Perfect Competition

Previously in Immoral Mazes sequence: Moloch Hasn't Won

Perfect Competition

In Meditations on Moloch, Scott points out that perfect competition destroys all value beyond the axis of competition.

Which, for any compactly defined axis of competition we know about, destroys all value.

This is mathematically true.

Yet value remains.

Thus competition is imperfect.

(Unjustified-at-least-for-now note: Competition is good and necessary. Robust imperfect competition, including evolution, creates all value. Citation/proof not provided due to scope concerns but can stop to expand upon this more if it seems important to do so. Hopefully this will become clear naturally over course of sequence and/or proof seems obvious once considered.)

Perfect competition hasn’t destroyed all value. Fully perfect competition is a useful toy model. But it isn’t an actual thing.

Some systems and markets get close. For now they remain the notably rare exceptions. Often people despair because they are intuitively modeling things as effectively perfect competition, at least over time.

This causes many people to think that everything must by default become terrible, likely right away, such as in the examples that open Meditations on Moloch, and Raymond’s kingdoms. And thus, that everything in general must become terrible.

The anticipation of perfect competition, rather than actual perfect competition, is often what causes things to become terrible. Anticipation of perfect competition creates perfect competition the same way that cooperation in a fixed-length iterated prisoner's dilemma has a backward induction problem.

Fighting this instinct is important. Responding instinctively with the detailed explanation, that competition is imperfect is not sufficiently quick or emotionally resonant. Two quick intuition pumps for when someone thus despairs, or argues for despair, are that this argument proves too much, and that, again, when you look around, many things are insanely great.

Remind Me: What Exactly is Perfect Competition?

Perfect competition is defined as a market with large numbers of buyers and sellers, homogeneity of the product and marginal costs of production, free entry and exit of firms, perfect market knowledge, one market price, perfect mobility of goods and factors of production with zero transportation costs, and no restrictions on trade. This forces the price to become equal to the marginal cost of production.

If even one of the assumptions listed above breaks down, price will no longer necessarily be equal to marginal cost of production.

The linked-to definition calls it a 'theoretical market structure' for good reason - this is a useful way to model some things, but never actually holds fully true and is not actually a thing.

When I Googled for an example of perfect competition, this was the top result, the thing that came up in the box at the top:

Agricultural markets are examples of nearly perfect competition as well. Imagine shopping at your local farmers' market: there are numerous farmers, selling the same fruits, vegetables and herbs. ... Another example is the currency market. First of all, the goods that are involved in the currency market are homogeneous.

Here is how much perfect competition is a theoretical construct: Farmers' markets were already, before noticing this on a later editing pass of the sequence, my first and most detailed example, in the next post, of highly imperfect competition.

Note that perfect competition is in important ways less competitive than imperfect competition, because there is no competition for differentiation, for iteration or improvement, or for long term concerns.

Super-Perfect Competition

We will define super-perfect competition as competition that mostly has most of the elements of perfect competition, but lacks free entry and free exit, which creates more production than there would be at equilibrium (and thus, also, a lower price). In particular we assume effective homogenization of products. The market coerces this production through some combination of trickery, force, mandates, exploitation of biases, false perceptions, cost of exit, rapid technological or regulatory change, predatory competition in pursuit of future market power, or other means.

Perfect competition destroys all the producer surplus.

More precisely, it sets their economic profits to zero and takes away all their freedom of action - capital invested in such production is risk-free in pure perfect competition so it earns the risk-free rate. Which in the real world right now is basically zero. In a closed economy of only perfectly competitive markets, there are no alternative investments to establish a positive risk-free rate, so as long as there is not a capital shortage across markets, the risk-free rate will be at most zero.

Super-perfect competition destroys more than all producer surplus. The saving grace of free ability to exit has been removed.

Producers in both cases also have no slack or freedom. They must follow exactly the ‘optimal’ short-term strategies. Anything else is sacrificed.

As a system approaches perfect competition, producer surplus is destroyed, producer slack is depleted, and freedom of action dies.

Perfect competition is at core a special case of perfect optimization, in this case of homogenized commodity production.

Again, perfect competition is an abstraction. It’s not a thing. But being very close to perfect competition in some places is totally a thing.

Super-perfect competition is totally a thing.

Perfect competition is where you can’t win. Super-perfect competition is where you can’t break even and can’t even quit the game.

On a scale where 0 is full monopoly with price discrimination and 1 is perfect competition, super-perfect competition is values greater than 1.

A clean example of super-perfect competition would be the market for rideshares on the internet. Another would be the airline industry, at least at some times in the past. The dollar auction works via super-perfect competition. Many of Scott’s other examples in Meditations on Moloch also involve similar situations, with players forced into participating.

In each case, super-perfect competition exists because market participants paid the cost of entry in anticipation of capturing a future market with levels of competition that would allow them to enjoy a producer surplus and make profits. When too many people make that same calculation, they become wrong.

Traditionally all of this is viewed as great for consumers, since they get the best possible price.

If all the consumers want is to cheaply consume a fungible commodity today, as optimized to simple metrics, they are in luck. Or at least they are in luck for now, since super-perfect competition often paves the way for future oligopoly. If they want anything else, this market won’t help them get there, because producers won’t give them anything else.

Thus, rideshares and the airline industry.

Universal Perfect Competition

The worst case for consumers is if they are also the producers - a world fully given over to perfect optimization of some defined outcome.

This is an incredibly strong and alien assumption to be making, and it has lots of strange consequences that are rightfully ignored in standard econ-101 models that are for thinking on the margin.

No matter how cheap prices of goods and quantities available might get, if you have zero surplus of any kind to spend on them, it doesn’t do you any good.

