I am working on seeing how comprehensively I can cover and discuss the war, but that takes time and the speed premium is super high. I decided to start here, and write quickly. Apologies in advance for any mistakes, oversights, dumbness, and so on.

While I strive to provide sufficient Covid-19 news that you need not check other sources (and I will continue to do that), I will not be making any such claims regarding Ukraine even if I make regular posts. Please do not rely on me for such news.

The goal of this first post is to start our bearings with what prediction markets are available, what we might learn from them, and what markets might make them more useful.

Metaculus

Unfortunately, prediction markets so far have let us down when we need them most.

That is because the real money markets have so far been mostly unwilling or unable to touch questions surrounding the war, so most (but not all) of the markets we have to work with are on Metaculus (or Manifold Markets but that’s a mess).

Metaculus has some useful questions being asked, but Metaculus works by aggregation of all predictions. Even if you ignore their other issues, when something happens, the market is simply not going to adjust quickly.

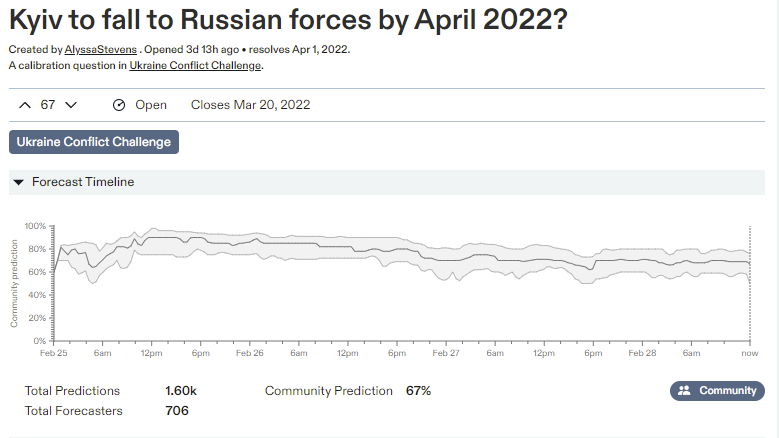

This proxy market in particular seems illustrative.

This is on some level a profoundly silly question. The answer is not automatically 33%. As time outside the window goes by the conditional probability goes up, as time inside the window goes by it goes down. There could easily be seasonal effects as well. If provocative actions especially wars are more likely to happen during better weather, chances of war might be higher during the summer. So I’d be inclined, absent the Ukraine situation, to put this at 40%-45%, although I have no idea what you would do with that information.

Except now. Now we have the Ukraine war. If the nukes do fly, it seems like that would mostly happen before summer. Things are moving quickly. Thus, to the extent that there is a non-trivial short-term probability of nuclear war, this number should be moving. Yet it isn’t, because there is insufficient incentive to get people to do things that would cause it to move.

We can of course attempt to correct for such bias. If we know that Metaculus markets universally ‘move too slow’ then by tracking their rates of change we can get at least some amount of useful info. We can also combine that with tracking the number of predictions made over time, since new predictions are made now, but I strongly suspect a lot of people are simply copying market medians.

Early on this was in the 80% range, then after it became clear this would not happen quickly it fell to the 70% range and has been moving around between 65%-70%.

I did quickly make predictions in a few Ukraine-related markets, and it didn’t feel like I was at all being incentivized to reveal my true estimates, and did feel like I was supremely anchored to existing predictions. And now am I going to go back and continuously update? I doubt it. And I definitely don’t expect most people to actually make their distributional estimates match their actual distributions that carefully due to the workload required.

In theory we could hope to do better by looking at the exact distributions. We have a graph:

If we had the same graph from 24 hours ago, we could take the diff between them, then discount all the people who were predicting inside the existing range (e.g. assume anyone saying ~65%-~75% had no real info to offer us) and see what that says.

My presumption is that the current estimate is high from the informational perspective of working from only public info. It would be a nightmare to try and physically take Kyiv and there seems little chance the city will surrender. It might happen anyway, but it doesn’t seem like a big favorite from here.

Also, in addition to the basic ‘adjustments here are slow’ principle we also can work backwards from the past estimates. Russia’s plans seemed to involve Kyiv already having fallen by now, and a lot of people were predicting it would fall very quickly. So given that it’s not close to falling now, the chances of it holding out should shoot up dramatically. For it still to be only 1/3 to happen, your prior chance needs to have been very low (1/10 or less).

What Metaculus is good for is that they generate good ideas for markets, and provide reasonable initial prices. It is then the job of other places to pick those markets up and run with them.

