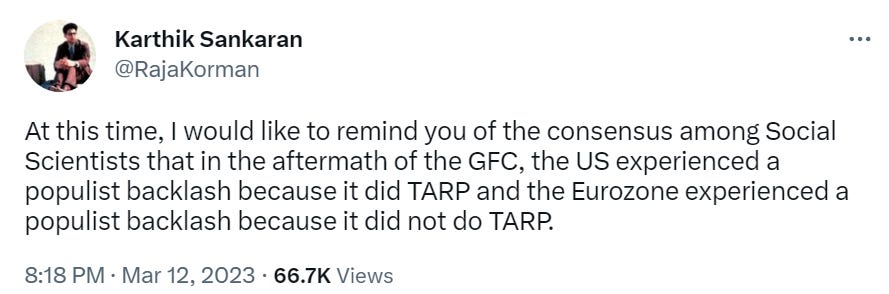

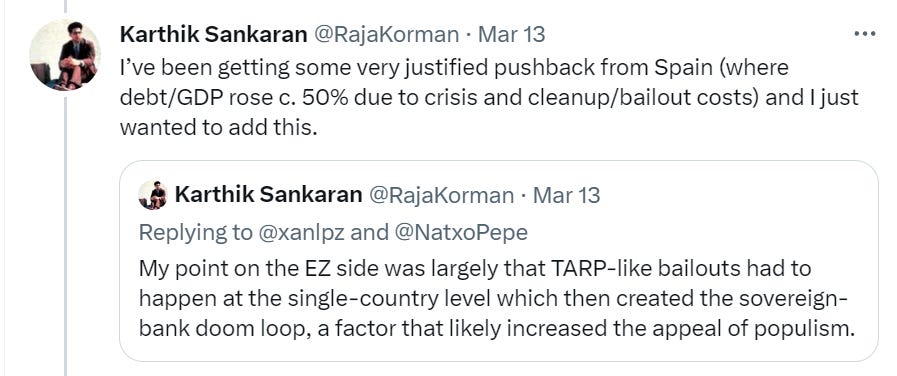

An emphasis of the Post’s summary is that the Biden administration was highly focused on how things would look, avoiding anything that would be called a ‘bailout.’

What my model says actually causes populist backlash, mostly, is the economic fallout.

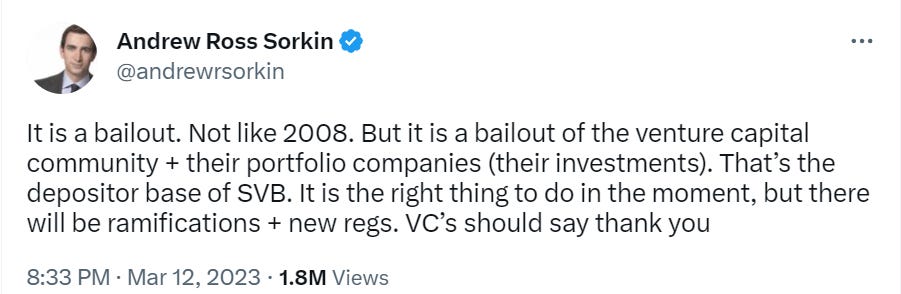

Quiet, sir. Yes, of course it is a bailout, and likely the right thing to do given we got to this point, but if it is the right thing to do you have to call it something else.

We do need to ensure the word bailout continues to have meaning. Here is what we do not want to become standard parlance:

They did bailout Bitcoin in the sense that ‘number go up’ after the announcement. They did not bailout Bitcoin directly, nor was Bitcoin about to face an existential threat if the FDIC had done acted differently. By this logic, the FDIC bailed out the whole stock market and also everyone in the world.

That is a sign of, depending on perspective, either no bailout, or a very good one.

I would contrast two bailouts, the bailout of making the bulk of funds available right away, which does not carry risk and is a lifesaver for companies, with making everyone fully whole, which does carry risk and not a lifesaver for these particular companies. The first bailout is about the companies at SVB, they should say thank you, while keeping in mind that one really is free in context. The second bailout isn’t about the companies at SVB. It is about fear. Fear about all the other banks, and all the other companies.

The Fear

It is not clear how far this fear goes. It does seem plausible that anything that would get that label is essentially off the table until after a lot of damage is already done.

The night of March 12 there was an emergency Zoom meeting, called on 15 minutes notice on normal Zoom, called by Treasury, that included most of Congress. Treasury felt that there was a domino effect in progress. So they chose to take their extraordinary measures to block further contagion.

Signature Bank was seized by regulators ‘after regulators lost faith in management and depositors fled, according to New York officials.’

“The bank failed to provide reliable and consistent data, creating a significant crisis of confidence in the bank’s leadership,” the state’s Department of Financial Services said in an emailed statement Tuesday. “The decision to take possession of the bank and hand it over to the FDIC was based on the current status of the bank and its ability to do business in a safe and sound manner on Monday.”

…

Barney Frank, the former US congressman who was on Signature’s board of directors, said he had a different perspective on how events unfolded.

…

The regulators “wanted to send a message to get people away from crypto,” Frank said in a Bloomberg radio interview Monday. “We were singled out to be the poster child for that message.”

…

Signature lost 20% of its deposits on Friday, as clients spooked by the collapse of SVB Financial Group’s banking unit fled to larger competitors, the person familiar with the matter said.

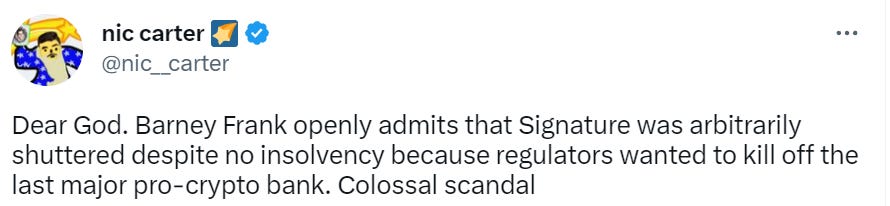

I find the framing of ‘he admit it’ here strange. Barney Frank was on the board of the bank that got seized.

“I think part of what happened was that regulators wanted to send a very strong anti-crypto message,” said board member and former congressman Barney Frank.

He’s not admitting that there is a crackdown on crypto motivating the action. He is making the accusation that there is a crackdown on crypto motivating the action.

What is interesting here is that no one is claiming that Signature Bank was insolvent, or that it was even unable to meet its liquidity demands. Regulators ‘lost confidence’ so they took the bank. That is certainly something one could see as more than a little suspicious. The question is, what exactly does a failure to provide data mean? If regulators kept asking ‘so, are you actually solvent?’ and Signature Bank kept saying ‘yes, totally, trust us on that’ then one can understand the lack of confidence. However things were moving rapidly, it is not clear if the demands were reasonable, and there is a plausible alternative explanation that the regulators were itching to take over the bank to cripple crypto, settle matters and send a message.

One thing they are claiming is that there was an ongoing criminal probe, although no one was yet accused of wrongdoing.

“The FBI and our partners remain steadfast in our commitment to keeping cryptocurrency markets – as with any financial market – free from illicit activity,” Michael Driscoll, the assistant director in charge of the FBI New York field office, warned after the US brought charges against the owner of a crypto exchange in January.

There is only one way to keep any market free from illicit activity, which is to shut down the market entirely - or to force it to shift entirely to illicit activity, in which case the terms lose all meaning. That does seem to be the plan here.

Also, as Matt Levine points out, this whole crisis could be looked at as contagion from crypto, so perhaps they decided they punished crypto for it here, or they decided that they would single out the crypto bank, the bank most similar to SVB, to punish in exchange for saving the other banks, a kind of blood sacrifice.

As a matter of rough justice you could imagine the Fed looking at the most similar bank — arguably Signature, with its huge proportion of uninsured deposits and its exposure to fast-money crypto/tech customers — and saying “no, not you, your shareholders are getting toasted.” The mechanics of the rescue mean that inevitably some bank shareholders will be bailed out, but not all of them.

I do not think they would have seized the bank under normal circumstances purely in order to attack crypto. It seems plausible that this bank needed to be seized in this spot. It also seems highly plausible that the ability to hurt crypto with this move made this move a lot more likely, whether or not it would have happened anyway under these circumstances.

There is obviously the default assumption that such decisions are capricious, arbitrary and corrupt as hell. Also kind of necessary given the rest of how our system is dysfunctional. You can see this any number of ways.

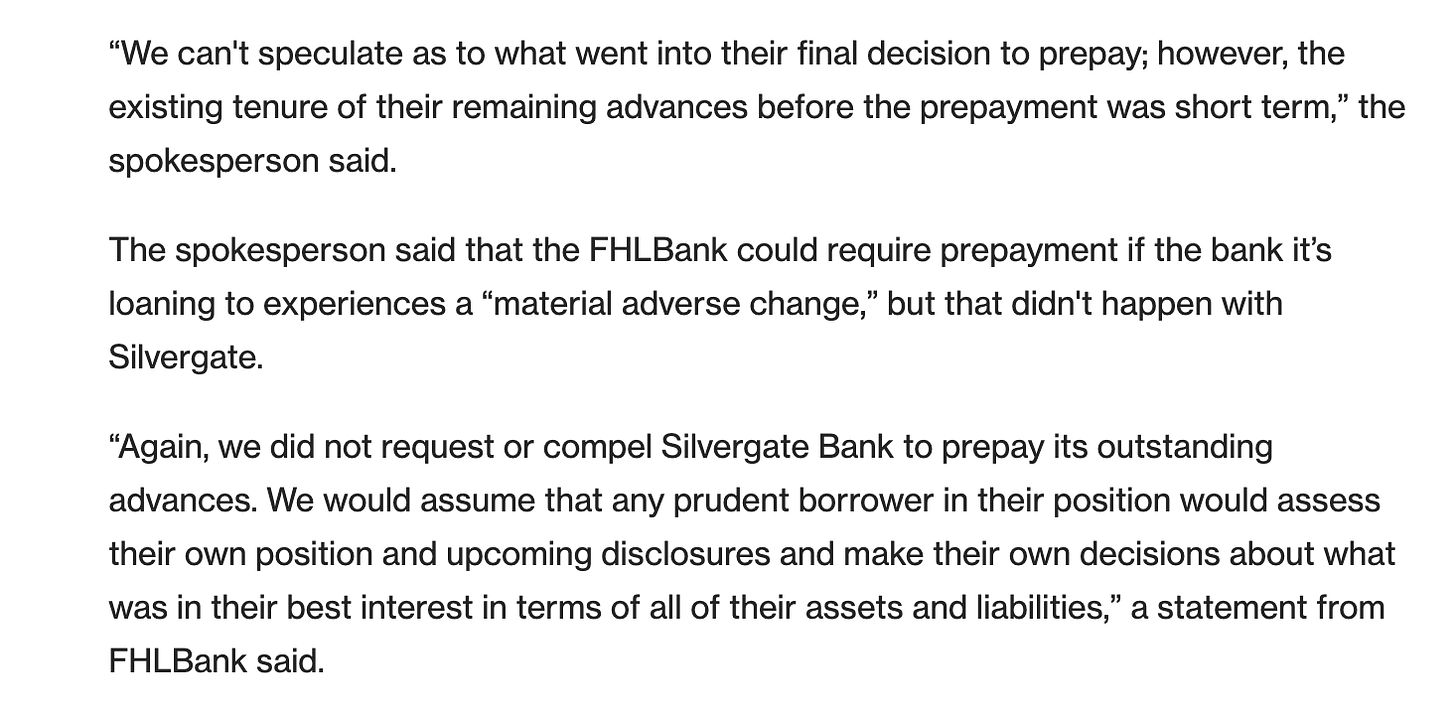

Then there is the issue of Silvergate bank, which by all accounts died when it acted as if it was compelled to prepay liabilities it… wasn’t compelled to prepay? Which could reasonably be called ‘inexplicably committing suicide’?

That makes it less of an inexplicable suicide. It doesn’t answer that many of the questions.

Are Taxpayer Funds At Risk?

Yes. The answer to this question is always yes.

Taxpayers are the ultimate backstop if things get bad enough. In the vast majority of timelines, things won’t get so bad, and taxpayers won’t be on the hook. That does not mean that taxpayers are not on the hook, for a risk no one else wants on their books, and that has real costs.

The argument being made is that we will pass this cost on to the banks. The taxpayers have the power to tax, and the power to charge fees to banks, and they will raise fees on banks going forward to reclaim any money spent.

A question I have not seen asked is: Who exactly pays when you do that?

The default answer is that the equity holders (and by implication, to some extent, bondholders) of banks pay the extra money. Money gone, money comes from banks, so equity is lost, it is not enough to threaten bank viability anywhere, all is well.

The alternative answer is that if you impose let’s say a 10bps (0.1%) tax on deposits at banks for two years to pay for the extra costs, what is the tax incidence there?

One presumes that the rate of interest paid on any accounts so taxed will be lower than the counterfactual rate by exactly the same 0.1%. Accounts that pay less than that might lose other features, but the people actually paying are not the banks, they are the depositors of money. They bear a striking resemblance to the taxpayers.

Similarly, if there is a future expectation that banks may have to pay such fees retroactively on past deposits or other past activity, what happens? The same thing. All banks bake that into their prices and bids and offers, they are financial people who are very used to doing exactly this sort of thing.

How Bad Could It Have Been? How Bad Could It Still Be?

Some people thought this was a nothingburger and mostly harmless.

Ultimately Treasury, FDIC and the Fed did not agree. Contagion was happening, dominos were lining up and a crisis was looming. The market also did not agree. If this was a nothingburger, we would not have seen the moves we saw.

So yes, things could have been quite bad, although the default bad outcomes are ‘we have to do more, later, and everything is worse’ rather than ‘we are stupid enough to watch the whole thing collapse and the world economy collapses.’