This is isomorphic to the standard Molochian future outlined in Meditations on Moloch. Standard Moloch-winning consequences follow.

Capital demands and gets the risk-free rate, which quickly settles at zero. Easiest way to see this is capital supply over time must be constant.

The Iron Law of Wages takes over. The only way to avoid it under perfect competition is a labor shortage. By assumption all consumption is by the producers, and capital generates zero return, so demand for labor is proportional to supply of labor, preventing any labor shortage. Thus we are in equilibrium right away. This drives labor's wage down to bare subsistence. Any gains from superior production are wiped out by lower wages, and only benefit those spending down existing capital.

Any actions that are not optimal permanently deplete your stored capital, including non-forced consumption. You cannot invest in optional assets, such as slack or creating the next generation, because those willing to not do so are competing (perfectly!) with you for a job.

You get a Disneyland with no children.

One could even argue this has already begun - that people in many nations having less than the replacement level number of children represents competitive forces so strong that young people no longer have the surplus to be comfortable having enough kids. If labor is willing to accept wages below the costs of reproduction, the Iron Law breaks low and you soon have literal no children.

Worlds given fully over to perfect or super-perfect competition, by default, lose all value to those within them.

That last clause of 'to those within them' is important! They can have value to those outside that world, if they can get their hands on some of the stuff being produced. Creating almost-perfect or super-perfect competition within a compact space, ideally containing few if any humans or other moral agents, can be a great way to efficiently produce an important fungible good. Not every system of the world needs to have surplus and enjoy economic profits.

Over time, many systems that are not monopolies move in the direction of perfect competition, if nothing changes and no one does anything to stop this effect.

An increasingly static world, drawn towards its permanent equilibrium, would by default look increasingly like some combination of perfect competition, pure monopoly, and other inadequate equilibria.

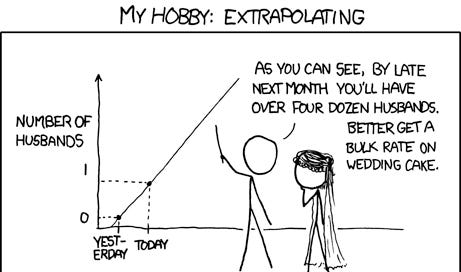

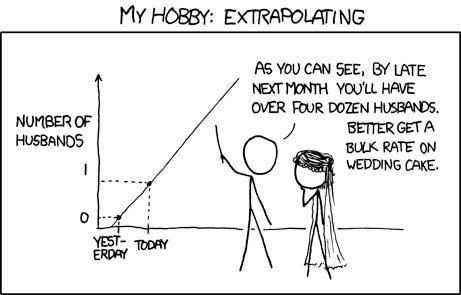

This is a lot of where the ‘Moloch wins because essentially perfect competition’ intuitions originate. Take a system. In that system, assume that underlying conditions are permanently static, except for the participants. Assume the participants won’t meaningfully coordinate. Assume that participants who do better beat out those who do worse and expand and/or replicate and/or survive marginally better.

Extrapolate.

The fact that this hasn’t happened yet gets viewed as a ‘temporary respite’ from the inevitable triumph of awfulness.

And in the very long run, given sufficiently advanced technology, maybe that’s true. It depends. We don't yet know the rules of that game. Details matter.

But even old Malthusian traps don’t work this way.

Things sometimes get bad. Once things get sufficiently bad that no one can deviate from short-term selfish actions or be a different type of person without being wiped out, things are no longer stable. People cheat on long term investments, including various combinations of things such as having and raising children, maintaining infrastructure and defending norms. The seed corn gets eaten. Eventually, usually when some random new threat inevitably emerges, the order collapses, and things start again. The rise and fall of civilizations.

The rise and fall of corporations or other organizations is often not so different.

Shocks are Inevitable

In the steady state, there needs to be enough surplus around to raise the next generation and deal with negative random shocks. And as per Scott’s second reason things might not get too bad, the horrible nightmare systems mostly aren’t actually efficient ways to get useful actions out of human beings. Neither is starving the people of resources too far. Things can only get so bad for so long.

If you make things sufficiently bad, before too long you get wiped out.

For now at least, poor folks still smile.

That’s not to say that this is a good solution. Our modern solution centers on robust competition and an industrial revolution. We let corporations and others drive each other into bankruptcy or dissolution. This can be because they get too far gone, or because outside improvements through technological and productivity growth create a superior alternative.

In the increasingly static and more technologically advanced future that is more of a true steady state and approaching its permanent equilibrium, both technologically and otherwise, shocks may cease to be inevitable and thus this danger would become much stronger. That's a huge problem that needs more attention. It's also beyond scope. It is important for us to remember that it is beyond scope and a different problem.

The practical danger to this system, that is on the rise now, is the temptation to not let this cycling happen. Preventing the cycle stops short term pain and protects the powerful. In the places things are getting worse or on pace to start getting worse, where Moloch is locally winning, this is a key mechanism.

This leads to another perspective on how people get to the ‘Moloch wins’ intuition.

Those that visibly follow Moloch here and now seem to prosper, here and for now, if no one is punishing them for it (and also, as per my not-yet-justified claim last time, Moloch's Army is in effect rewarding them for these intuitions and punishing others for lacking them).

The things that exist and are big or visible, and thus seem important, are mostly steadily getting worse most of the time. Despite this, things overall kept getting better on almost all fronts for a long time, whether or not that is continuing recently.

But it’s tough to see that blossoming forest for the rotting individual trees.

That question again. How does Elua pull off all these unfortunate accidents?

One key reason is that Elua is antifragile. Accidents and disorder are good for business.

Next in sequence: Imperfect Competition