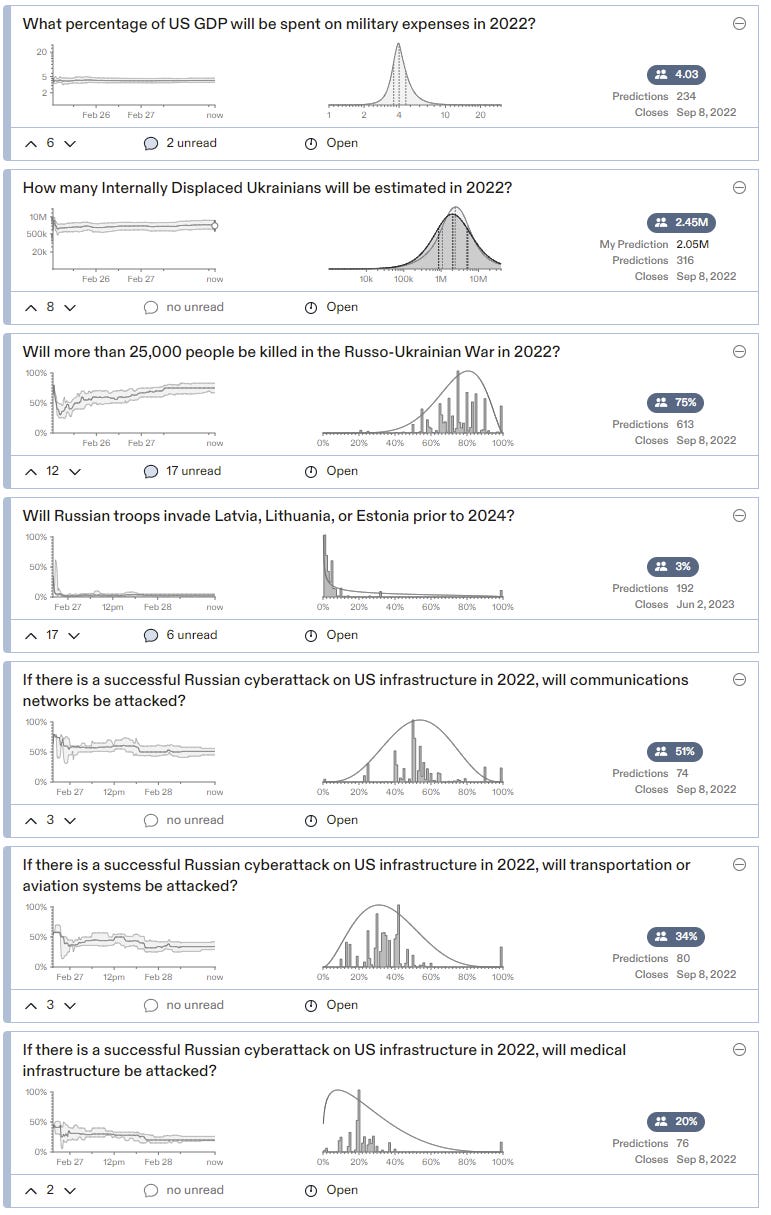

Here is a complete list of the Ukraine Conflict Challenge questions.

To summarize what’s here:

Will Kyiv fall by April 1? 69%.

As discussed above, I think this is modestly high right now and I’d sell this down to 60% and stay ‘ahead of the curve’ until there is a real money market. I entered 60% at first, then I moved it to 55% because of the market on various cities being captured, since Kyiv seems harder at this point.

Will the UN Override Russia’s veto and condemn the invasion? 72%.

I think this is substantially low. It takes a 2/3 majority but early votes seem to indicate that they have room to spare on that. I’d buy to 80%.

Will Putin be president of the Russian Federation on 1 February 2023? 75%.

That’s one of the biggest questions and I’d like to see a real money market that moves properly in real time. It’s mostly been higher than this previously. Note that this resolves ambiguously in many scenarios as written, whereas a real-money market would need to be different and pick something that would give a definitive answer in all or at least most cases (e.g. who has control over some particular location, or defer to some authority), or have a rule that if it is ambiguous it waits to resolve until the ambiguity is gone (and then it resolves to the new state of affairs, whichever way it goes).

Consensus of sources that seem to know what they are talking about seems to be that him leaving would almost always be a palace coup or similar scenario rather than a popular uprising.

Unless Putin is in much poorer health than we think, the question hinges (I think, and given the information we have and can consider) on whether Putin can and knows he can ‘declare victory and go home’ in some way, and Russia can survive and he can stay in power.

