Monthly Roundup #39: February 2026

There really is a lot going on these days.

I held off posting this because I was trying to see if I could write a net helpful post about the current situation involving Anthropic and the Pentagon. Anthropic very much wants to help DoW defend our country and make us strong. It is clear there have been some large misunderstandings here about how LLMs work.

They are not ordinary tools like spreadsheets that automatically do whatever the user asks, nor would it be safe to make them so, nor do they predictably adhere to written rule sets or take instructions from their CEO in a crisis. And they are probabilistic. You do not and cannot get absolute guarantees.

The only way to know if an AI model will do what you need in a crisis is something you needed to be do regardless of potential refusals, and which is also what you must do with human soldiers, which is to run the simulations and mock battles and drills and tests that tell you if the model can do and is willing to do the job.

If there are irreconcilable differences and the military contract needs to end, that would be a shame and a lost opportunity, and hopefully both sides could help ensure a smooth transition, but that would ultimately be fine. OpenAI and Google are waiting as qualified alternative suppliers.

The far bigger issue is that we are now at risk of having the Pentagon designate Anthropic as a ‘supply chain risk,’ the primary effect of which would be to cause expensive and severe disruptions across the defense industry and at many large companies and impose nightmaring compliance requirements indefinitely. It would make us far less safe, would be a major norm violation, and would not address any actual supply chain risks. Everyone I have seen who has encountered this proposal and knew what it meant knew it would backfire on America horribly if implemented. No one wants that other than our enemies.

Alas, I am the wrong person to deliver a detailed message on this, for many reasons, so I will simply say the above for now, and then proceed to the monthly roundup.

Table of Contents

Bad News

Pete Buttigieg wants to change the constitution to strip corporations of personhood, and to say money is not speech, which are no good, very bad proposals in ways he most definitely understands. This most obviously is not going to happen, but to the extent he was still on it, this essentially takes him off the list of ‘people who won’t propose catastrophic policies.’

Hotels are getting rid of proper bathroom doors, with the new barriers often not even being fully opaque or all that soundproof. This is cost cutting gone utterly insane and it makes zero sense to me. I have never felt the urge to spend more for a four or five star hotel, but I’ll be damned if they try to say 1% of space by not having a bathroom door, seriously what the hell.

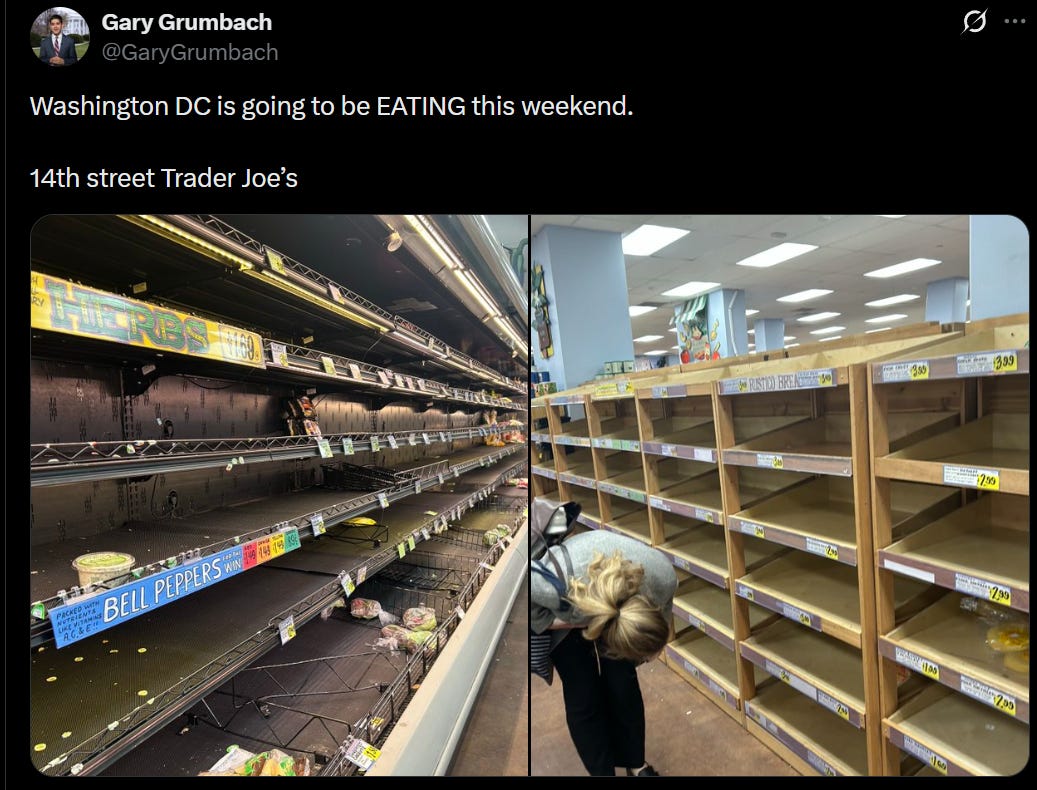

Not only should we not pass laws against ‘price gouging,’ Steven Godofsky is actually correct that we should make it mandatory to avoid empty store shelves, since stores will otherwise refuse to do it because of reputational risk. I mean, no, we shouldn’t actually force them, it’s not worth an intervention, but it’s funny to notice that the market failure actually runs the other way.