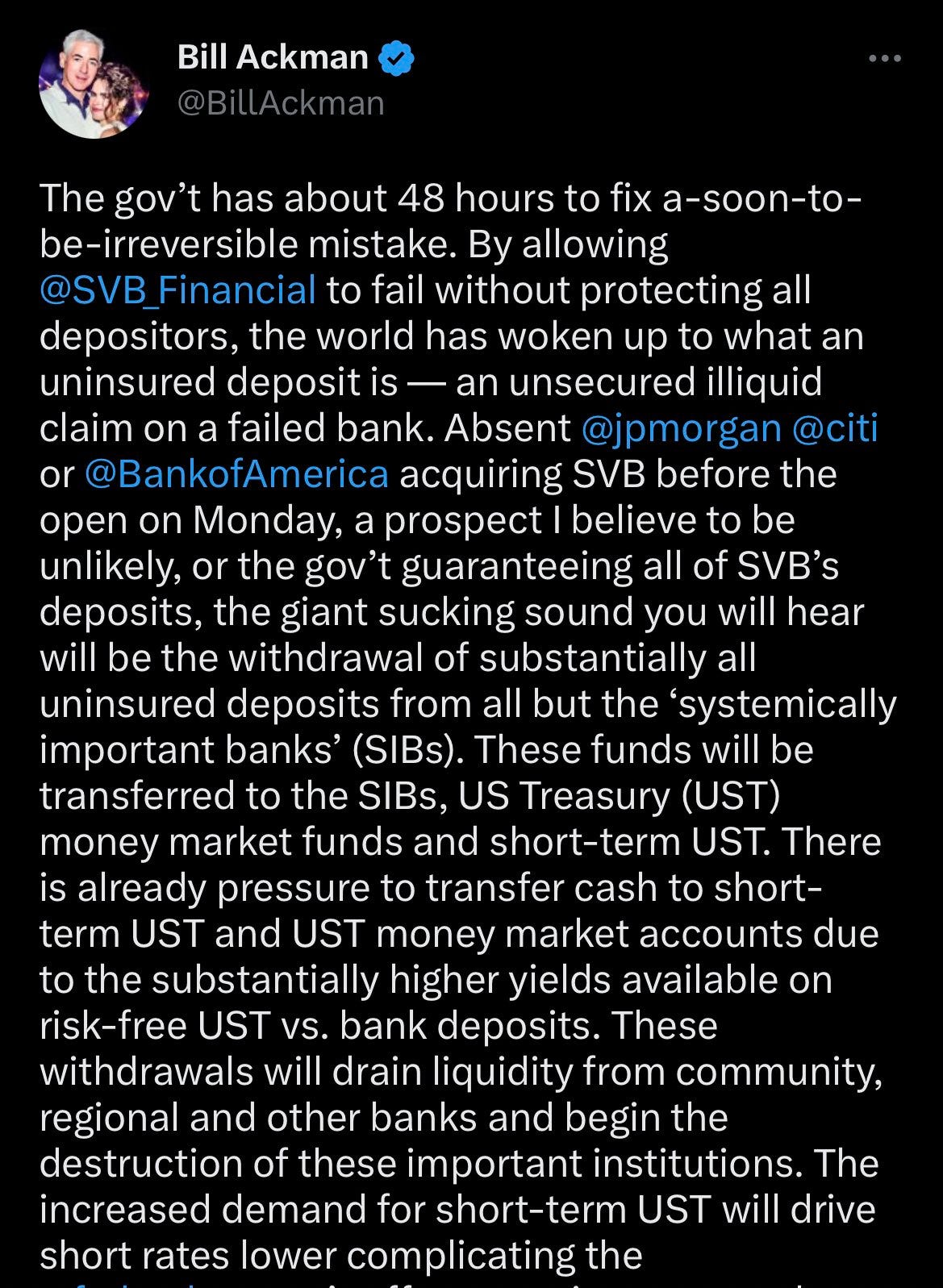

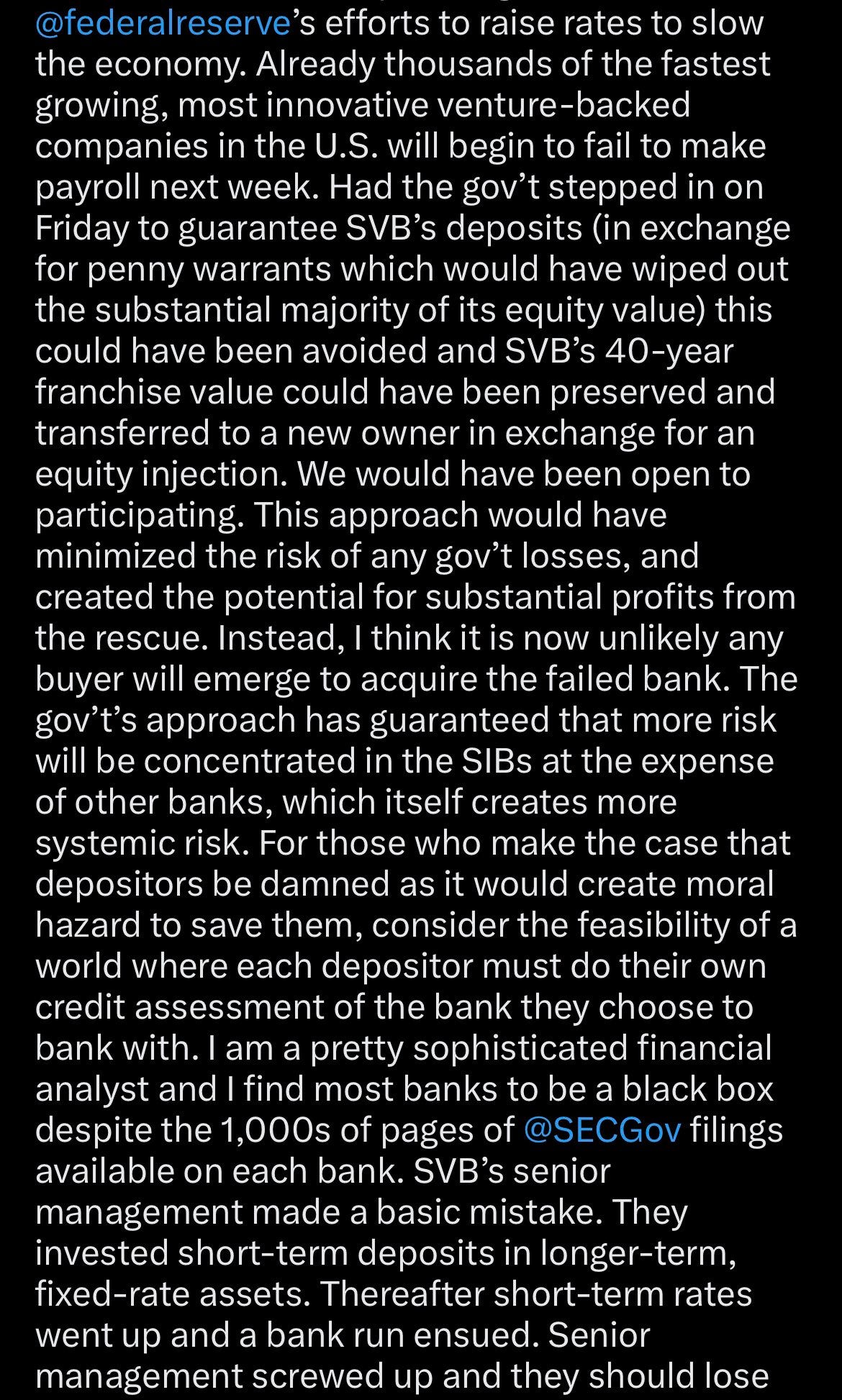

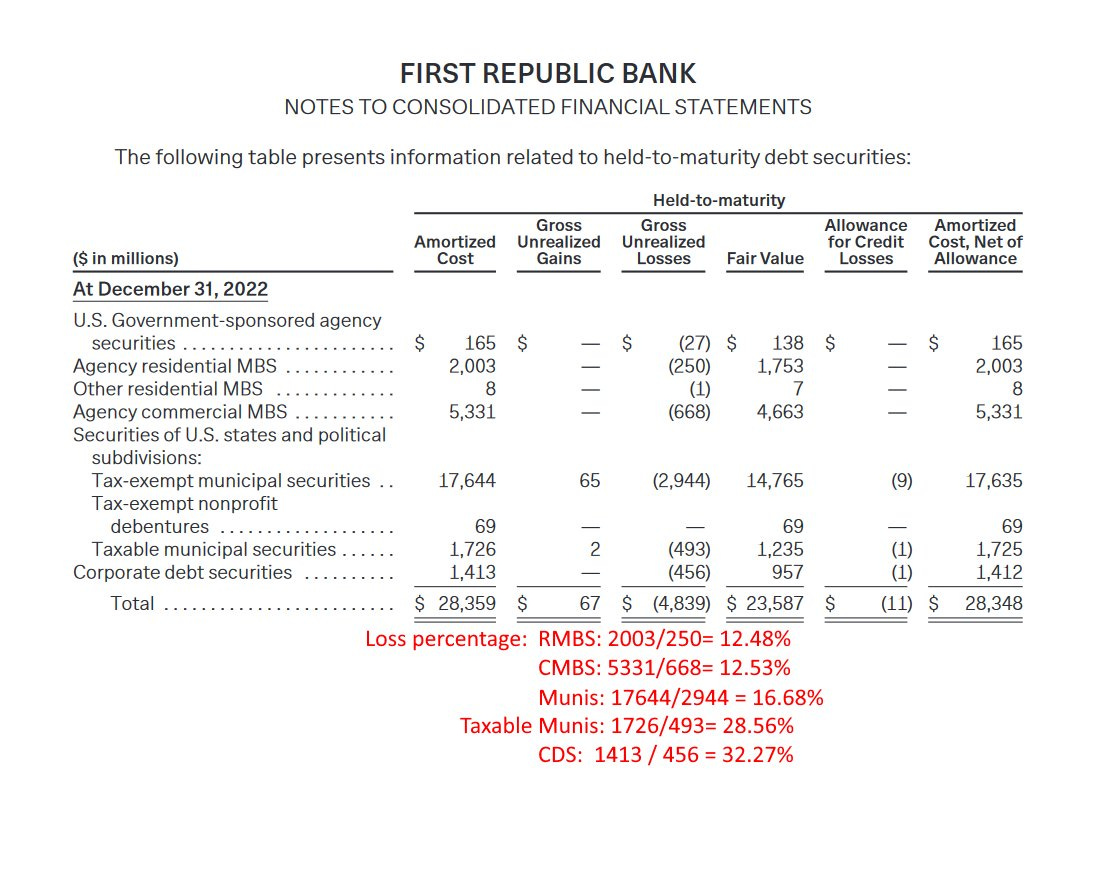

Here was Bill Ackman warning us, and yes I hate these giant Twitter posts too.

Jason spent the weekend tweeting in all caps about how awful the situation was, how he said people would line up at banks for their money on Monday and mostly not get it, got rightfully called a ‘psychotic ignoramus’ by Taleb and then said he was adding ‘psychotic ignoramus’ to his bio but I am sad to report it was not there on the 15th. His details were very wrong, but the fear behind them, that this would cause widespread contagion, looks like it was indeed correct.

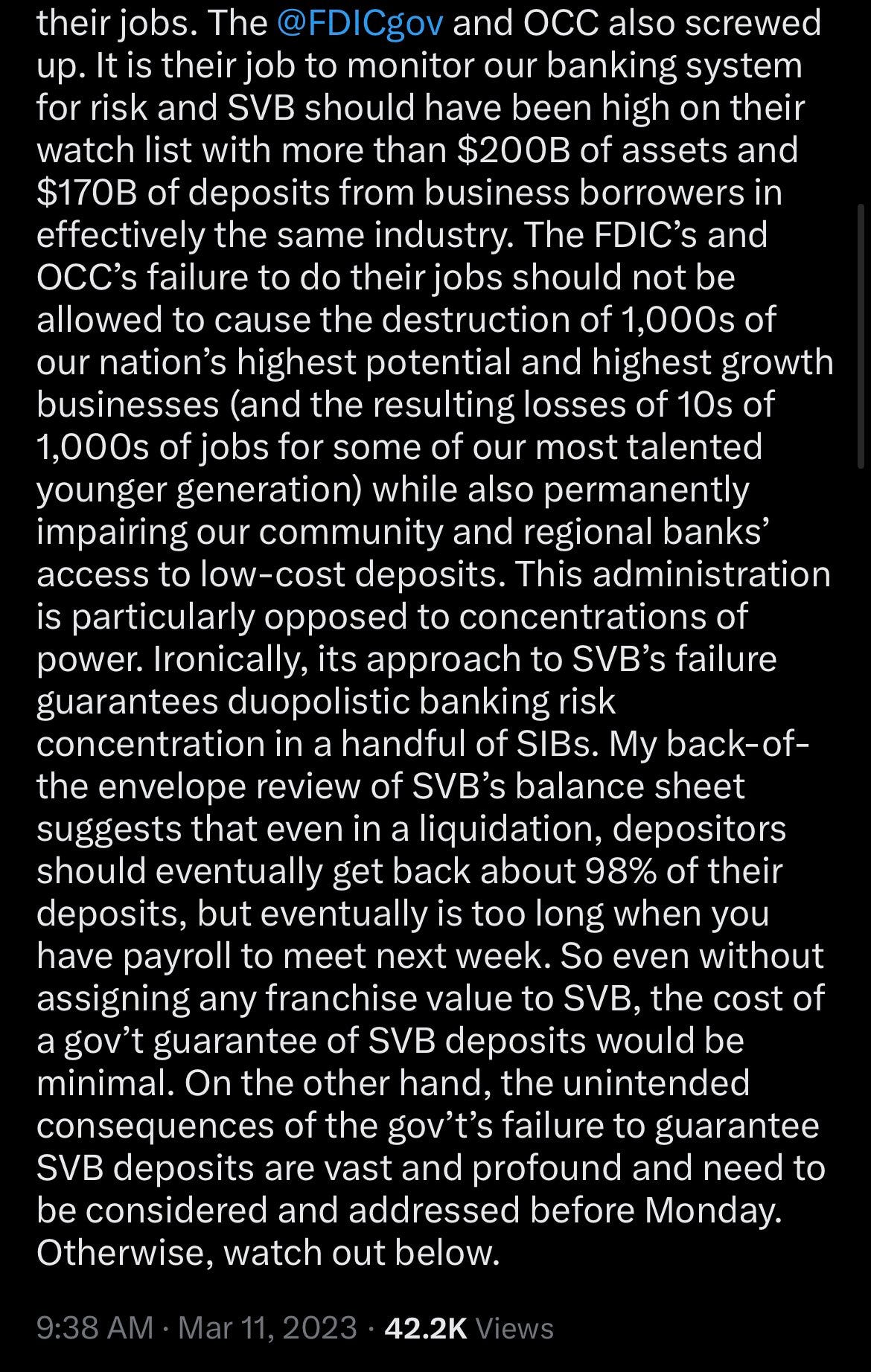

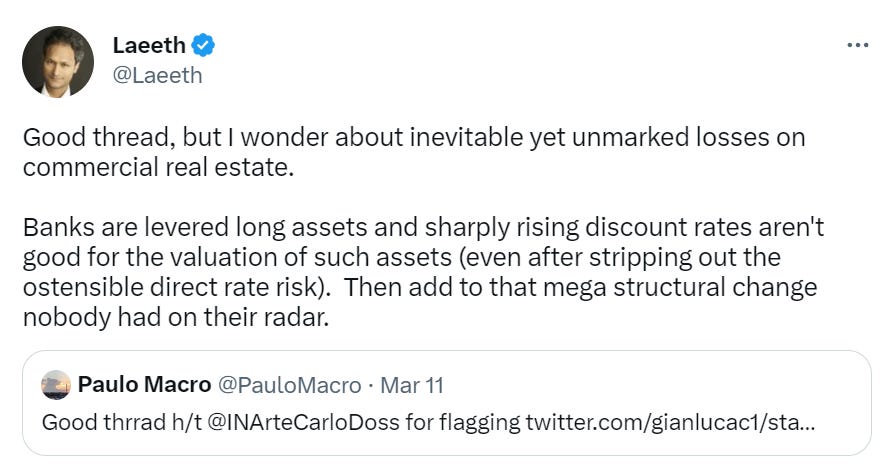

First Republic Bank would have been the next big domino to fall. Once again, the entire problem is that asset portfolios involve lots of things that pay very little interest for a remarkably long time, and thus have lost quite a lot of value. Only the fiction of not marking to market is keeping such places afloat.