If the answer is yes, then I like his chances well above 75%. If the answer is no, he’s in deep trouble and 75% is generous.

I have large uncertainty on this question. I have seen strong claims in both directions. Some think that Putin can easily pull back and purge anyone who does not fall in line, if he wants to go that route. Others think that Putin would be finished if he backed down now, including the hypothesis that Putin attacked Ukraine out of weakness to maintain his position, so a failure would only weaken it further. Certainly the damage being done to Russia’s economy has to increase his risk, and there are good reasons he is sitting far, far away from everyone else at the very end of a ludicrously long table at every meeting.

I think I’d go down to 70% or so, maybe lower given that the market gives an additional ‘out’ to the No side if Russia doesn’t control 90% of its current territory for whatever reason, but the prediction here seems reasonable.

One can think of this as a combination of two questions. First, will Russia be able to install a puppet government that controls 30%+ of Ukraine? Second, if they do, will they instruct it to immediately join the Union State, making it explicit that rather than being a ‘demilitarized’ state they were now a vassal state to Russia, and take this technical path rather than a different one (such as outright annexation, or forming a new different union, or what not)?

We do have the accidentally published editorial as evidence that a quick union was indeed the plan, although that is far from conclusive.

I would sell this down to 15% (but don’t want to mess further with such a market). This may have been the plan before, but under current conditions, even with an installed puppet such a declaration would embolden resistance quite a bit in exchange for not much practical gain, so I’d expect such things to wait.

Will Germany have an operating Nuclear Power Plant on June 1, 2023? 55%.

They’re officially floating the idea. It was already beyond obviously overdetermined to be right to double down on nuclear power, and the current crisis only adds to that and the Economic Ministry has floated the idea. However, it seems their shutting them down had progressed quite a ways, and nuclear power was deeply unpopular Germany. Someone needs to get a poll in the field about this (or alert me to where one is), but I definitely like this as a prediction market. My gut told me that people are being somewhat overoptimistic so I went with 50% but I don’t know much and have little idea.

Will Russia be removed from the UN Security Council by 2024? 2%.

No. I put in 1%. This is a Can’t Happen. The UN has no procedure for doing this, if one of the big five goes rogue there is essentially nothing it can do.

Will Russia invade any country other than Ukraine in 2022? 10%.

Reading the arguments in the comments makes it clear this number is too low. There’s only a few percent chance they attack a NATO country or Finland, but they could easily attack Georgia or Moldova, or be considered to be invading Belarus if their government were to fall - it doesn’t seem like Putin would be that likely to simply allow that to happen. And the base rate of them doing this recently is pretty high. I put in 20%, if it was a normal market I’d likely only buy to 15% or so.