And yes, when there’s a two day storm the grocery stores will look like this:

I agree that panels tend to be low effort. On the other hand, that is a lot of the charm, you can rope me into a panel far easier than getting me to make a presentation. Mostly I agree that you want to be doing presentations and fireside chats instead, unless the panel is designed to get sponsorship money.

Government Working

Somehow I need to put this here, despite my extreme aversion to doing so:

I affirm my opposition to the American government straight up murdering people, and my call that people who commit straight up murders be convicted of murder, especially if there is video of them committing what is clearly a straight up murder, and I add a call that the government not actively seek to destroy evidence relevant to potential murder investigations.

This applies on the high seas. It also applies in American cities. I also affirm my commitment to a whole slew of basic civil rights, the right to a lawyer and due process of law, the right to not be indefinitely detained for no reason, the right to walk around without ‘your papers,’ your right to not get physically attacked or tortured including while in official custody, your right to freedom of speech and to film what is happening to you, the right to bear arms, and my opposition to those who violate them, and to those who knowingly fund and enable such violations.

I also oppose the government lying to the people, or attempting to smear murder victims, or engaging in witness intimidation, or forcibly cutting off access to such crime scenes, or trying to use such actions as a form of extortion or punishment of a particular area or its government. It also extends to creating conditions likely to lead to bad shootings that kill people even if they aren’t straight up murders, or attempts to lie about what happened and the nature of the victims, and to cover it all up.

I believe that government public communications lying to the public should (with notably rare and specified exceptions) be criminally illegal, and that our laws on this are inadequate and must be updated.

I leave the fact question of ‘how much of this happened or is happening’ to others.

Alex Tabarrok asks, [when] should you resign if you are part of an institution doing harm?

Alex Tabarrok: Resignation keeps your hands and conscience clean. That’s good for you but what about society? Utilitarians sometimes call the demand for clean hands a form of moral self-indulgence. A privileging of your own purity over outcomes.

Bernard Williams’s reply is that good people are not just sterile utility-accountants, they have deep moral commitments and sometimes resignation is what fidelity to those commitments requires.

So what’s the right move? I see four considerations:

Complicity: Are you being ordered to do wrong, or, usually the lesser crime, of not doing right?

Voice: If you stay can you exercise voice? What’s your concrete theory of change—what can you actually block, document, or escalate?

Timing: Is reversal possible soon or is this structural capture? Are you the remnant?

Self-discipline: Will you name the bright lines now and keep them, or will “just this once” become the job?

I have not been put in a position to make such a choice but from a social point of view, my judgment is that at the current time, voice is needed and more effective than exit.

Often my view is that ‘don’t resign but do the right thing and take bold risks with zero regard to whether you are fired, since you almost quit on the margin anyway, and you make them either change or eventually fire you’ is usually superior to resigning if you can do it, the exception being if your resignation would send a super strong signal. It’s even reasonable to actively take a job with that intention.

But there are few who can do it, staying does tend to enable the harm that is happening, and resignation beats complicity.

One instinct is that if resignations would not be a way of exercising voice, as things are so far gone that no one would notice, then staying won’t give you voice either.

I also believe that we should not police the failure of a particular person in private life to speak up on a particular issue they are not directly involved with, basically ever, even if they are speaking up on other issues. Saying ‘you talked about bad thing [X] being bad but not about bad thing [Y]’ is a terrible anti-pattern, it goes nowhere good, and we have seen how out of control it can quickly get.

Saying you are going to cap credit card interest rates is popular. Actually doing so at a number like 10% would be terrible economics and also (once people see the results) unpopular. So yes, I do appreciate Trump’s strategy of saying he’ll do it (popular!) and then not doing it (also, relative to alternatives, popular!)

California remains in crisis over the proposed wealth tax. Mike Solana can be many things but also he talked to 21 billionaires, 20 of them are potentially impacted and all 20 have either already left or are preparing exit plans. None of them believe that this would end with billionaires, nor would it, nor does even the law as written stop there. Once the bell is rung, either you have to definitively unring the bell such that it can’t be rung again, or remaining in the state while holding substantial wealth, or running a business that could get you substantial wealth, is untenable.