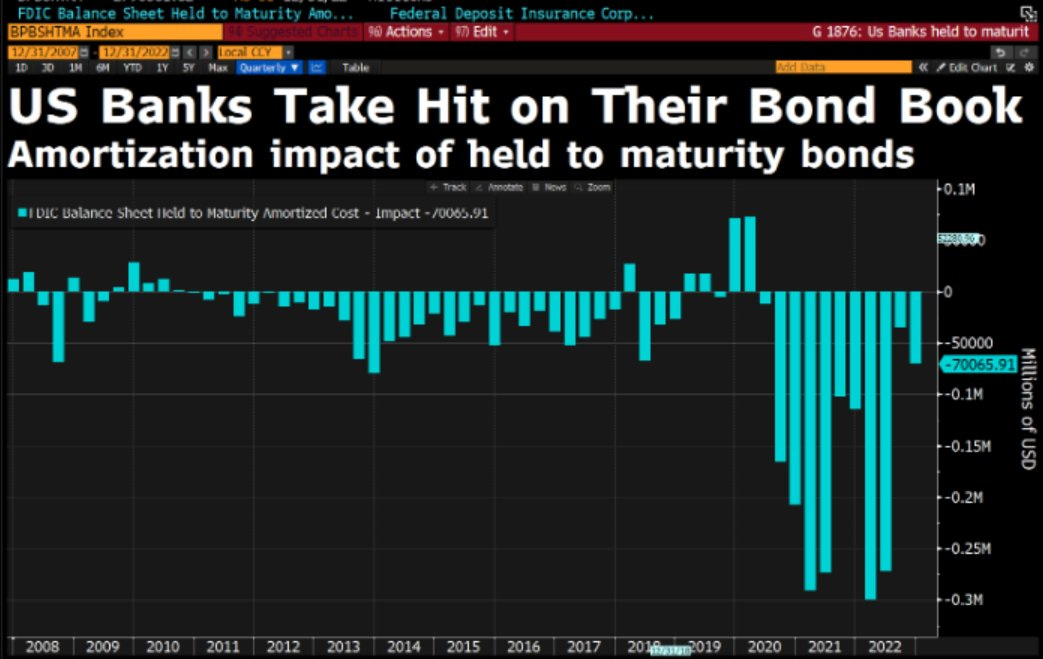

The problem cuts across the banking sector. Banks borrow short and lend long. They all hold a large quantity of long term loans that have lost a lot of value and which they are pretending did not lose a lot of value by saying ‘hold to maturity.’

What about commercial real estate, for example?

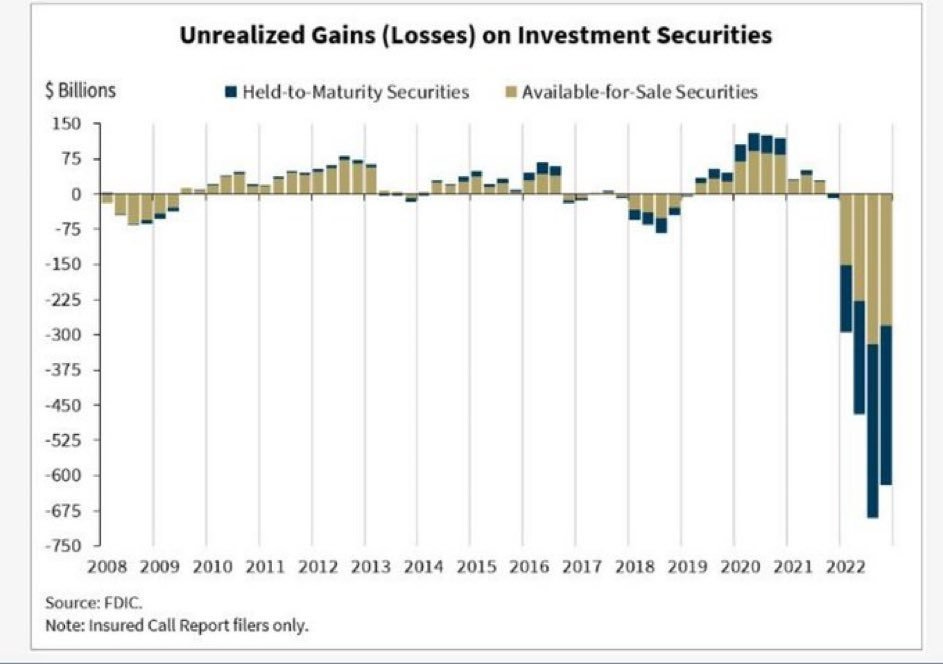

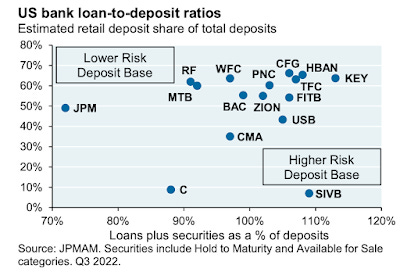

This is one of the most important charts.

Translation: The gold is ‘losses we have admitted we lost’ and the blue is ‘losses we are pretending we didn’t lose as far as the government is concerned.’

Bank securities portfolios are quite large.

Between the end of 2019 and the first quarter of 2022, deposits at US banks rose by $5.40 trillion. With loan demand weak, only around 15% of that volume was channelled towards loans; the rest was invested in securities portfolios or kept as cash. Securities portfolios ballooned to $6.26 trillion, up from $3.98 trillion at the end of 2019, and cash balances went up to $3.38 trillion from $1.67 trillion.

The presumed solution is to lure a bunch of deposits with higher interest rates, take the losses on these loans and power through it. Hopefully that will mostly work.

Payroll is a very big deal. Even the possibility of not making payroll is a big deal, half of Silicon Valley spent the weekend scrambling to ensure they’d make payroll if funds remained tied up. If large numbers of companies suddenly can’t make payroll, that is very bad and causes many very bad things to escalate quickly. It also has potential fallout before it happens, since unpaid wages can sometimes pierce the corporate veil, which means anyone potentially involved could get fired proactively, snowballing the crisis. Every time I game out a potential banking crisis, the last line is something like ‘…and then a bunch of companies miss payroll’ because one does not need to know more to know not to go down whatever road that is.

That’s why, to me, the bailout of these companies that they needed was ‘they can make payroll’ via release of most of the funds, and then the bailout that everyone else needed was making all depositors fully whole so there weren’t additional runs elsewhere.

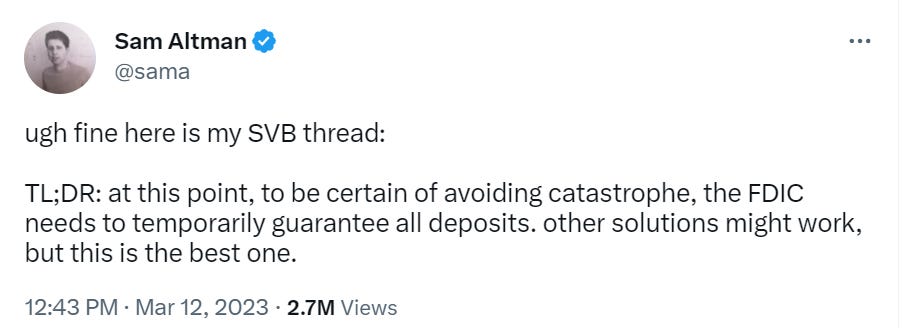

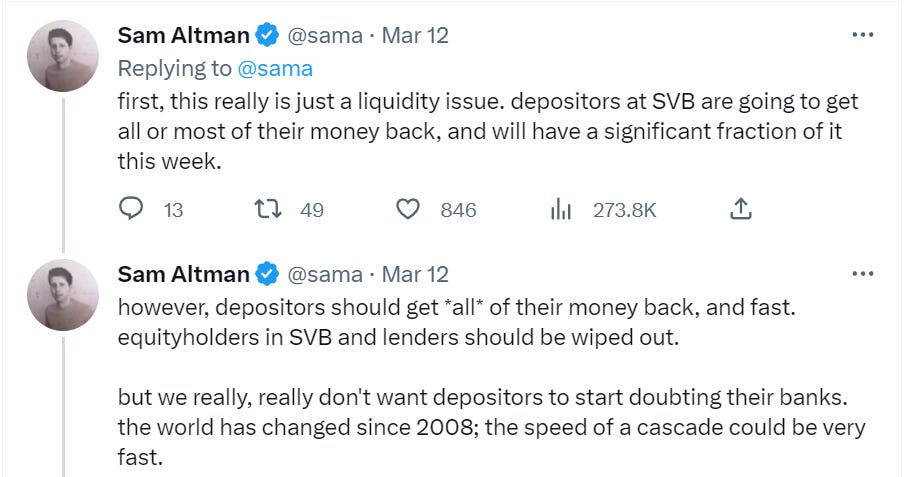

Thing is, Sam is fundamentally wrong about this. The issue was not liquidity. The issue was solvency.

Mark to Market Accounting

Sometimes you think about things more and they get complicated.

Sometimes you think about things more and they get simple.

Matt Levine wrote many thousands of words about all this, in which he points to the fact that unlike in It’s a Wonderful Life, declines in the value of bank assets are now noticeable, and thanks to social media people notice them and point them out, and people learn that banks that are insolvent are in fact insolvent, which makes them collapse.

Whereas if everyone had the good manners to simply not notice the problem, the bank could have been broke but muddled through until they were not broke.

Banks are kind of broke rather often - I joked today that they are ‘only’ broke 25% of the time. Except we pretend their losses don’t count.

We have accepted the principle that bank failures are bad, that depositors need to be made whole essentially no matter what, and the taxpayer is on the hook for all of it.

In exchange for this, we make the banks prove they are solvent, and that they have enough of a capital buffer.

Then we let them cheat.

Except reality does not care what your spreadsheet says.

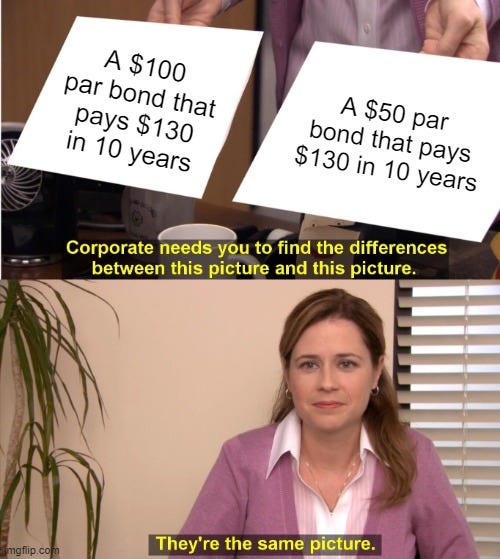

Hold to maturity accounting (HTM) is pure and utter bullshit.

I said it.

So does Arnold Kling, who periodically shouts it from the rooftops.

There are a number of big problems here. To me, the biggest root of the problem is the failure to require mark-to-market accounting on all loans and securities.

You might not be able to adjust for default risk of illiquid assets. You can still damn well adjust for the changes in interest rates since the loans were issued, allowing for initial value to be par.

John Cochrane, ordinarily quite the grumpy economist, offers the counter-argument, which is that the business purpose here is valid. If you have a $100 liability coming due and a $100 bond that comes due at the same time, they do offset, so if you mark one to market you have mark the other ‘to model’ and you have the problem of illiquid or manipulated prices, and perhaps HTM is the less bad option sometimes.

My response to this is that we do have a reliable market price for movements in interest rates. We already require marking to market, as I understand it, for ‘impairment’ of an asset, so that’s covered. So if the market price of the asset itself is unreliable, we don’t have to rely on it, we can instead look at the highly reliable change in interest rates, and adjust based on that.

As for John’s example of you matching the future $100 to a future $100 liability, if you could have paid that liability with a new bond that costs $80, then I don’t see why you are treating the two bonds differently there either. If you have to count a future liability at its full face value, that is a second, different accounting problem.

There is one accommodation we must make. In the spirit of ‘get your government hands off my Medicare’ one cannot move instantly from HTM accounting to MTM accounting while there are solvency tests in place. The banks only play by the rules set. Don’t hate the player and destroy the game, fix the game for next time. For now, we are stuck. Going forward, in exchange for this favor, I propose a simple exchange. Starting today: No more marking anything newly issued as hold to maturity. At any bank, or anywhere else. Forever. Not for the purposes of any official test, and not for the purposes of any official business. This crop of bullshit must be the final crop of bullshit.