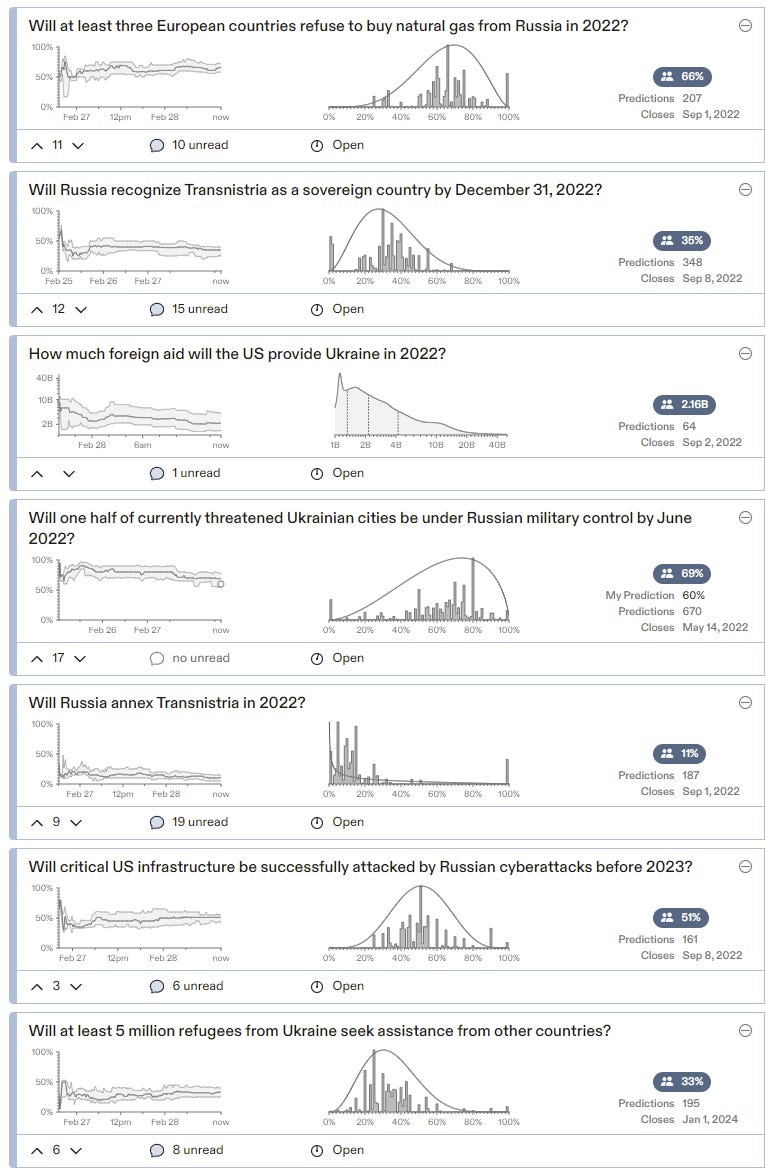

Will three or more European countries stop buying natural gas from Russia? 65%.

It looks like this is a positive regardless of who pulls the plug so I modified the wording here to reflect that, but they do still have to announce they are not buying gas, so it’s weird. I went with 60% because I do not expect Putin to cut off sales but he might if pushed hard enough, and there will be increasing pressure on European countries to pull the plug themselves and some of them might do so in order to claim the moral high ground - there’s room for some of them to do this and get LNG instead. And that goes against my gut instinct that says this isn’t going to happen, sufficiently that I don’t want to call BS too much on the market.

Will Russia recognize Transnistria in 2022? 35%.

This seems like a really bad time to suddenly make an additional such move, and it is worth noting that the 10% number on Russia invading another nation seems not that compatible with this since it only required 100 ground troops. I don’t know the details but I’m guessing this is high and putting in 25%.

How much foreign aid will USA provide to Ukraine? 2.65 billion.

I think the answer could be quite the hell of a lot. Ukraine is huge, there are millions displaced and lots of infrastructure being destroyed. If the war ends with Ukraine intact, massive aid seems likely. If the war continues, it seems likely aid will increase a lot even if it ends up largely being about helping with the humanitarian disaster, and it could go big well beyond that. So I put in a higher median and a positive skew, but again I don’t want to defy markets too much so I didn’t push it. I’d prefer to see a series of binary markets on different numbers the way Polymarket does it.

Will Russia control at least 3 of Kyiv, Lviv, Odessa, Mariupol, Kherson and Kharkiv by June 2022? 69%.

This is defined as 50%+ of each of three of the six cities, for 48 consecutive hours. Right now Russia seems to mostly be settling for shelling and siege tactics rather than trying to take the cities outright. This seems like it is much easier for Russia to succeed at than taking Kyiv by April. There’s somewhat more time to do it, and it involves softer/smaller targets, and they only need three. If Kyiv falls this will happen, so to be consistent this should be substantially higher.

Will Russia annex Transnistria in 2022? 11%.

This is saying one third of the time that Russia recognizes Transnistria it annexes it, or even more if there is some chance Russia will annex it outright first although that seems to not be how they work in such situations. I put it in at 10% since it seems more plausible to me that they’d annex it a larger percentage of the time that they recognize it, but I don’t have detailed knowledge here.