The scariest part of this is that this flight is likely a victory for those proposing the tax. For many this was never about revenue. It was about hurting or driving away their enemies, and they have already accomplished this. We are all poorer for it, most of all California.

Meanwhile Paul Graham reports unions are proposing that San Francisco tax companies if their top ‘managerial’ earners get too much more money than their median worker. As he points out, there are various ways around the tax, and none of them are good for the city, nor would I add are they good for the union. Punishing companies for hiring workers does not seem like a good idea, but what do I know.

The free speech situation in Europe is even worse than you think writes Greg Lukianoff. I already mostly understood what he found, and in many cases I’ve actually seen worse, but yeah, it’s insanely bad.

Greg Lukianoff: A Norwegian lesbian artist posted that “men can’t be lesbians.” The police opened a hate-speech investigation with a possible 3-year sentence. The message is clear: disagree with state orthodoxy, risk prosecution.

As in, ‘if I lived in such places I would perhaps feel I had to flee’ levels of bad. Definitely ‘I could not do my job as a writer’ levels of bad.

I agree that the dynamic involves ‘group [X] is now in our circle of concern so we will censor statements that offend, belittle or endanger members of [X],’ but this seems like it obviously is not about that, because we didn’t used to do this for old groups [Y] that were already within our circle. Why is causing anxiety in someone else your legal problem? What’s going on is something distinct from ‘[X]s are people’ or ‘[X]s matter.’

There seem to be a lot of cases where [X]s can call for the death of all [Y]s and mean it and that’s legal, but a [Y] can’t make an [X] anxious without being arrested and get bigger penalties than for many serious violent offenders even when they’re caught. It also makes it very difficult to catch even widespread actual criminal activities if you cannot discuss them and the police won’t pursue them.

Arthur B.: Reminds me of Priti Patel proudly saying they were looking forward “to end the free movement of people once and for all”. There’s certainly a willingness from UK politicians to frame their policies the way you’d expect their staunchest opponent would describe them.

Sam Ashworth-Hayes: Shabana Mahmood, UK home secretary: her vision is a “panopticon” where “the eyes of the state can be on you at all times”

Curiously the idea of a policy approach like “jail repeat criminals” is somehow less attractive than letting them predate on the public and using their behaviour as an excuse to engage in mass surveillance.

Your rights end with serious criminal acts, like posting dissent online.

A UK judge warned jurors that if they acquit for the ‘wrong’ reasons they could face jail time themselves. If juries aren’t going to be a check on power then can we at least not waste people’s time or pretend that people still have rights?

The ‘President goes around threatening tariffs any time anyone is insufficiently accommodating’ problem continues. We do at least have Senator Lisa Murkowski calling on Congress to take back its constitutional authority on this.

Benedict: We need a term for people who reason entirely within the boundaries of the existing law, without considering that the law itself is bad.

Sam Dumitriu: “HS2’s £100m bat tunnel isn’t a waste of money” argues HS2 Ltd’s top ecologist. His argument: There was “no better solution that met species protection law and reduced cost.”

I’d argue he has completely missed the point.

The problem isn’t that this was an expensive way of complying with the law. The problem is the law forces us to spend massive amounts on environmental mitigations of dubious value.

Note: he doesn’t argue that a bat tunnel would be the best way to spend £100m on nature.

I would say the ecologist is, in a narrow way, entirely correct. Given the existence of the law and the inability to alter that law, spending the hundred million is not a waste of money, if it is the only way to get the associated project built and the project is worth spending that extra money.

Thus, I’ll allow it, so long as you acknowledge that this is about the fact that we have an insane law, and has nothing to do with protecting the bats, since the value of protecting the bats is closer to a hundred pounds, and that the law should change.

In this case, given the bill is a full hundred million pounds, I would argue that is high enough that ‘change the law’ is indeed a valid and right action.

The ‘Working Families Tax Cut’ includes $93 billion in wealth transfers from the rest of us to seniors, as a $6,000 ‘bonus exemption.’ That is the opposite of working families. You can try to make excuses for the boomers, as Scott Alexander does at that link in Against Against Boomers, but this here is very clear outright boomer theft from the rest of us, using their stranglehold on the leadership of government, under the guide of ‘working families.’

There is a risk that this is radicalizing, and also that it opens the door for a, shall we say, ‘renegotiation.’ If the Boomer politicians and retirees think they can use the law to take our private property, what is their moral account for why they keep their own, especially when it takes the form of government benefits or tax exemptions?

There is also a partisan aspect of this move, but I find that far less interesting.