Note that we are kind of doing this a little bit with the Fed’s Bank Term Funding Program.

Eligible Collateral: Eligible collateral includes any collateral eligible for purchase by the Federal Reserve Banks in open market operations (see 12 CFR 201.108(b)), provided that such collateral was owned by the borrower as of March 12, 2023.

You have to have owned the bonds before this all went down. No cheating on new bonds. Exactly. I simply want this extended a bit further.

Will that make it more likely that we will notice our banks are insolvent, or close to insolvent, in the future? Why yes. Yes it will. Good.

Matt Levine notices that the service the Fed is providing, that used to be provided elsewhere, is ignoring that interest rates have gone up, and that this service can be extremely valuable. Which it is. It’s great when the sucker sits down at the table.

Tyler Cowen is also explicit about it.

Note that every now and then the U.S. banking system is semi-insolvent, but matters work out because “on paper” losses do not have to be either realized or reported as such. Remember the 1980s? One danger is that if other banks start selling their bonds at a loss, the problems in the system will become increasingly transparent and compound themselves. That is not the most likely scenario, but it is something to watch out for.

Thing is, it didn’t work out? We had to do the whole giant S&L bailout that was allowed to balloon in size? Yes, we keep having insolvent banks and they keep mostly muddling through over time because we offer them various subsidies to make the money back, but again, either we want to allow banks to be insolvent or we don’t?

If the Fed wants to give loans to banks in excess of the value of the posted collateral, we can choose to do that . But let us do so without pretending we are not doing that, and not on this strange accounting basis.

If we want to allow our banks to operate with smaller margins of capital, or even with small negative amounts of capital, we can choose to do that. But let us do so without pretending we are not doing that.

How to think about that? To be continued later, under the discussion of moral hazard.

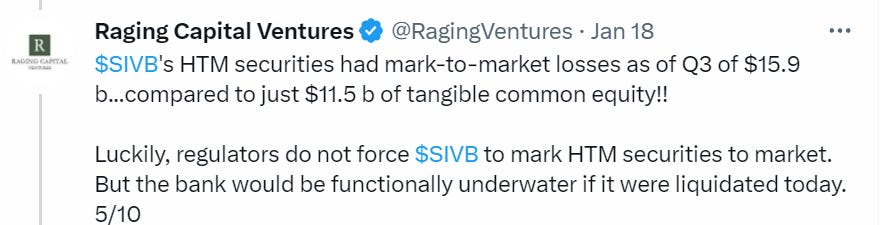

Who Could Have Predicted This?

In other words, even counting enterprise value, SVB was openly broke in January.

The problem wasn’t subtle.

The Hypocritical Oath

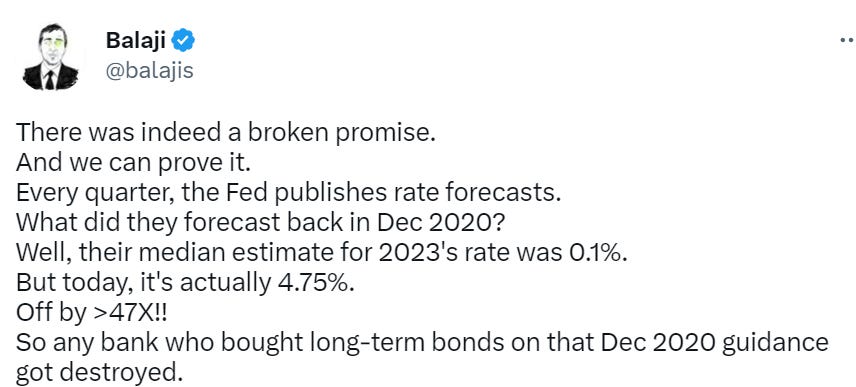

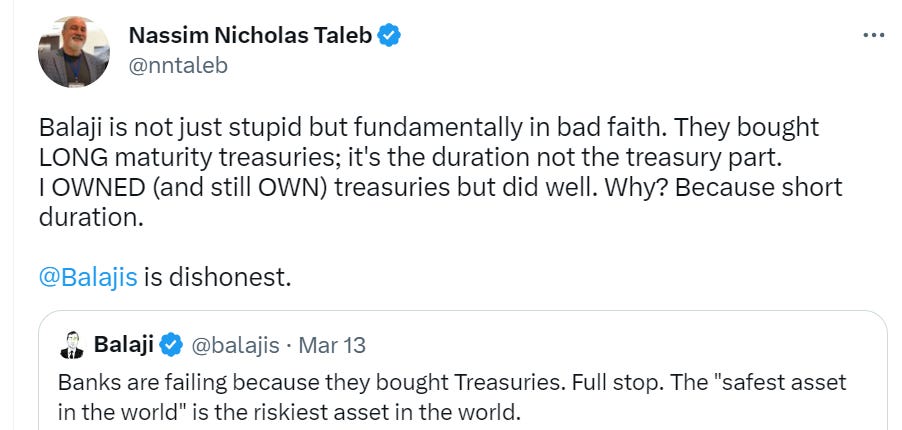

You can stop wondering if Balaji’s criticisms of traditional economic and government systems come from a reasonable place rather than continuously talking one’s book.

That is not how any of this works. That is not how it works in finance. That is also not how these words work in English. A median of 0.1% is not a promise, nor does it exclude the possibility of 4.75%. The Fed explicitly says these are not promises every damn time.

Except these were the banks crypto and startup people used so their intentional purchase of buzz saws to walk into is somehow the fault of a forecast. Yes, I bet the farm on interest rates staying low forever to chase higher returns, but ma, you promised! High interest rate make number go down, number must go up, it not fair!

I too would criticize the Fed here, potentially up to the level of breaking their commitments. Not because they raised rates too high too fast. Because they raised rates too slowly and not far enough, in the face of clear inflationary pressure. These banks, given they bet the firm on low interest rates, should have been wiped out far sooner.

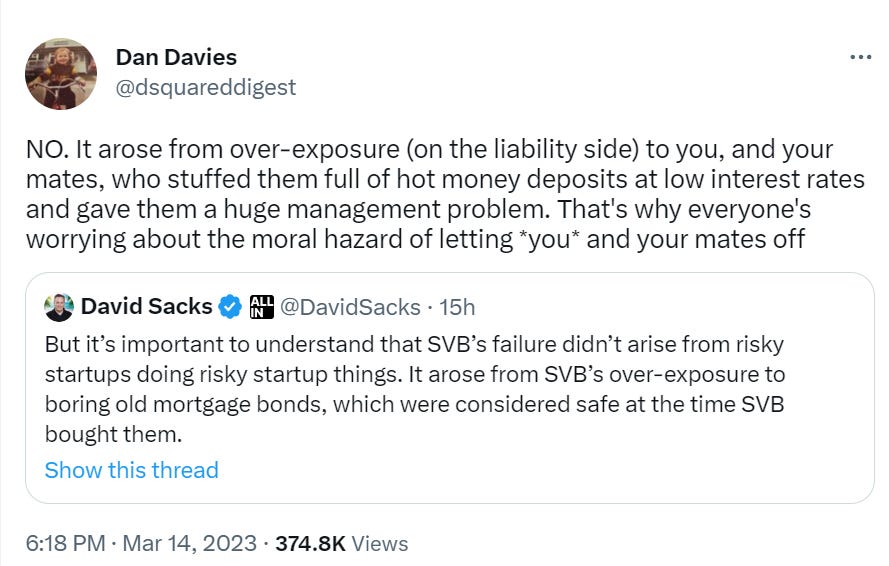

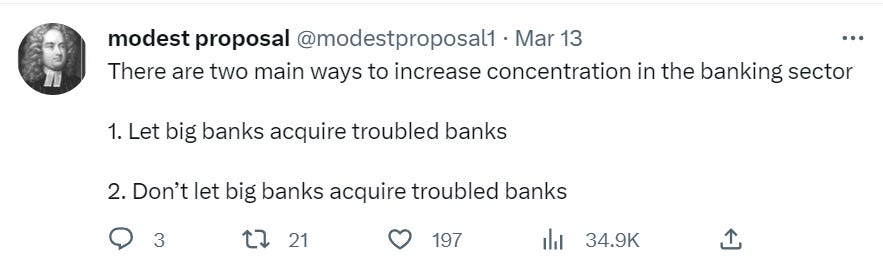

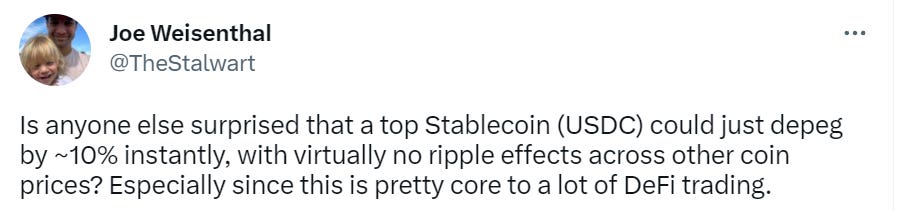

Joe Wiesenthal explains here in further detail how fully this is not how any of this works, with Modest Proposal pointing out correctly that such criticisms are simply in bad faith.

Nassim Taleb says he can’t get how some people are not offended by this. I would say that most people are used to this level of disingenuousness and dishonesty, and many of them are busy talking up their own books in similar fashion. While those who aren’t would be wise not to be newly offended by events that match one’s expectations. At some point you make your pinned Tweet ‘What Donald Trump did today is a disgrace’ and you stop harping on the exact details.

Another absurd line is to call for bringing back Glass-Steagall, as Robert Reich does at this link. Nothing that happened here relates in any way to any repealed provisions of Glass-Steagall. Silicon Valley Bank did not do ‘risky investments’ we don’t want banks to do, it took on tons of interest rate risk.