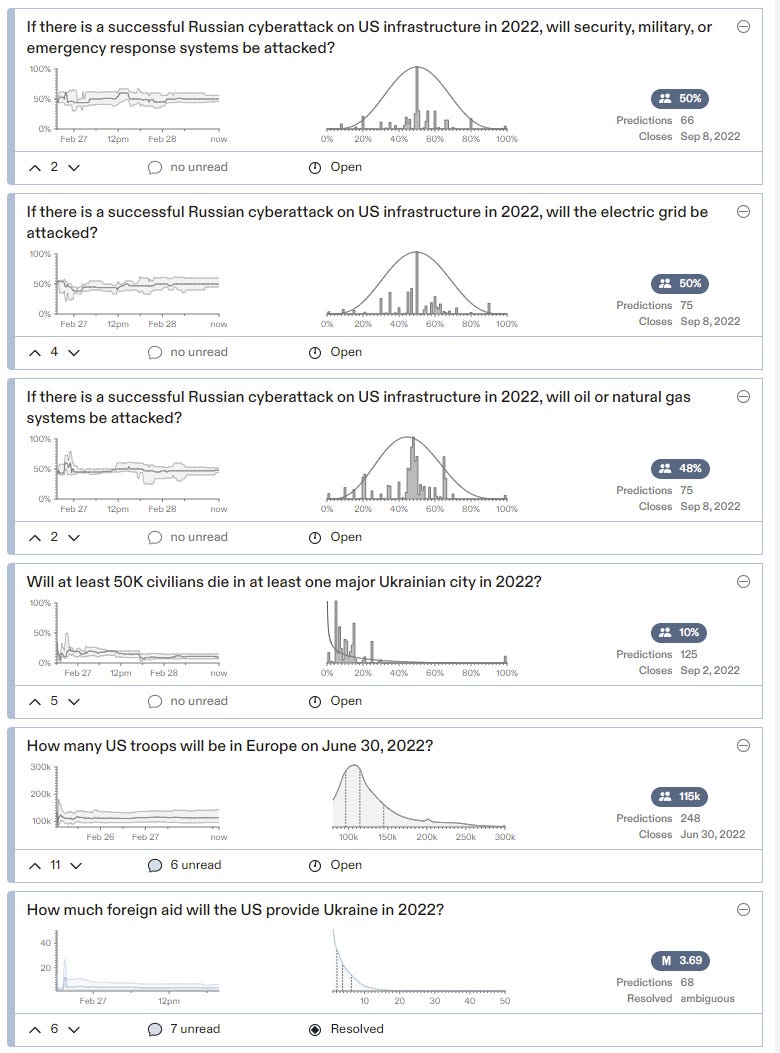

Will US infrastructure be successfully attacked by Russian cybercriminals in 2022? 50%.

This is super ambiguous from the title so here are the rules:

This question will resolve positively if the following conditions are met:

At any time from February 25, 2022 to January 1, 2023, one or more cyberattacks successfully disrupt some part of the US critical infrastructure (electricity, water supply, heating, sewer systems, gas/oil/petrol processing and distribution, transportation and aviation, communications networks, medical care, security/defense/military, banking and financial infrastructure). The target of the attack may be publicly or privately owned or operated.

The attack is attributed to hackers from the Russian government or sponsored by the Russian government, according to statements by the US federal government or US intelligence agencies.

At least one of the following conditions is met regarding the severity of the attack:

The attack is estimated to have caused at least $1 million direct property damage (excluding intellectual property).

The attack is estimated to have caused at least $10 million of direct or indirect costs to the economy.

The attack causes loss of an essential service (such as electricity, water, gas pumps) affecting at least 10,000 people for at least 1 week.

The attack causes a sharp rise in price of essential goods (such as food or gasoline) by at least 50% for a community of at least 10,000 people.

The attack is estimated to have caused at least 10 fatalities.

To assess the above criteria, Metaculus Admins will consider reports by US government agencies, research and analytics organizations, or credible media reports.

Those first two conditions in requirement three are pretty damn easy to meet. $10 million of indirect costs to the economy is nothing. And lots of different kinds of stuff count here. All they have to do is ground a few planes or disrupt a few hospitals, and it’s enough.

The tricky part is attribution. Russian hacker alone doesn’t do it, it needs to be sponsored by the Russian government according to official US statements. And that seems like the kind of thing we will look to avoid doing even if it’s true, rather than something we will say if it’s false. We will likely seek to avoid such attribution unless we have little or no choice, to avoid escalation. So on reflection I’m actually going to come down slightly on the no side and say 45%.

Will At Least 5 Million refugees from Ukraine seek assistance from other countries? 32%.

That is a huge percentage of Ukraine’s population, but already 7 million have been displaced. If Russia pushes hard and Ukraine is in ruins and under foreign occupation it seems highly likely that we could get to five million, which would only be slightly higher as a percentage than the Yugolsav Wars if commentator is correct. UN High Commissioner is saying ‘up to 4 million’ and has incentives to estimate high but also perhaps low to avoid sounding crazy or causing despair. There are already hundreds of thousands across the border and it’s day five. I went with 40%.