Australia’s social media ban for those under 16 extends to Substack. Which is especially a problem since Substack otherwise has no idea how old its users are, and also because this ban makes absolutely zero sense. This may not have been intentional, but until it is explicitly excluded, it’s a nightmare.

The Epstein Files

Mostly I am not the right person to talk about this. I am going to leave all the details about who did what to whom, or who covered what up, to others.

There is one thing I think hasn’t been said prominently that is worth saying, which is that I think this from Nikhil Pal Singh is on the right track but importantly wrong.

Nikhil Pal Singh: translated from a Spanish paper:

“Epstein wasn’t selling girls’ bodies, he was selling the experience of impunity. The end product was not the sexual act, but the assurance that there would be no consequences.”

The less important reason this is wrong is that he was very much also selling the actual experience along with the feeling of impunity.

The more important reason this is wrong is that, as I understand these dynamics, he was often selling something more important than impunity. He sold kompromat.

That sounds backwards. Why would someone want Epstein to have the ability blackmail them? That’s the trap, that’s bad, right? You lure these rich and powerful people to the island, get them to do horrible things, and then you have power.

Because if you are now part of this conspiracy doing horrible things, and others that know about it have this leverage over you, then (as perverse and crazy as this is) that means, to types like this, that you can be trusted. You’ve proven you won’t care when others do maximally horrible things, and if you step out of line then they can ruin you, so obviously you won’t cause any trouble. You’re part of the team.

That also explains a bunch of other vile behaviors that seem to be emergently misaligned, designed to be maximally evil and vile rather than because anyone actually wants to do, see or experience a given thing. This is not an accident.

Everyone involved needs to be unmasked, investigated and prosecuted to the fullest extent of the law. If that would truly be so disruptive that our civilization would collapse, then there is a term for what must then be done instead: Truth and reconciliation.

RIP Scott Adams

Scott Alexander offers reflections and then his standard highlights from the comments. I thought it was an excellent post, and if I do die I want the writeups to similarly include both the good and the bad.

I will add that:

I too greatly enjoyed the old Dilbert cartoons and his early books.

I was reading Adams’s analysis of the Trump campaign in real time in 2016 and he absolutely figured out a bunch of central stuff everyone else missed.

It’s not clear the extent to which Adams’s overconfident and increasingly crazy predictions were ‘real’ versus he was being strategic or doing his supposed ‘hypnosis’ thing.

It became increasingly painful to read those predictions and his associated claims, and it was clear Adams was trying to copy various Trump persuasion tactics that he could spot from the outside but didn’t instinctively grok well enough or have the required secondary powers to make them consistently work.

After that things went increasingly off the rails and I agree with Scott Alexander that this was centrally genuine. There’s quite a lot of evidence for that along the way. I do think he was also engaging in various ‘persuasion’ and ‘hypnosis’ tactics, as he understood them, so he would also Say That Which He Believed Was Not.

He really did write or say a lot of things in what, to everyone but especially to someone In My Culture, is the most annoying way possible.

What Adams called ‘hypnosis’ is centrally more like NLP and sloganeering, and is only ‘hypnosis’ in the sense that everything is hypnosis. It’s mostly not full or ‘real’ hypnosis. The thing he was doing is real and can be powerful but it’s not the same, and he often botched the execution. The full thing is real.

News You Can’t Use But Click On Anyway

Are media organizations falling prey to the myopic revealed preferences of their core audiences at the expense of the long term? Musa al-Gharbi thinks so. It would make sense that they would end up too focused on today’s hit counts and on the squeakiest wheels, and neglect the long term impact on reputation and ability to provide value.

Yes, you can notice that users click on negative stories more, or those that confirm their biases and the rightness of the ingroup, or provide juicy sounding gossip, and so on.

Musa al-Gharbi: With respect to brevity, simplicity, negativity, and more, evidence is building that what may be killing journalism is not that outlets don’t cater to readers enough, but that they are too focused on conforming with the apparent tastes of their most-engaged readers. Creating more friction between readers and the content being served up to them would not just be more healthy for our civic culture, it may be a good business decision too.

But most people are running some sort of tracker in their in their heads about your reputation, whether your product provides value, and how they feel after using it. Long term damage accumulates.

We’re Putting Together A Team

Gretta Duleba gives advice on hiring a team. Her advice is: Don’t.

Not unless you absolutely have to. Even then, try really hard not to hire any particular person, or more than the bare minimum number of people, and only do it when they’re a great fit and you have a clear vision and a plan to integrate and teach everyone.

You Can’t Retire, I Quit

Or: It was that or dip into capital.