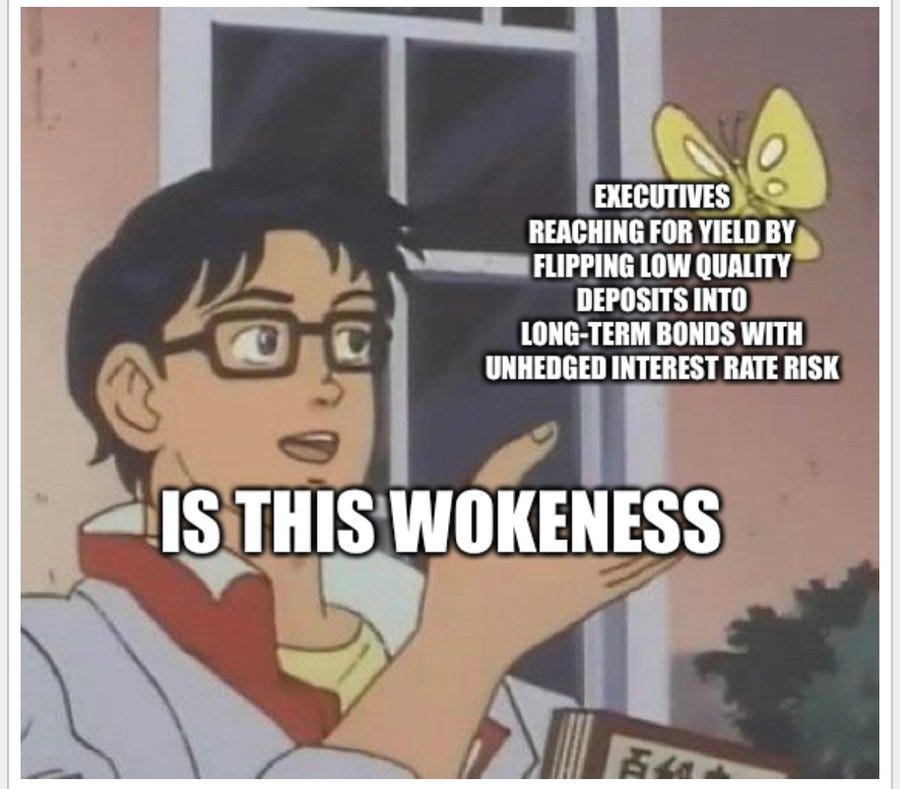

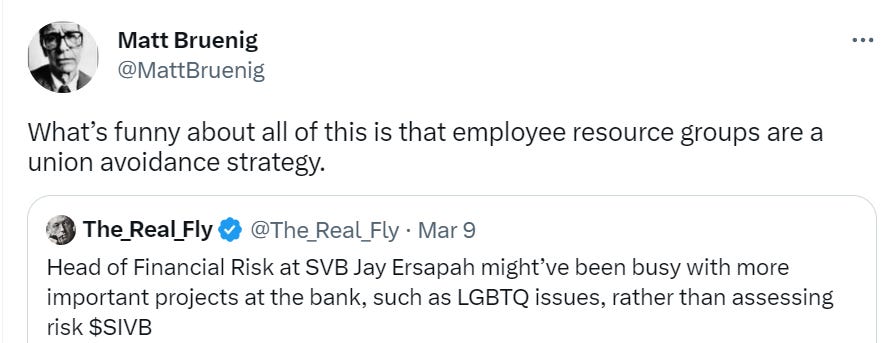

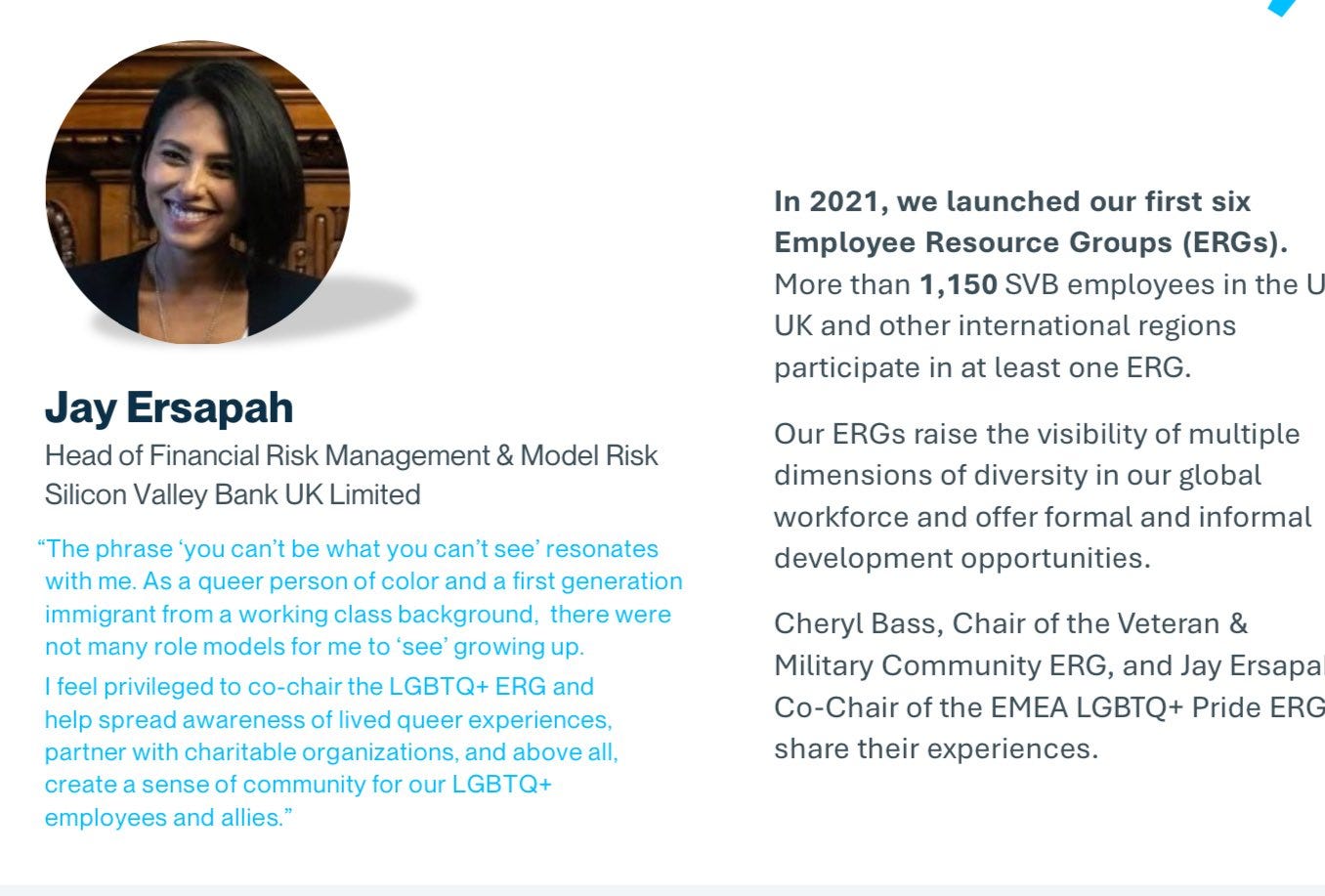

People on the right are blaming this all on wokeness, because of course they are, that is what they blame everything on. It is pretty dumb.

The responses I saw to the ‘Go Woke, Go Broke’ chorus did not, however, seem to be responding to the actual model of those who say that Go Woke will cause Go Broke.

A reasonable retort to that would be to say ‘those people do not have a model other than Woke Bad, if I saw Woke Bad my ratings or poll numbers go up’ and that is indeed a lot of what is happening.

There is still a clear theory here. It is good to understand it.

The model here is simple - wokeness as a distraction. When you have a bank (or anything else) you must choose what to prioritize. Where will you spend your time? How will you choose who to hire? How do you ensure you make the best business decisions?

If you are making hiring and promotion and pay decisions on the basis of things that don’t relate to the ability to make risk-adjusted-return-optimizing decisions at the bank, you will get what you managed for, and the decisions at your bank will not be so good at making the highest possible risk-adjusted-returns.

You could replace Woke with Anti-Woke in all this, or with short term KPIs, or looking cool to those in Silicon Valley, and the story all still works. You can say ‘they were focused on the bank showing a profit, not on the bank making good decisions’ and you would be very right. You can say ‘they had moral hazard and they noticed,’ and you would be right again.

This is a story about what people didn’t pay attention to, not what they did.

Perhaps, indeed, if your customers are not checking your balance sheet too carefully and neither is your regulator, you will fail to realize you are taking on existential (to the company) risk in the form of epic bets that interest rates will never go up, or you won’t care.

There isn’t zero validity to the concern about prioritization of unrelated causes, however you think of those causes. If you are raising capital on the basis of your woke credentials, and customers are choosing where to bank on the basis of woke credentials, then that is that many fewer people checking to see if your bank is taking on large interest rate risk.

How much of the fault lies in such mechanisms? I assume more than zero. I also assume it is pretty far down on the list of mechanisms.

What will the Fed do?

Inflation slowed to 6% in February. That’s still way too high, we are still above the long term trend, and also the ‘big pressure points’ are little things like ‘food at home’ up 10.2% and ‘rent of shelter’ up 8.2% (owner’s equivalent rent is up 8%). Many are saying that the housing component is lagged and in reality is already coming down. I hope they are right.

As of the morning of March 15, there is still a huge mark on the expected rate path going forward.

Here is one prediction related to that.

The idea is that we will once again bailout the banks, this time by abandoning the inflation fight to avoid making the banks insolvent due to their bonds and loans losing too much value. That would not only put taxpayer money at risk, it would put the dollar itself at risk.

The counterpoint from John Cochrane is that the whole point of raising interest rates was to constrain banks, so they would be stingy with money, and slow inflation. If banks are in trouble due to rising interest rates, well, mission accomplished and perhaps we don’t need to keep raising interest rates. There is something to be said for that perspective.

Watch the Money, You Fool

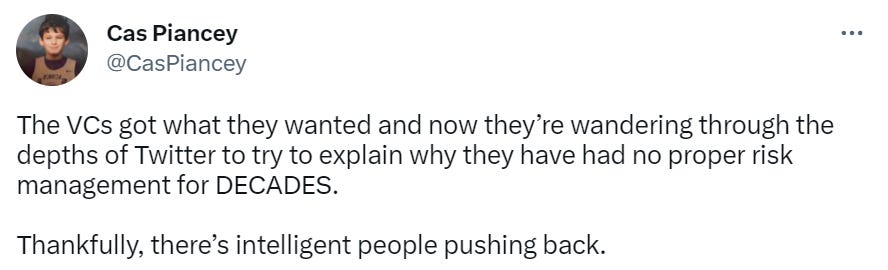

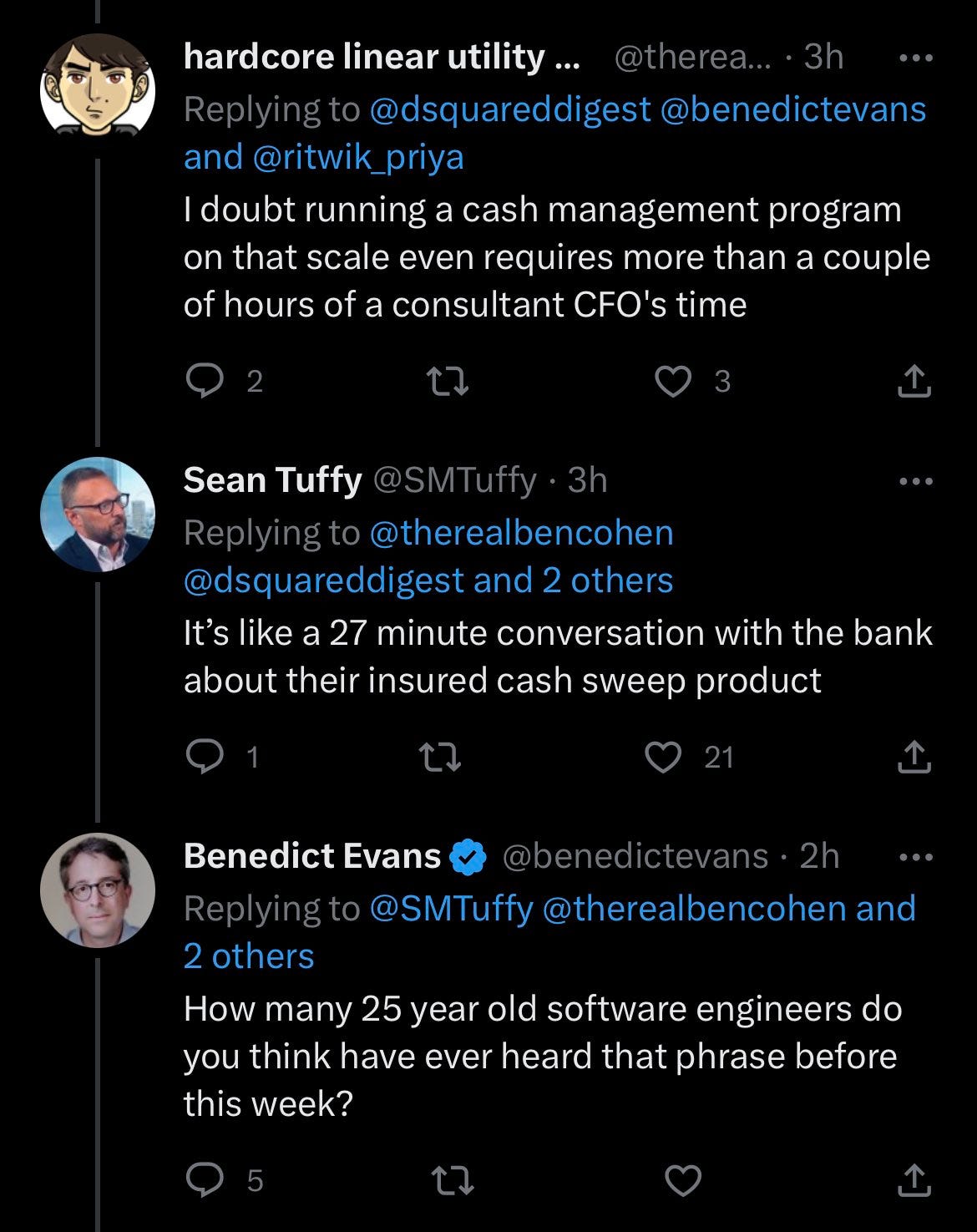

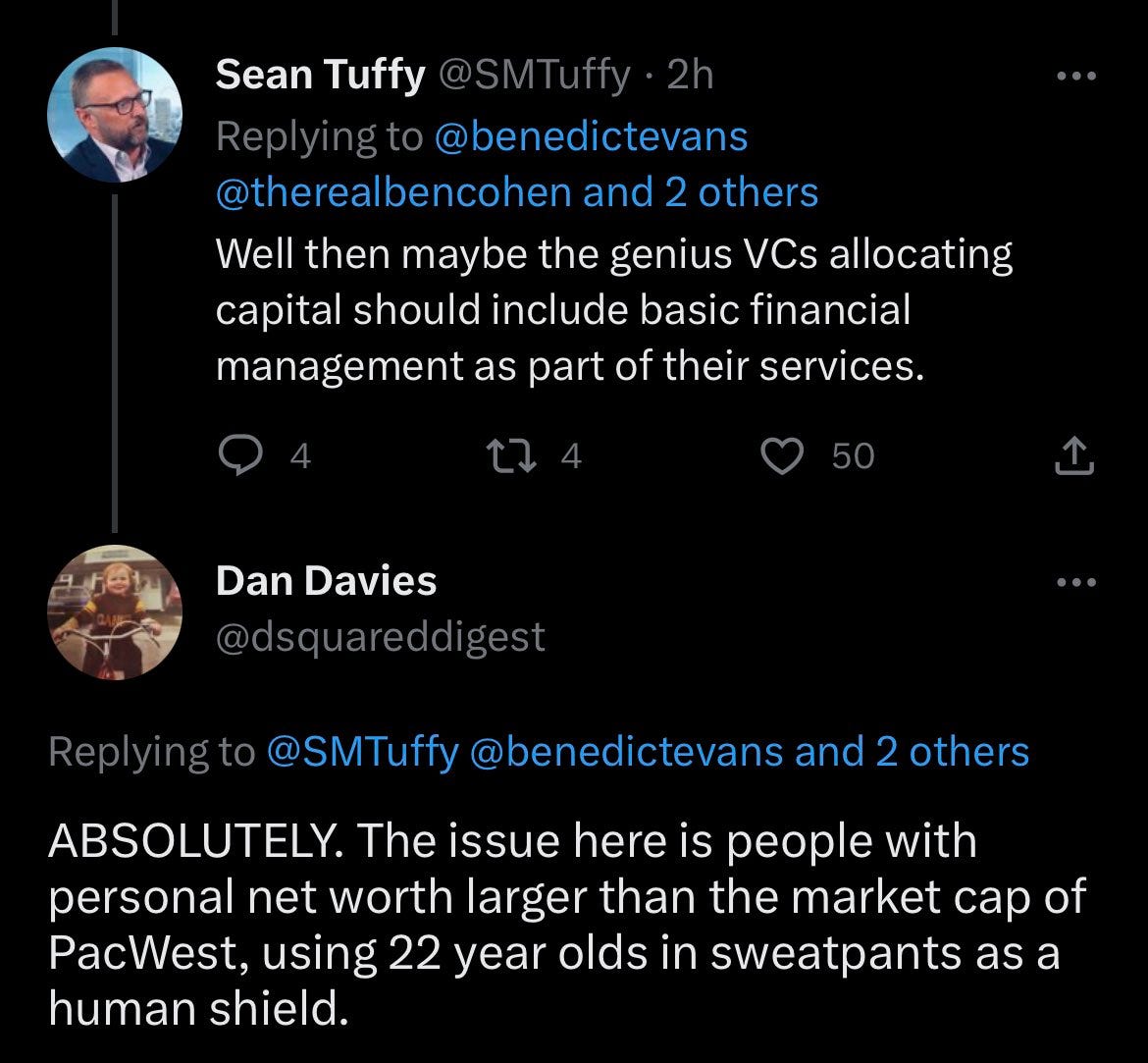

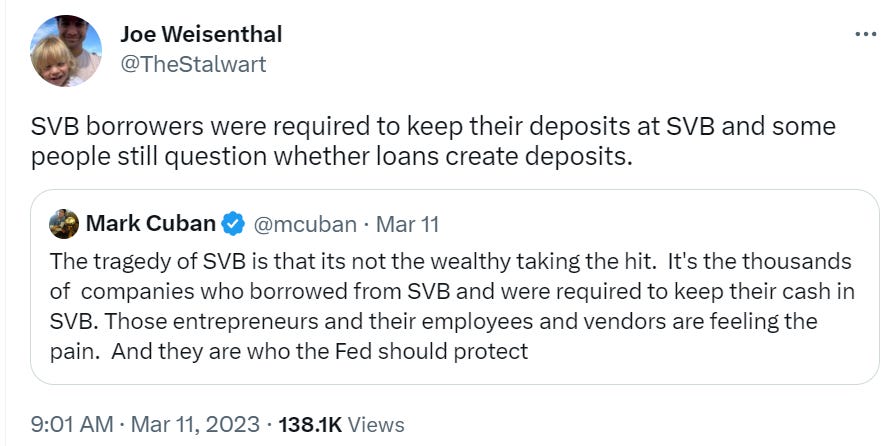

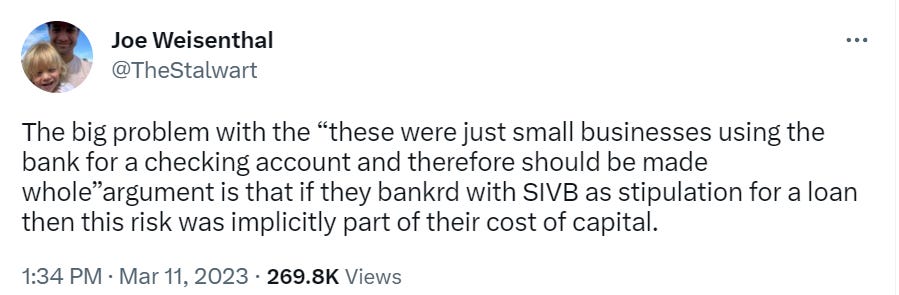

As Joe Weisenthal notes, there are a lot of people in tech saying ‘small start-ups can’t reasonably be expected to do cash management.’