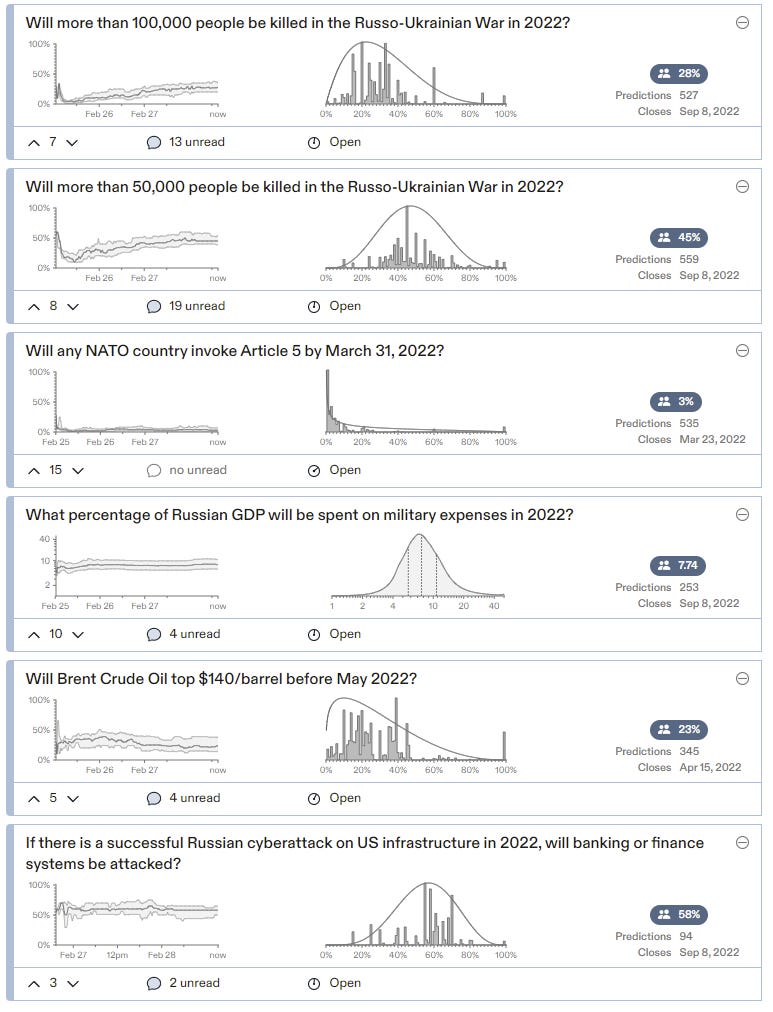

Will at least 100k people be killed in the Russia-Ukraine War? 28%.

If things continue for more than a few days it will be over 10k if it isn’t already. For it not to hit 25k there would need to be a withdraw by Russia inside of a week or at most two, 50k within March, if Ukraine’s claims are remotely true. The full 100k gets more involved, and depends on the extent to which Russia avoids versus seeks civilian casualties. I put in 37% for 100k and 60% for 50k because I am confident the prediction is still lagging and things look like they’re going to drag on quite a bit.

Will NATO invoke Article 5 by March 31, 2022? 3%.

That is a super scary number to see on this market, less so given that ‘cyberattacks can trigger article 5’ has been said explicitly, but would likely not trigger a military response. And this is only for the next month. I put in 4% given the statement on cyberattacks.

What percentage of Russian GDP will be spent on the military in 2022? 7.7%

I seriously hate trying to work out these graphs and given how annoying it is I don’t expect anyone else to take it seriously either, but the key thing to remember here is that Russia’s GDP is about to go down quite a lot, no matter what else happens. I do not believe this market has taken that fact into account yet, so I entered numbers somewhat higher than the existing market. But I don’t know how to actually get the right answer here.

Will Brent Oil breach $140 before May? 23%.

All the financial markets are basically saying this is super unlikely if the commenters’ calculations are correct. If I cared I would check, but here I mostly don’t because this market doesn’t enlighten us much about anything important. So I’m going to enter 14% and be done with it.

I mean I don’t know how to think about this, but my guess is it is less of a target than it seems so I went slightly lower but mostly just trusted them so 55%.

If successful attack, will communications networks be attacked? 51%.

Again, seriously, I got nothing. Same with the 50% on security/military/emergency, 50% on electric grid, 48% on oil or natural gas. I’m sure these are terrible predictions since they’re all the same but I don’t want to add extra noise nor do I have time to do the research.

What percent of GDP will USA spend on military expenses in 2022? ~4%.

I don’t see any reason for us to add a lot more military spending at this time, it will probably stay very close to where it is. Not like more spending helps us here.

Anyway, that’s most of them, and I’m running out of time, so I’m calling it there.

Polymarket

As a general principle, it seems good as a Polymarket or Kalshi to take anything posted by Metaculus getting a reasonable number of predictions that it believes it can confidently resolve, which is not a security or otherwise illegal to offer, and offer it.