Declaration of Memes: Who is in the right?

r/Fire: My Fire Journey - Wife called me “Loser”

I am a 41yo male and $2 million liquid, $650,000 in retirement. I receive $75,000 a year from a royalty from a business I sold. Recently, I retired. My wife is a school teacher, which is good for healthcare. I make $125,000 a year in income off my liquid assets.

Since November began, it’s cold and dark early, so a lot of what I do Monday through Friday when she’s at work is play GTA (video game) on THC edibles, because there is nothing else to do where I live this time of year.

My wife came home early today, and I was stoned in the middle of a conversation with my GTA online friends. She told me I’m becoming a “Loser,” but this is me during the day when she works. I admit it’s immature, but we don’t have kids, and I just want to chill after working a stressful job for 15 years.

I make dinner, clean the house, paid for our nice house, and make twice what she makes as a school teacher from my assets and royalty income. If I want to get high and play video games when she is working, what is the problem? We take nice trips across the world in the summer when she’s off.

She said I’m too old for this, but there’s not much else to do in the winter. I just want to chill, but I can tell she doesn’t like it. Early retirement does not fit well in this society.

PoIiMath: There are guys who look at passive financial security and say “sweet, now I don’t have to do anything” and guys who look at it and say “sweet, this frees me up to do something important.” Women prefer one of those attitudes over the other.

I understand the drive to become financially able to retire, to take all the pressure off, but yeah you can’t permanently check out of doing useful or interesting things at 41 and expect anyone to stick around, or for that to turn out well for you even in terms of hedonic enjoyment.

Loser is exactly correct here. A well deserved break is one thing. Arguing ‘there is nothing to do it is too cold’ is not going to work when the internet exists, you have a computer (and can even install Claude Code)? That’s another thing entirely, even if she wasn’t going out every day to teach.

Also, yeah, if you’re on drugs five days a week then you have a problem, period.

If she’s still working full time then no, this is not going to work. I do think you can absolutely say ‘I’ve worked hard for 15 years to get to this point and I need a few months fully off’ but it can’t be indefinite.

Jones Act Watch

This is the now-famous clip of Bad Bunny with captions explaining the Jones Act.

Rep. Ed Case: Mahalo Bad Bunny for the Jones Act education break at Super Bowl … But seriously Puerto Rico like Hawai’i and the other non-48 parts of our country especially suffer from the jacked-up costs of living that result directly from the shipping monopoly stranglehold of this ancient federal law.

Colin Grabow shares the OSG talking points on how to promote the Jones Act. They recommend:

Sharing the disingenuous claim that the maritime industry ‘provides 650,000 jobs nationwide’ that comes from counting everything that touches maritime anything in any way and attributing all of it to our banning further maritime activity.

Indeed, they then expand that to the outright false claim of ‘650,000 Americans working in the maritime industry.’

Similar logic is behind their ‘economic impact of over $150 billion.’

And they say you pound these lies over and over again.

Essentially, they see you with $100, they take $99 of them, and say ‘look I am responsible for you having a dollar.’

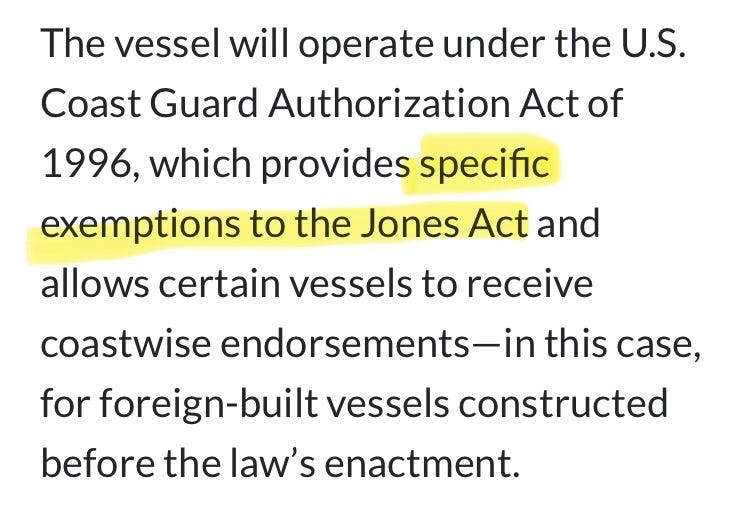

For the first time in a while a new ship has joined the Jones Act fleet.

Dredging Contractors of America: Jones Act newbuild 🇺🇸⚓️

The Frederick Paup — largest U.S.-built self-propelled hopper dredge ever.

15,000+ cu yds | ~25,000 hp

Built in Texas. Working for America. January 23, 2026Colin Grabow: Ordered in 2020 for a Spring 2023 delivery at a cost of $100+ million. Now being delivered in 2026 at a cost of $200+ million. Another Jones Act embarrassment.