So I’m going to go ahead and say complete and utter bullshit to such statements. I do cash management. I had to figure out where to put my own personal money in light of the exact same risks here, balancing them against the benefits of various banking relationships and options. I was still doing that during this crisis.

As in, despite having zero exposure to SVB and no bank accounts with over $250k, I was in a hotel room in Mexico next to a beach, gaming out for real whether I needed to be sure I had any transfer orders or wires going out on Monday morning.

That’s me being quirky. Reasonable precautions are still relatively easy to take.

I can totally imagine this, and at MetaMed we indeed did not hire a CFO, in part because the budget was tight and I was confident I could handle that aspect of the business myself. I am not defending that decision, except that on reflection it was not obviously wrong, and if I could not have worn that hat it would have been pretty dumb.

If you did hire a CFO, and they let this happen, then that CFO absolutely better be so fired, they had one job. That job included not signing the covenants saying they weren’t allowed to do their job.

If you didn’t hire a CFO, then someone else effectively had that job. Talk to them.

You know who knows? Bo knows, and so does Bucks star Giannis Antetokounmpo, despite having to spell out his full name on all of the required documents.

Here’s someone thinking like a true startup founder, I am sure many people are on this already.

Also strongly agree to K.I.S.S.:

If your start-up or an individual is not thinking about where it has cash and how that cash flows and what to do in various scenarios, it is taking a calculated risk not doing that, which means potential consequences.

If your response to threats to your cash is ‘why would a tiny little business be keeping careful track of its cash flows and counterparties?’ then you are not running a business. You are ‘doing a start-up’ and performing start-up-ness to those around you. Which, in many cases, meant banking where it was cool or signing covenants to that effect, and I am Jack’s complete lack of sympathy for your stressful weekend.

If your response to threats to your cash is ‘I have a billion things to do and no time, I am new at this, and I messed up or took a calculated risk’ then I have some sympathy, when the whammy hits you it sucks. Still your own damn fault, start-ups face an existential crisis twice a week, roll with the punches my friends.

Here is a fun story of someone who did not do the research.

A Question of Moral Hazard

The moral hazard problem is huge, far bigger than most people want to acknowledge. So is the problem of the banks taking the economy hostage, where their business model is ‘extract money from the economy by taking huge risks, because if it goes badly they can threaten that not saving them would tank the economy, which in turn makes them able to take the risks even bigger next time, rinse and repeat.’

What percentage of the the long term profitability and equity of the banking sector comes from these kinds of dynamics? That is a very good question. The answer ‘more than all of it’ is within my range of plausible answers. Perhaps we should act, and charge insurance fees, accordingly.

There are a few things people do agree on.

Everyone agrees that shareholders in Silicon Valley Bank should be wiped out.

Everyone agrees that bondholders in Silicon Valley Bank should be wiped out if there is not a surplus of assets left over after making all depositors whole.

Everyone agrees that the board and management should be out on their asses.

I would presume mostly everyone would agree that it would be good if any recent share sales from insiders, and any recently paid bonuses, would also be clawed back, at least if necessary to pay depositors. Senator John Tester has explicitly called for this, I do not expect to see similar others speaking against his proposal. Not that I have much expectation that such claw-backs will actually happen, given our system. Still worth trying what we can.

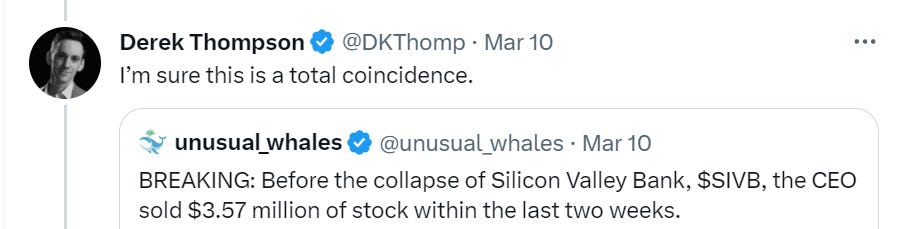

Also, the CEO sold $3.57 million of stock within the last two weeks. I am confident the SEC is investigating and not being inclined to take it kindly, and I look forward to Matt Levine updates on the subject.

Suppose we did all that. Would that be enough?

No. That would not be enough.

What if it was made 100% clear that bondholders and any other non-depositor creditors were completely wiped out, now, no matter the value of the assets, because no one was willing to bid above $0 for the bank and taxpayers should get any upside risk alongside the downside risk?

As opposed to the current market price of SVB bonds, which is up to 47-50 cents on the dollar (despite no one being willing to buy the bank itself). That’s some pain. It’s not exactly being wiped out. Let’s say we did wipe them out, and the rules allowed this.

Better. Still no.

Do not get me wrong. It is a hell of a lot better than nothing. This is much much better than if we actually let such people keep their jobs and their claims. It is not enough.

The problem is one Arnold Kling often talks about. Yes, those who work in management got wiped out and got nothing. What they did not get is less than nothing.

That is a serious problem, if the bank being worth a lot less than nothing is a live option.

And that if the bank gets seized by FDIC, that is kind of an expensive thing to happen.

Thus, if you are management, and you notice your bank is in a lot of trouble and you are not in line to get a good bonus, what do you do? You gamble. Why not? Bet big on house prices never going down, or low interest rates. If you’re right, great, big bonus. If you’re wrong, the worst you can do is lose the bank and go home with nothing.

That does not sound, to me, like a complete fix for the moral hazard. If you want management to actually ensure the bank does not fail, or that when it fails it fails gracefully, you are going to have to do better than that.

Then we have the aspects that Scott Sumner points out. Banks are insufficiently diversified, they live with implied guarantees, they know we are committed to short-term financial stability at essentially all costs. All of that pushes banks to take more existential risks. This does not ensure financial stability. This ensures financial instability.

The only way to have stability, in the medium or long term, is to solve moral hazard. Regulations can only hope to work to solve this if people want them to solve this, and few involved actually want to solve this.

This is not only management. Think about the bet that SVB actually made here, and what the consequences were, with the stock at $0. Again, the stock owners do not owe money, they get to sell at $0 and go home.

Which is fine, that’s how all of this works. Except that this encourages the bank to take stupid risks so long as they can stick FDIC with the bill when those risks go wrong, the same as management. Stockholders will always, always want to take far more risks than are justified, if they can turn around and then demand various forms of bailouts across the system when things don’t work out. Whether or not a particular bank’s stockholders end up at $0 is insufficient to stop this.

The problem is even worse if we allow insolvent banks, what Arnold Kling calls ‘Zombie banks,’ to continue operations. They have even bigger incentive to take even bigger risks, heads they win, tails we lose.

Thus, we do need stricter bank regulations where it counts, at least for medium sized banks like SVB, to deal with moral hazard. More than that, rather than the strategy of ‘ignore that banks are insolvent and let them keep gambling to try and make it back’ we instead need to use the strategy ‘notice that banks are about to be insolvent, and if they can’t fix that right away then take over the bank now.’

How do we make these effective regulations that deal with the real problems, rather than purely being costly drags on operations? That would start with ending hold-to-maturity accounting, and getting markets on bank outcomes that are de facto prediction markets, such as being able to speculate on the expected value of FDIC bailouts (or the outcome of bail-ins, if we dare) for a given bank, or even bank bond market values, and then putting that risk upon the bank.

It then must continue by ending the recent focus on process and refocusing on what is actually happening. The regulators need to think it is their job to apply their expertise and sense, spot obvious things like SVB’s interest rate bet, and demand such issues be addressed yesterday.

If you’re looking, it’s not like these problems were that hard to spot.

The best time to do that was many years ago. The second best time is right now.

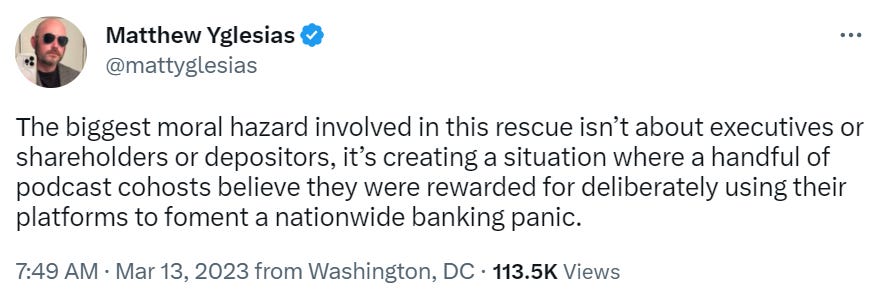

Another distinct aspect of the moral hazard is it might be bad to engineer bank runs.

Litany of Tarski: If there is going to be a bank run, I desire to believe there is going to be a bank run. Same goes if you ask me if there is going to be a bank run.

However, if there is going to be a bank run if and only if I say there is going to be a bank run, I desire to not say there is going to be a bank run. And if someone does the opposite loudly and strategically, I would prefer they not be rewarded for that.

I don’t think this should be illegal or anything like that.

Although Senator Mark Kelly disagrees?

In addition to the usual overwhelmingly important defenses of free speech: If you tell me I am not allowed to be told bad news about your bank, I know one place I am not about to take any risk with my money.

I do hope we would have appropriately calibrated social reactions.

Should There Be a Size Limit on Deposit Insurance Anymore?

There are two worlds we can live in.

Either we live in the world where yes, it is your job to worry about your bank and if it fails it is not on you, or no, it is not your job to worry about your bank and if it fails it is partly on you. You can’t have it both ways.

If it is not on you, then we have to solve moral hazard another way.

If it is on you, then we need to stop complaining when people get hurt.

Will Eden says it should not be on you, no matter your size. Essentially no one looks at bank balance sheets when choosing banks, people do not do the research. If you are trying to get people to do the research by putting them at risk, and then no one does the research, all you are doing is putting those people at risk. This also sets up the incentives for future bank runs. And the system mostly implicitly guarantees all deposits anyway.

I strongly agree especially with Will’s last point, which is that we need our systems to set up people to win by default. If we are going to send people the message ‘don’t worry about your bank’ then it needs to be correct to not worry, and we won’t want to change that messaging. So we don’t have much choice here.

That means we need to ensure unlimited size deposits, which in turn means we need to charge enough in fees and impose sufficient restrictions on banks that we are comfortable with that. That’s simply the way it goes.

Sam Altman says it should not be on you, in a thread well-entitled ‘ugh fine here is my SVB thread’ on March 12.

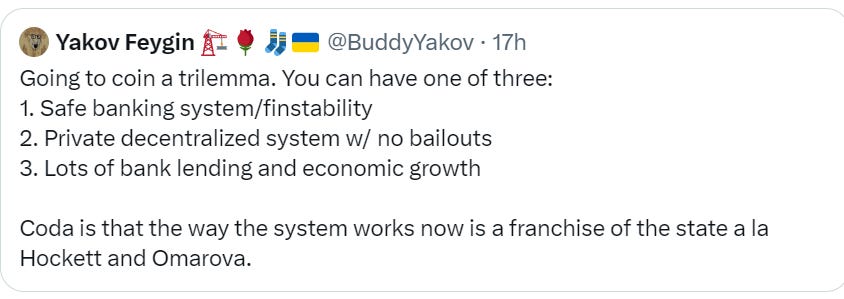

This again cuts to the central dilemma. Choose one:

We want depositors doubting their banks.

We don’t want depositors doubting their banks.

It sounds a lot like we don’t want this. Someone else is going to have to go around doubting the banks, then.

Scott Sumner says it absolutely must be on you.

We are in trouble, and we’ve been in trouble for our entire history. And if depositors have confidence in deposits that exceed $250,000, then we will be in even greater trouble. The moral hazard problem will become even greater. Unfortunately, I suspect that SVB depositors have little to fear.

Scott’s perspective is that the problems come from moral hazard and socialized losses. If we allow more socialization of losses, heaven help us. Bank management was simply responding to its incentives. At core, I agree. We must solve the moral hazard problem, except the proposed solution would not function reasonably now, whether or not it did in the past. Getting rid of it makes the moral hazard problem worse, and it will need to be fixed another way, but the ship already sailed - we were already in world two, where depositors do not care about any details of their bank’s solvency, and they’re not about to start now. Either they are following ‘only bank at GSIB’ or they are trusting the system.

Scott Sumner is absolutely correct that the system is flush with moral hazard, even more than it was two weeks ago, and that almost everyone is thinking about it wrong, the problem goes so much deeper than people realize. If you bail out banks depositors all the time then banks will take socially undesirable risks, constantly.

His solution is to go back to depositors having to worry, suggesting that back in the 1920s people did indeed care a lot about bank safety. Did they do a good job evaluating banks? Not a perfect one, but a good enough one that the only safe way to respond to the threat of a bank run was to have a very clearly highly safe bank. Thus, marble Greek columns at the bank and very safe balance sheets. Which, perhaps, is what we would like our banks to do.