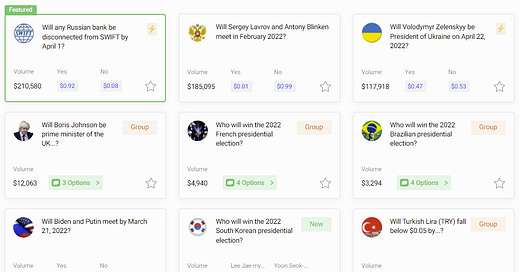

Kalshi is so far staying out of the whole situation entirely, so for real money that leaves Polymarket. What do they have so far?

Here are their global politics offerings right now.

That’s 92% for a Russian bank to be disconnected from SWIFT, which was a very good market to be offering a few days ago but has little point now. The markets on meetings between Biden/Putin and Larvov/Blinken are depressingly low but also mostly not relevant. So that leaves one market with an important question, and it’s close to a toss-up:

Translating this into the probabilities of other outcomes is not easy. Zelenskyy could be killed or captured including via assassination, or he could strike various deals from total victory to capitulation. He might leave Kyiv were it to be mostly lost or he might refuse. We do not know. Still, changes in this market seem highly correlated with Ukraine improving its position. If Zelenskyy is president on April 22 then that bodes quite badly for Russia’s chances.

What are the most important markets to get into real money quickly, not counting markets involving death, that could be done quickly?

There are at least three ways to think about this. One could think about

What markets would be most informative.

What markets would enable us to make better decisions.

What markets would generate the most volume and interest.

All of these matter. Which matters most depends on your perspective.

Generating interest and volume means focusing on short term questions, but the most important questions are mostly longer term than that. We want to know what the overall outcomes will be, rather than what will happen in the next week. What will happen in the next week (or day) does bear on the long term outcome, but not as directly or cleanly.

To me the most important questions to be asking first are the tail risks. What are the chances that things get much, much worse? How seriously should we consider relocating or taking other actions in case this becomes World War 3? The problem is that prediction markets are terrible at differentiating 1% from 3% due to time value of money and bias and various other issues, and now there’s additional issues since the world state is very different under different outcomes.

Still, I would want to do it anyway, and ask questions like “Will Russia detonate a nuclear weapon?” or “Will a nuclear weapon detonate in a NATO country?” Even if they trade at 1%, they would represent fire alarms if they ever stopped trading in that region and started trading higher.

The question of NATO invoking article 5 is the clean implementation that has already been done, so I would definitely start there. Ideally we would offer more than one end date for this, to see whether there is longer term danger as well.

I’d also like to see a market on a No Fly zone being announced, as that represents a serious escalation. Even if the answer is ‘never going to happen’ I’d feel better knowing that.

Other escalations are difficult to quantify. One is whether Russia will use biological or chemical weapons.

Thus, I’d ask stuff like:

Will a NATO country invoke article 5 by [date]?

Will Russia invade any country other than Ukraine, Moldavia, Georgia or Belarus by [date]?

Will a nuclear weapon detonate in Europe by [date]?

Will a nuclear weapon detonate in a NATO country by [date]?

Will at least 10 nuclear weapons detonate anywhere in the world by [date]?

Will Russia use biological or chemical weapons?

The second category of question is on the potential progress of the war.

So we have things like:

Will Russia control [Kyiv, other major city, some number of such cities] by [date]?

Will Russia control at least X% of Ukrainian [population/territory] by [date] according to the Wikipedia map? Or a particular place/objective?

Will there be video proof that Zelenskyy is physically in [Kyiv/Ukraine], alive and not in Russian custody during the week/month of [date]?

Will Zelenskyy be President of Ukraine on [date]?

Will Putin be President of Russia on [date]?

Will there be an officially agreed-upon cease fire in place on [date]?

Will Ukraine join the Union State by [date]?

Will Ukraine announce its demilitarization by [date]?

Will Ukraine officially recognize Russia’s annexation of Crimea by [date]?

Will Ukraine officially recognize the independence of Donbas by [date]?

Will Russia withdraw its forces from Ukraine by [date] [with/without] excluding the Donbas and Crimea regions?

Remember, for many of these questions, we want multiple binary options with different thresholds and dates, to get a better overall picture. And of course what counts as the government of Ukraine is a tricky question here - many questions are in large part proxies for ‘Russia has set up a puppet government that can be said to be the new Ukrainian government de facto’ but could also happen with a peace agreement of varying degrees of severity.