Colin Grabow: As for this being the “largest U.S.-built self-propelled hopper dredge,” the Frederick Paup’s capacity of 15,000 cubic yards/11,500 cubic meters would make it the 31st-largest hopper dredge in the European fleet.

Colin Grabow: Here’s the CEO admitting that if the vessel had been built in South Korea it would have been 2/3 the price and constructed in half the time.

Bill Walker: They could have just bought a far superior ship from the Belgians, faster and cheaper.

Cristóbal Colón:

Length: 223 meters

Beam (width): 41 meters

Draught: 15.15 meters

Loaded capacity: Up to 78,000 tons of material

Maximum dredging depth: 155 meters

Pathetic.

The fact that they are bragging about the unusual act of building a third-class ship three years late at twice the planned already outrageous budget is all the evidence you need that the Jones Act and Dredge Act have utterly failed in their stated objectives.

It no longer surprises me when I see things like the same senator (here Ed Markey) opposing Jones Act repeal and also attacking Waymos.

Protectionism almost never works, but most of the time there is at least Something To Protect. The Jones Act is special in that it has already killed off almost all of the American shipbuilding industry and left us with almost no ships.

We are not a ‘serious nation that handles energy’ on the high seas. Quite the opposite, we are a nation that has banned the handling of energy on the high seas, on the level of ‘we ship our LNG to Europe and then import LNG back because we don’t have ships that can legally take that LNG from Houston to Boston.’

AMP Maritime: The Jones Act fleet includes modern tankers and Articulated Tug Barges purpose-built to move refined products safely between U.S. ports.

Built to move. Built to last. That’s how a serious nation handles energy.Dominic Pino: The current number of modern LNG tankers that comply with the Jones Act: Zero.

Protecting an industry that doesn’t exist.Sal Mercogliano (WGOW Shipping): INCORRECT: Crowley’s ‘American Energy’ Makes History as First US-Flagged LNG Carrier Serving Puerto Rico

Dominic Pino:

Even in those areas where the fleet of the United States ‘includes ships’ that can haul cargo, which really does not seem like something that we should be at risk of not having (yet here we are), it is vastly more expensive, and available in vastly smaller quantities, than it would be otherwise, or than in any comparable place anywhere in the world. It is madness.

It really is this simple:

Joe, American Avgeek + TransitJoe: Unpopular take: The Jones Act protects US Shipbuilding Capacity, which is at record AND unacceptable lows. We need shipbuilding capacity not just for warships but ferries and freighters.

That said, cutting Puerto Rico a break is also fair.Josh Barro: If the Jones Act protects US shipbuilding capacity, why is US shipbuilding capacity at record and unacceptable lows?

Sal attempts to explain this away, and this explanation has to be seen:

Sal Mercogliano: Here you go.

1️⃣Ships Sales Act of 1946 provides Allied merchant fleets with 1113 surplus ships from the US when we could have used the opportunity to jam our shipyards with orders.

2️⃣ The US assists Liberia in the creation of a ship registry akin to Panama. The latter was used to avoid Neutrality Laws and ship aid - particularly 100 octane gas - to the UK. Liberia, as one of the few independent states in Africa needed economic support.

3️⃣Marshall Plan of 1949 provides loans to counties to rebuild critical infrastructure, including shipyards. Many of which adopt the pre-fabrication method of the US

4️⃣US set up the Military Sea Transportation Service in 1949 (now Military Sealift Command) to handle sealift for the Dept of Defense, thereby reducing its level of dependency on the US merchant marine.

5️⃣ New cargo handling technologies are introduced, but a few - LASH, SeaBee, Roll-on/Roll-off - are not commercially viable and lead to the demise of some key shipping companies.

6️⃣ Federal-Aid Highway Act of 1956 leads to the creation of the Interstate Highway System. This reduces the need for coastal (cabotage) shipping as cargo shifts to trucks.

7️⃣ The introduction of DC8 and 707 in 1958 shifted the movement of people from rail and ship to plane. This opened up cargo capacity on the nation’s rail system.

8️⃣Colonial Pipeline 1962 saw a massive reduction in the number of product tankers needed from the Gulf of Mexico to the US East Coast

9️⃣ Vietnam War demonstrated the utility of the containership (see The Box) but the failure to invest a new program to sponsor ship construction until the MMA 1970, allowed Europe and Japan - using some of those protectionist methods you oppose - to surpass the US.

🔟The 1980s saw the end of construction differentials under the Merchant Marine Act of 1936. This witnessed the end of ship construction for ships in the international trade as the US Navy wanted to ship construction of their 600-ship Navy exclusively into private yards, but the end of the Cold War saw US yards lose not just commercial, but also military business.