I am not convinced that this is what we want banks to do. My model of what happened back then is that banks failed a lot anyway, they took these safeguards exactly because of that, and so we had a socially undesirable frequency of bank failures as a function of bank solvency. Which also meant that we had too much bank solvency, and too much signaling of stability (no one actually wants to pay for those giant Greek columns) raising cost of banking and capital. I do not want to go back to that.

Also we cannot go back to that. We now live in the age of the internet and social media and instant electronic banking, and soon the age of AI. Also the age of the globally systemically important bank (GSIB). If we got rid of FDIC and deposit insurance, we would not go back to the old world.

Instead we would live in a new world, where any non-GSIB would be at a severe disadvantage, forced to be actually and also provably safe in an age of instant bank runs, while everyone rushed to the GSIBs.

Scott Sumner agrees, except he says that’s good actually. We should be like Canada and have a handful of very large banks, that is fine, they have done fine. The problem with this plan is that it is fine until it isn’t. This is the opposite of the antifragile system you want, normally everything is fine right up until one of those six fails (especially without deposit insurance, good luck with that holding in a crisis) and everything is so very not fine.

Scott’s final claim is that a banking crisis would not impact the macroeconomy, citing the timing of the events around 2008 - first recession, then banking crisis. As long as the Fed adjusts monetary policy to keep NGDP on track, he says, nothing happens. In so many cases I think such targeting (which wouldn’t actually happen here and he would I think agree with that) would indeed nullify or solve a lot of problems, and it’s the right Fed policy. This is one place I do not think that is true. A real banking crisis, the kind of thing we stopped from happening in 2008, is an entirely different beast. If we actually got that, ‘expected future economic growth’ is the least of our problems, we would be more in ‘hope that social order can be maintained’ territory.

I do not see a path, no matter what we do, to letting the market organically impose discipline on banks here. We need to be more clever to have any chance.

What can we do instead?

One idea is to make FDIC insurance prices variable, depending on the health of your bank. We want banks to hold more capital and to find ways to actually be more safe, whatever form that takes.

What if rather than saying ‘here is your minimum, below that you are Not Okay and above that everything’s fine’ we instead charged a continuously rising penalty rate on FDIC insurance as banks got close to the edge, and if banks had tons of extra capital they got a discount? And of course, as part of this, we’d get rid of hold to maturity accounting.

The problem with this is that you get whatever giant risks you aren’t measuring properly. That’s what happened at SVB, they bought tons of ‘safe’ assets while taking on a giant unsafe bet on interest rates because the system didn’t check for that. Also they cheated on the accounting, because the system allowed that too.

A better potential implementation is that there could be an insurance market for deposits at each bank. We could require a small portion of all required deposit insurance to trade freely on the open market, a kind of CDS market on bank deposits. Effectively, we would have a prediction market on bank failures. Then, based on that market price, the bank is charged a fee that reflects the real risk it imposes plus administrative costs, likely with some minimum price. Also, depositors would have one easy place to turn to notice when their money was at risk, and decide what to do.

If that is too weird, we already have another reasonable proxy, even for banks without CDS, which is bank bond values. We know what the value of a given riskless bond would be, so if your bond is worth less than that, that is the market-assessed risk to your bonds. It should be fairly simple to extrapolate from that to the necessary premium to charge for deposits, even if the calculation is a bit lossy.

Another problem is, if you guarantee all deposits even implicitly, what is to stop a bank from calling all their liabilities deposits? Will we end up having to pay out what are actually bondholders next time around? If there is this huge subsidy to deposits over bonds, who would sell a bank (that is likely taking tons of bad risks due to moral hazard) a bond rather than demanding being given a high-paying deposit, perhaps with a covenant of some kind so they cannot simply withdraw at any time and the bank commits to the interest rate?

One could also say this already happened. If you are forced to keep your money in SVB in a deposit account, is it even a deposit? Or is it a bond disguised as a deposit?

One thing I am down for is a large required quantity of bonds before deposit insurance can be invoked. If you don’t have bonds that are ready to absorb your losses, then you haven’t earned your FDIC insurance, or at least you haven’t earned it beyond $250k.

One could hope that FDIC insurance premiums could fix this issue, especially if adjusted to effective risk, charging more for large deposits at riskier banks, and basing costs on market evaluations of true risk as discussed elsewhere.

Modifications in the face of a crisis still make things tricky. If you have it written into black letter law that all deposits are always insured, you invite some truly awful scenarios here.

This suggests that perhaps the implicit rule we have now is not so bad, for sufficiently large deposits. If you’ve been a good failed bank, and didn’t try to game the system on your way out to saddle FDIC with billions of extra liability, then we will do our best to find a way to do right by your depositors. They’ll mostly be fine. However, we leave ourselves a way out. If the bank tries to make all its problems our problems in a crisis, we can pay everyone their $250k and go.

Why Would You Use Silicon Valley Bank?

One might reasonably ask why anyone in their right mind would use Silicon Valley Bank over its rivals. I mean, would you fully trust the long term financial stability of something called the Silicon Valley Bank? Why not use one of the big banks with all the branches and expertise and security?

The good answer is that, from the perspective of a start-up, big banks royally suck at handling start-ups. They do not understand your needs. They do not trust you. They want things you cannot provide or they won’t feel comfortable. They don’t exactly offer pristine user experiences.

Wells Fargo is an unusually bad bank. The people there seem to be quite indifferent to doing their jobs well, I can’t blame them given everything that has happened (and also I’d like to thank them again for the 30-year fixed rate 2.5% interest mortgage loan, great trade you guys, it’s worth nearly two thirds of its face value sixteen months later.)

I’ve still had other similar problems with Chase Bank. Wires refused flat out, no matter what I did. Other wires that had fake several-percent-wrong exchange rates with no warning, like it was normal. Their mortgage department could not handle my lack of holding the same jobs for years and the guy trying to help me gave up. The list goes on.

Whereas when I used First Republic Bank for MetaMed, I got both great friendly service and also free freshly baked cookies. They’ve now ruined the cookies with the pandemic, the service still seems very good. If I had a start-up I would still want to bank with them, even if I’d keep it under the $250k limit.

I’d also note that when they offered me a mortgage, they asked me to keep high balances with them afterwards as part of the deal.

Shades of SVB. Brings us to another reason one might bank there.

It was not only those who took on loans. Many VCs also made it part of their covenants that their startups would bank with SVB.

Part of this was that SVB was indeed a superior user experience. Part of this was that SVB was where all the cool kids banked. And part of this was a scheme to ensure the bank kept access to interest-free deposits. This was setting up start-ups so they were forced to take existential risk if SVB were to fail.

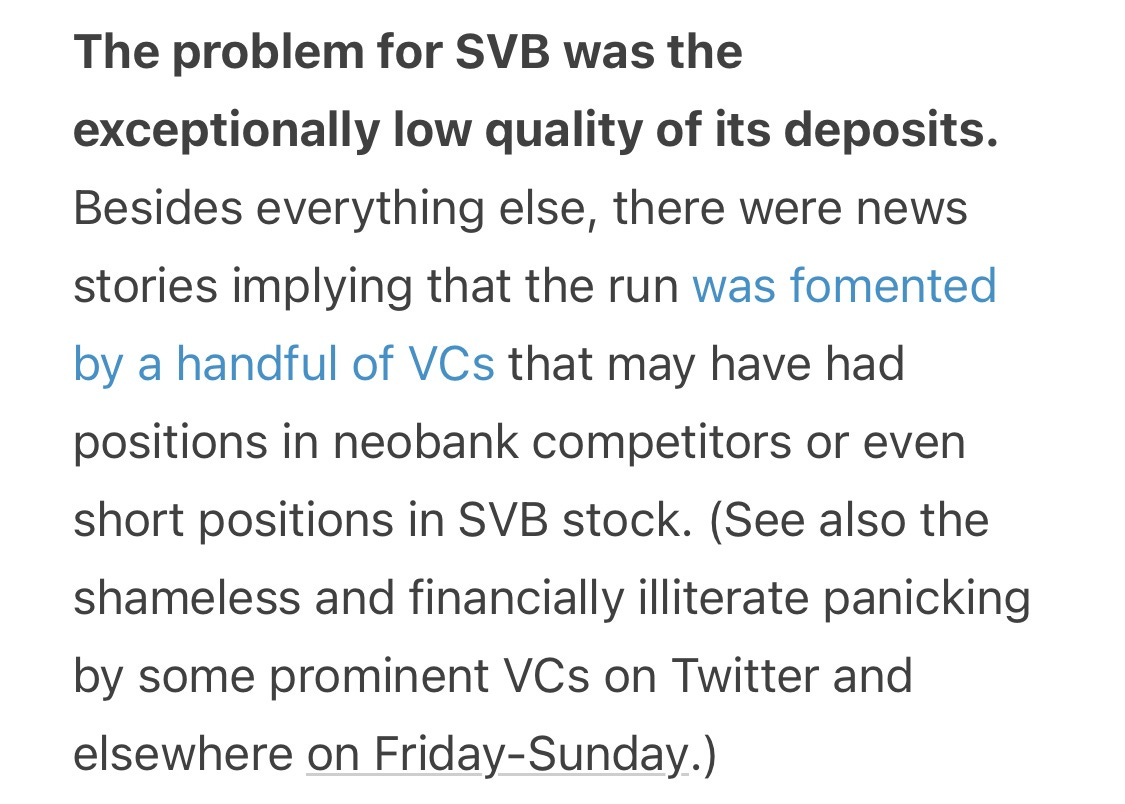

Extremely Low Quality Depositors

How central to the collapse was the problem that Silicon Valley Bank, as Matthew Klein says, had ‘extremely low quality deposits?’

In only some ways were these low-quality deposits. Yes, they were not long term reliable. They were, however, free.

People said ‘here is some capital, we don’t need any interest, simply give us the money back when we need it.’ I would love to be in that business. That business sounds great. Yes, they are a bunch of VCs that are some of the most herd-minded trend-following people on the planet, and that would not hesitate to do things like short your stock and then tell your customers to pull their money. That part is not great.

Although it is a little impressive, perhaps? Next level information cascading.

This is the ‘now look what you made me do’ argument.

(What follows is someone describing their actions during a bank run, doing what they need to do to protect themselves, in which they discover they were not only foolishly keeping all their money in a single insolvent bank until the last minute, they were also not logistically ready to participate in the resulting bank run.)

Are we seriously going to say ‘it is the fault of individual businesses that did what was right for their business instead of what was right for the surrounding business ecosystem?’ Do we want businesses to do what is right for the surrounding business ecosystem? I thought we instead passed a bunch of laws designed to insure they didn’t do that in other contexts.

There were a bunch of unreliable deposits, which the bank responded to by making a giant firm-risking idiotic interest rate bet. That is not the fault of the depositors. That is the fault of the people managing the bank. If the deposits are unprofitable at 0% interest, then it is time to charge fees or time to not make a profit off of them for a bit, or refuse the deposits unless they come with other profitable services.

SVB not only didn’t turn away or charge for deposits, they arranged covenants and agreements to lock money into SVB. That is less ‘oh poor bank saddled with all this short term cash’ and more people who didn’t appreciate or care about the risks involved.

Good Advice

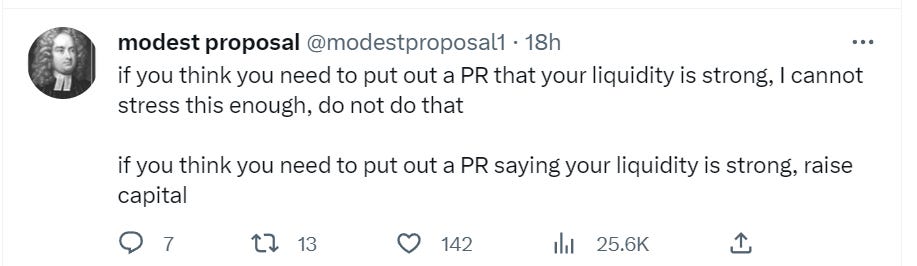

Some very good advice indeed, right here.

I too cannot emphasize this enough. I do not understand people’s continuous failure to understand this point. Do not ever put out PR that your liquidity is strong.

As noted up top, if you do have to raise equity, do it before you have to raise equity, and if legally possible only announce it after the paperwork is signed, even if it costs a little extra that way.

I have a galaxy-brain suggestion for a regulatory change that might help here.

The problem with raising additional equity is that the moment you declare that you are raising additional equity in the market, everyone panics and sells and runs the bank, so no one wants to give you equity.

How about if you didn’t have to do that?

Simple proposal. All banks can be allowed, at any time, without notifying the public in advance, to do at-the-market offerings of additional stock. Have every bank issue, let’s say, 50 shares for every 100 existing shares, and have those shares be owned by the bank. The bank is then allowed to sell those shares into the open market to raise new capital. Periodically, they announce if they have done this, and top off their share supply if necessary.

If you are a shareholder, and you learn that the bank has done this, you are sad that the bank needed to raise capital in this way. You are also very very happy that the bank did successfully raise that capital, given it needed to raise it. So does the value of current stock now, before any problems, go up, or does it go down?

If one answers that the value of your equity has gone down due to the bank raising more capital at the price the market will bear, that strongly implies that the value of your equity was due to that equity’s ability to get a share of private gains in good times that would be offset by public losses in bad times, and you are upset that you now have less of a claim on the ability to offset losses onto the public.

Here is a story (3 minute video) of one good way to handle a bank run. Keep smiles on all faces. On day one, keep every station open at all times, stay late, no breaks, but do everything slowly and by the book, hand out and count small bills and check the signatures. Show off the armored car delivering more cash. Loan money to another bank to keep them open, because the alternative is worse. Then on day two, when you can, pay out quickly in $100s and don’t let any lines develop, and everyone will think things are normal and go home. Brilliant.

TBBGB (The Big Banks Get Bigger)

Fundamentally, this is the problem.

I do not struggle here. The political calculation is simple. If you allow Chase to buy a bank, Chase gets bigger, and that is your fault. That is now on you. If you don’t allow Chase to buy a bank, Chase gets bigger, and that is not your fault. Any questions?