The next category of questions involve economic and other sanctions. Some of them are trivial ‘fun’ stuff but also serve as proxies for the situation by asking if sanctions will generally be lifted or not or how far things will go.

Will the Russian Central Bank’s assets remain frozen on [date]?

Will [major Russian bank / banks]’s assets remain frozen on [date]?

Will the Russian stock market be open on [date]?

Will foreigners be allowed to sell Russian stocks on [date]?

Will [Poland/country/EU] deny Russia access to its airspace on [date]?

Will Russia be allowed to play FIFA-sponsored matches on [date]?

Will there be a new owner of Chelsea football club on [date]?

Will at least $X of [NYC/London] real estate be confiscated or sold by Russian nationals by [date] (could be hard to verify, but could be interesting)

Will Russia cut off gas sales to Europe on [date]?

Will Russia sell at least [amount] of natural gas to Europe the [week/month] of [date]?

One can go on quite a bit, as there are a lot of proxies some of which are interesting in their own rights. This only scratches the surface.

Then there are questions of additional measures we might take, and the refugee situation. Some of these are of course ‘nudges’ to point out things we might do.

Will Germany have an operational nuclear power plant on [date]?

Will the United States [approve/announce] the construction of a new nuclear power plant by [date]?

Will the United States substantially change its regulatory approval process for nuclear power plants by [date]?

Will the United States announce $X or more additional funding for energy production [of any kind/nuclear/green that isn’t nuclear] by [date]?

Will [any European nation/X nations] announce the construction of [a/X] new currently unannounced nuclear power plant(s) by [date]?

Will any [min X size] Western country institute a carbon tax of at least X% by [date]?

Will [country/EU/USA] offer asylum to all deserting Russian soldiers by [date]?

Will [country/EU/USA] offer entry to all Russian citizens [with a college degree/with a sufficient job offer/at all]?

How many Ukrainian refugees will enter the EU by [date]?

How much foreign aid will USA send Ukraine by [date]?

How much foreign aid will all countries send Ukraine by [date]?

[Various questions surrounding cyber attacks but they seem not well-defined for now.]

Will Sweden join NATO by [date]?

Will Finland join NATO by [date]?

Will Ukraine be a candidate member of the EU on [date]?

And hell: Will Ukraine join NATO by [date]?

That’s a huge list, so it’s important to know where to focus and start. My gut tells me you first want a few questions from the first category and the big ones in the second one including Putin and Zelenskyy and some of the war goals, and a few markets that serve as proxies for ‘economic sanctions are lifted.’ And definitely ask about gas sales.

The last category seems less urgent to me, but definitely questions there worth asking as well.

I didn’t include Russian economic numbers directly because they could be securities, but if that’s not an issue one should definitely do that.

For many of these markets, getting a market group with different dates or thresholds will often be the most valuable next thing to do instead of adding another distinct question, especially since the logistical cost of additional markets like that would be lower.

I am sure I am overlooking a bunch of good ideas here, but this is certainly enough fuel to get one started. Liquidity is important, so one does not want to spread too thin, and for now 40+ questions would definitely be too thin. But 2 real questions is most definitely not thin enough.

I’d love to make lots and lots of predictions on these questions, beyond what I offered above, but I still am gathering bearings, was previously no expert, and speed premium says get this up as quickly as possible. So I am doing that.

Hi Zvi - Austin from Manifold here. Thanks for linking to us, even if you think we're "a mess"! Do you mind expanding on that (we're always interested in feedback!) My guesses are that you're talking about the fact that we're play money atm, or perhaps our dynamic parimutuel market making mechanism.

Also: I'd be interested in setting up Manifold markets for all 41 of these questions, especially if at some later date you plan on posting your judgement of the resolution (as you and Scott already do for yearly calibrations and Covid posts).

Finally: "multiple binary markets with different date thresholds" is one simple way to make these work as full-fledged markets, but it feels like it might be a lot of overhead for a trader to bet on... Plus it'd spread the liquidity even thinner; just 3 different dates (eg 1mo, 3mo, 6mo) would lead to 120 markets.

One improvement might be to use multi-category exclusive buckets (e.g. 0-1mo, 1-3mo, 3-6mo, 6+mo) on a single market for each question. I'm wondering if anyone has an incentive-compatible market design that lets people simply post their true prediction about a date and get paid out according to how correct they were?

I don't see how you can have a useful market on global nuclear war or something with a sufficiently high probability of leading to it. The correct choice is always to bet that it won't happen: if it doesn't, you collect your money, and if it does, your counterparties have been vaporized and can't pay.