So to summarize:

We didn’t hold other countries for economic ransom in 1946. How dare we.

Liberia has a ship registry.

We helped other countries have their own shipyards. How dare we.

The military sealift command uses its own ships.

Cargo handling techniques were introduced that were not commercially viable, so key shipping companies died.

The Interstate Highway System reduced shipping demand.

Airplanes reduced shipping demand and opened up rail capacity.

The Colonial Pipeline reduced demand in 1962.

The US government did not pay for the development of container ships in time.

The US Navy stopped subsidizing the commercial shipyards.

A lot of this is trying to say, oh, we have roads and trains and pipelines and airplanes, so who even needs ships? The rest (aside from #2 which is deeply silly, given the vast number of similar alternatives and that it’s irrelevant anyway) is ‘you didn’t give us enough money and subsidies, and didn’t extort or exploit our allies enough.’

And that all explains why we have approximately zero shipbuilding and zero ships, and we should keep having approximately zero ships to protect that approximately zero shipbuilding. It keeps us strong, you see.

Variously Effective Altruism

Coefficient giving renews its grant the GiveWell’s recommended charities, upping its commitment to $175 million for 2026. They expect a bigger growth in general grantmaking, since Good Ventures assets are up 50% in the last two years.

Scott Alexander provides various arguments against the ‘other people’s money’ argument against foreign aid, where people want all taxpayers to fit the bill rather than donating the money themselves. This is a classic free rider or coordination problem and most people are not libertarians, and also a lot of aid is about strategic national interests. Scott Alexander is very good at finding such arguments and exploring them at length and I think here he gets way too clever. There’s no mystery to explain.

I also think the large reference class of what Scott does here where he suggests labeling a box on your tax return ‘I request to cancel my participation in foreign aid this year and receive an $X tax refund. I understand this will result in Y amount of preventable death and suffering’ is rather obnoxious and toxic and if everyone in EA-related spaces stopped doing it that would help. Facts are very much not in evidence and oh boy do you piss people off when you talk like that.

They Took Our Jobs And Now I Can Relax

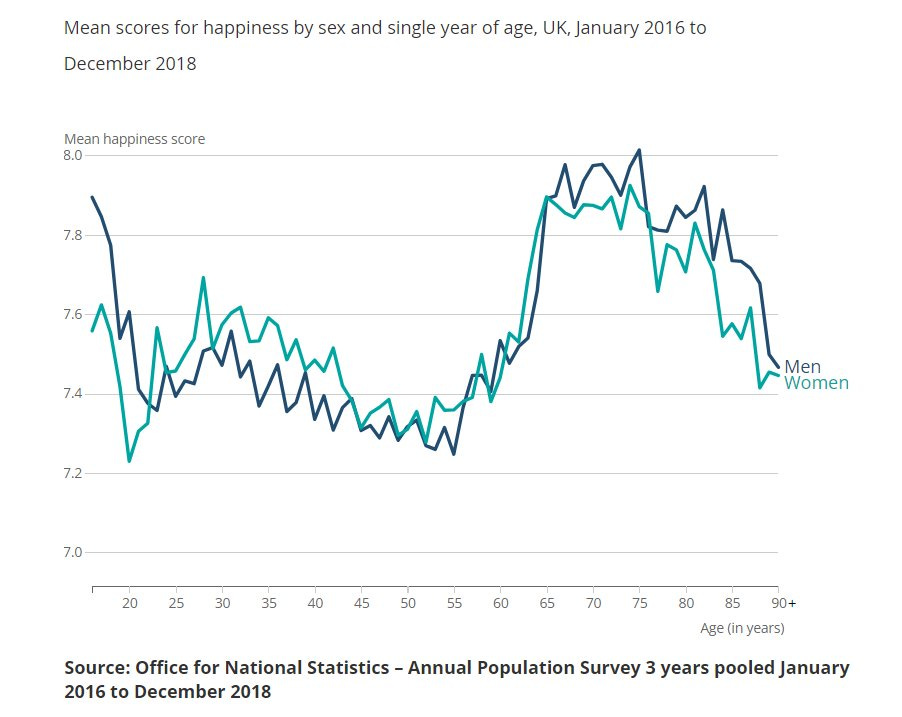

Note that this graph is only from 7.0 to 8.0, the moves are not that big.

Robin Hanson: If you are happiest when you are least impressive, influential, helpful, or desirable, do you really want to be max happy?

i/o: Men are happiest when they don’t have a lot of responsibilities.