The problem is that big banks offer big advantages in safety, illusion of safety, and also the advantages of scale. Too big to fail is a big game. What do regional smaller banks offer that can make up for that? Either we charge the big banks enough to balance the scales, or the problem will only get worse.

Does Everyone Hate Tech?

Who is everyone? What does it mean to hate tech?

Some Very Online people, at places like Slate, hate tech and will go on rants about how awful and parasitic tech and start-ups and venture capital are, with their original versions calling loudly to ‘euthanize venture capitalists.’ That does not mean a meaningful number of people hold such views, places like that often spout deeply unpopular Obvious Nonsense.

I do think it is clear that tech’s view of tech, and non-tech’s view of tech, especially of startups in tech, are very different.

Are funded early stage founders scrappy underdogs? Mu. Depends on perspective.

As a former start-up founder, I’d offer this metaphor.

A football player works hard in high school, then in college. Gives it their all on every play. Trains. Practices. Studies film. Makes it to the NFL draft. Is taken in the sixth round, and is now fourth in the depth chart in the defense of the Jacksonville Jaguars.

Are they a scrappy underdog, fighting for their shot at the big time against everyone saying they’re not going to make it? Or are they making six figures playing the game they love and past the point where well over 99% of their rivals have already failed and are now hoping they can actually use that degree to get a day job, the envy of the true scrappy underdogs fighting to put food on the table or live their dreams?

Yes. They are very obviously both. They have fought tooth and nail and they have won the right to be the scrappy underdog in the great game. You would love to be them, in expectation they have a great thing. They still face huge obstacles and impossible odds between them and their dreams. Every day is a grueling all-consuming grind and your best is never good enough. Your one shot will probably be gone within a few years with nothing to show for it but life lessons, a story and some trauma.

Exact same thing with early stage funded tech founders.

Here’s to all the scrappy underdogs.

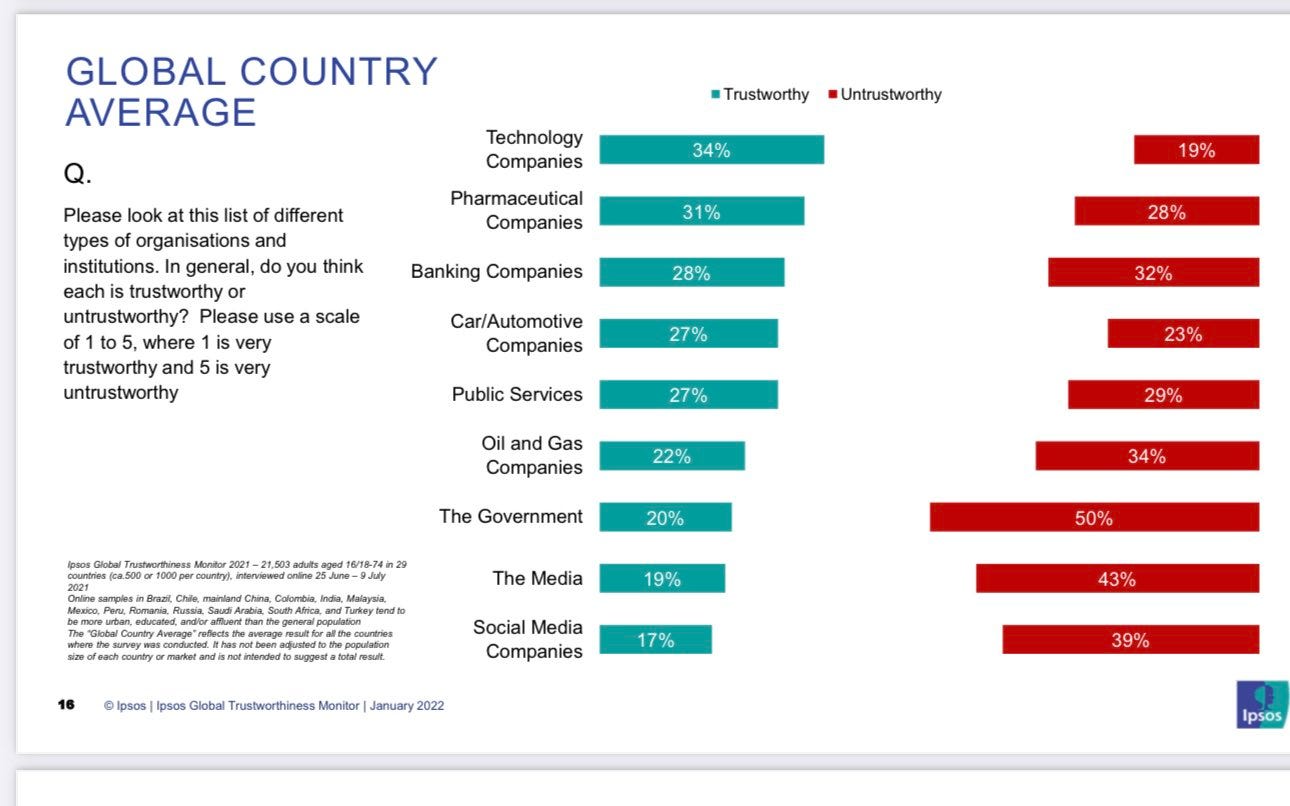

It turns out the public actually is a fan of tech, compared to alternatives. Here is the worldwide chart compared to many other sectors.

Technology companies come out at the top. Social media companies are at the bottom. Which I hope we can all agree is totally fair. In America, the numbers are not as good, no one trusts anything all that much, they’re still better than things like Media or Government.

Trust is still a weird metric. Who I trust and who I like are different sets. It does match confidence.

Confidence is still much closer to trust than it is to like.

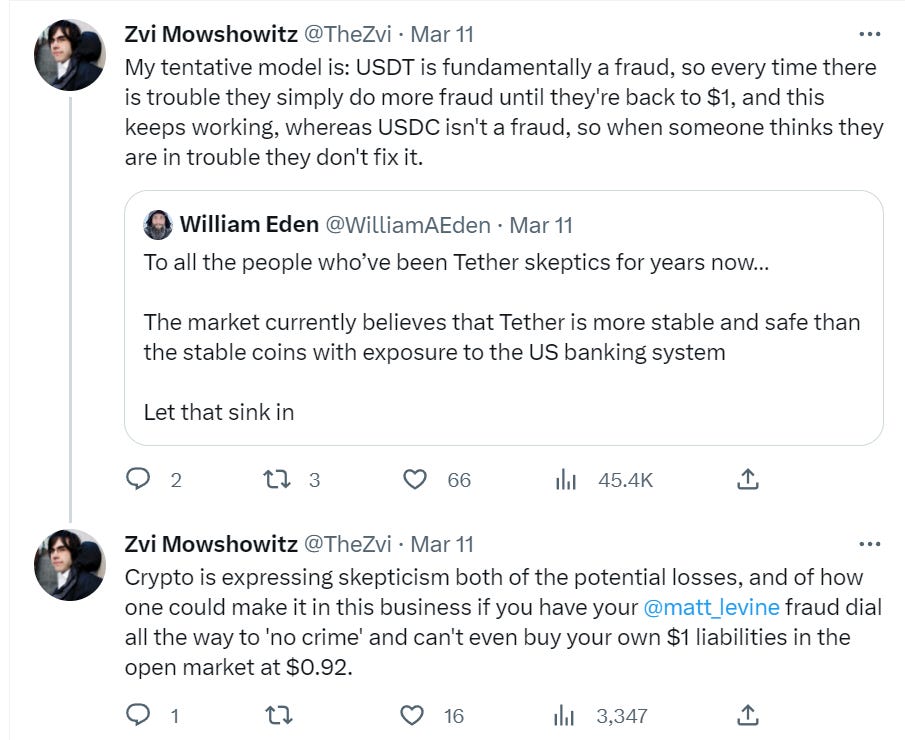

A Tale of Two Stablecoins

Briefly, in at least some places, USD Coin (USDC) was trading as low as $0.92, while Tether (USDT) was at one point trading as high as $1.06.

This was the most obvious trading opportunity of all time, if you were in position. If USDC had lost outright all its money at SVB, it would still have paid out something like $0.88, and there was never a serious scenario where depositors got less than ~70 cents on the dollar even if things got horrendously bad, and there was a very good chance USDC would be fine. And obviously Tether would quickly be back to $1.00 at most.

Once again, the efficient market hypothesis is false. This only lasted a few hours. It was still beyond dumb.

There are several interesting things to note here.

One thing to note is that USDC seems like it should be kind of important to crypto, yet everyone basically shrugged this whole event off?

One way to interpret this is that direct traders of USDC lost their minds and there was logistically no one to fix that for a few hours, but everyone knew the price move was not real. The other is that it turns out USDC is not systemic at all within crypto, we can simply use a different stablecoin or adjust for its new value.

Another way to interpret this is that crypto has different views than others might about the proper place to move the fraud dial for maximum consumer confidence.

I like my custodians to not want to do much crime or fraud. Crypto world disagrees. They see Tether’s willingness to do crime and fraud as an important method for protecting Tether’s peg. They approve. Whereas no one is willing to use crime and fraud to defend USDC, which means the peg is much less robust.

Unless and until, of course, the entire house of cards collapses. Yes, well.

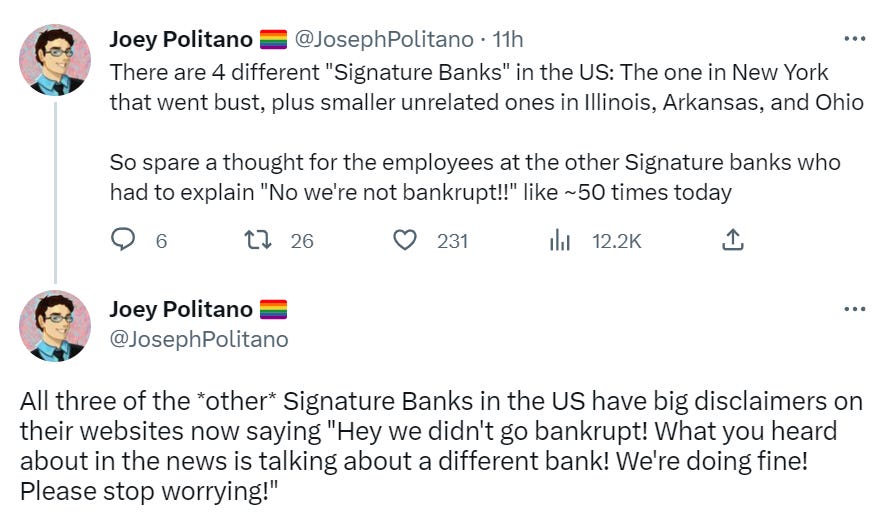

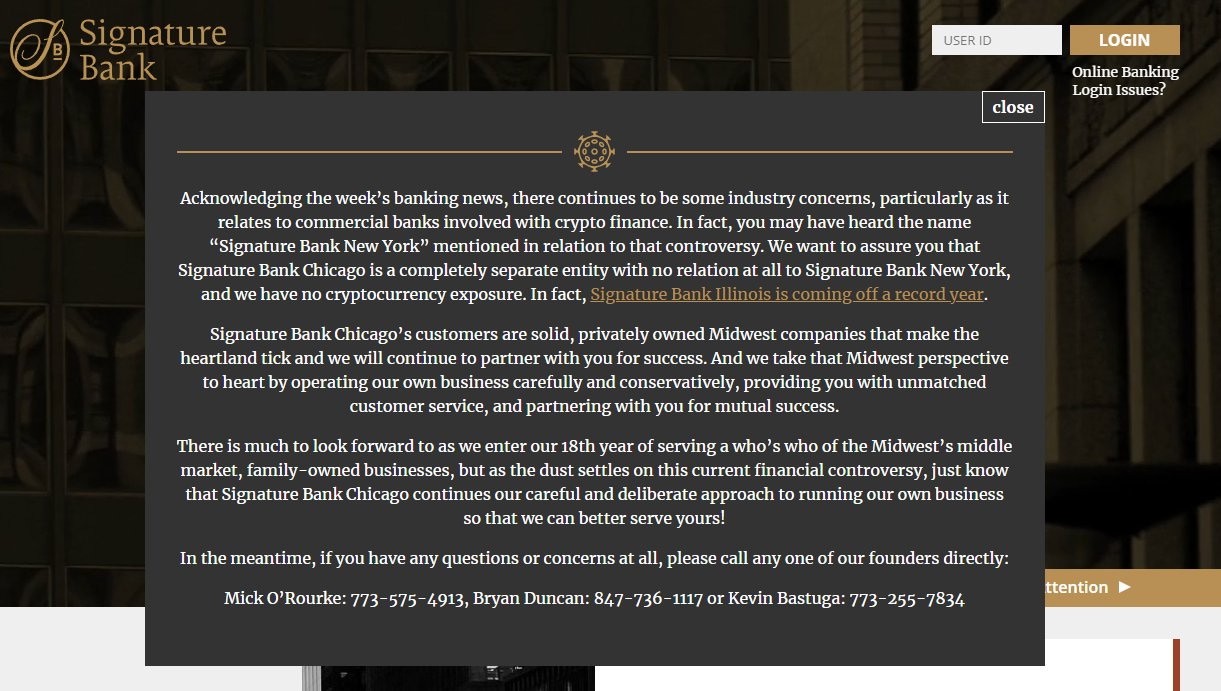

The Lighter Side

The survival rate of Signature Banks remains high at 75%.

I think PBD wins the prize for first person to say this take out loud, we were all thinking it:

If everybody did proper cash management (i.e., split it up among multiple banks) then we get the exact world we're currently in but with unlimited FDIC insurance.

Simplified math: Imagine that everyone has $25M. After SIVB they split it up among 100 different banks.

Before: Person1 keeps $25M in Bank1, Person2 keeps $25M in Bank2, ..., Person100 keeps $25M in Bank100. 100 banks each have $25M in deposits from a single depositor, 1% of which is FDIC insured.

After: 100 people each keep $250K in Banks 1-100. 100 banks each have $25M in deposits from 100 depositors, **100% of which is FDIC insured.**

So why not just have FDIC insure everything in one spot? If people are smart enough (or if a startup provides the necessary automation to make it trivial) then 100% FDIC backing is going to happen anyway.

Matt’s email newsletter is free, but historical examples are gated if you don’t subscribe. I get them through one of the archiving services if I need an old one, and subscribe to not miss one now. Strong recommendation!