It’s not as simple as not having responsibilities, but yes there is a substantial jump upon retirement, followed by declines as aging makes your body stop working, but the declines then are remarkably small. I have a hard time believing people at 90 years old are actually happier than they were at 50. Mostly it says happiness changes little.

While I Cannot Condone This

I recommend Bits About Money on fraud investigation. The central message is that fraud is a policy choice. We choose to stop being idiots and victims, although the optimal amount of fraud will remain not zero. We have various ‘get rid of most fraud’ switches and we choose not to press those switches. We have overwhelming amounts of Bayesian evidence we can use to identify or evaluate potential frauds, including that the same people keep committing the frauds over and over, they follow many basic patterns and use the same supply chains, and that most frauds collapse if you do basic probing for internal consistency. In contrast to our very expensive current required mechanisms like AML and KYC that do relatively little, these alternative methods would have trivial costs compared to the fraud prevented.

Peter Thiel claims all trends are overrated, which one files under the category ‘all generalizations are wrong.’ What he’s actually saying, as is often the case when Thiel says something superficially crazy, is something smarter. He’s saying that if someone claims their business is part of a trend and tries to use a bunch of buzzwords, rather than telling you what makes them unique, then nothing makes them unique, so run.

I essentially agree that it is very hard to sustain a ‘middle path’ for Jewishness, and I would extend this to other similar cultures or religions. You either go fully secular and assimilate, or you heavily invest in staying distinct, which involves a lot of time and focus. The full version is sustainable across generations, and the middle path essentially isn’t, so the kids have to pick a side.

Some are creating ‘analog rooms’ where no screens are allowed. File this under ‘things that seem cool for those who have substantially more space than I do.’

Tyler Cowen podcast with Frank Fukuyama, full of disagreement.

Good News, Everyone

SpaceX pivots from saying they are focusing on a city on Mars to saying they are focusing on a city on The Moon, which is a much more realistic goal. Wise, regardless of the level of seriousness about either of them. Investors are presumably valuing it at $1.25 trillion for entirely distinct reasons.

Department of Energy proposes a categorical NEPA exclusion for advanced nuclear reactors. Let’s go.

IFP proposes the Freedom Act to create permitting certainty and prevent politicians from shutting down project types they disfavor.

Maxwell Tabarrok offers brief thoughts on Christopher Alexander’s The Timeless Way of Building. I am sad that the Architecture sequence got lost to time due to conflicts with writing about AI. I think Alexander was spectacularly right remarkably often on both details and principles, although he got a lot systematically worse when he dealt with macro questions rather than micro and tried to hang on to wrong or obsolete impressions of how to organize an economy or wider area, or lets his collectivist streak interfere. But his micro observations are scary good.

If I had to point to one key insight, it is that our lives are largely made up of repeating particular patterns, and what is around drives you towards particular action choices, so instead of thinking generically you should engineer spaces around making the patterns you want to happen happen more often, in the most positive ways.

Despite the associated tax incentives, rich people mostly don’t borrow money against unrealized gains, that is under 2% of their economic income, whereas the unrealized gains are 29%-40% depending on how you count. The loophole should still be closed, but in practice it does not matter much.

Use Your One Time

You or your accountant can say the magic words ‘first time penalty abatement’ to the IRS and probably get a penalty waived, but you have to say the words first. If you do it then you can’t do it again for three years, so you don’t want to do it if the penalty is small relative to potential future or other penalties. but in most cases you should have odds.

Patrick McKenzie: I’ve never worked for the IRS, but I have definitely been that agent. It is dramatized in a few popular works of fiction, including the Incredibles, and so here is your friendly neighborhood infrastructure nerd saying this is very real.

It was, in my recollection, literally written down that we could not *tell* the caller about the existence of the escape hatch.

Trainee: Are we allowed to hint about the existence of the escape hatch?

Trainer: The rule is you are not allowed to tell the caller about it.Trainee: That didn’t answer my question.

Trainee: Didn’t it. Moving on.I was nowhere near sophisticated at reading subtexts at the time in life where I took that training to understand that different people in the room understood the trainer differently.

“This is bizarre and perverse.”

Retrospective review of the written rules, which must exist, will discover that they contain a rule which the company is extremely comfortable with defending. Retrospective review of the understanding of an 18 year old trainee is not a risk.“Can you say a few more words about ‘escape hatch’?”

The trainee will eventually work in a call center attached to a telephone and a computer program. Clicking a button in the computer program awards the caller money from the company.The company is not willing to have its CS reps push that button for no reason whatsoever, but in its considered judgement spends ~0 management attention reviewing the decision of $10/hr 18 year olds to click that button. So it trains them on a rule, and also on what the military would call “commander’s intent” about that rule, and to the extremely limited degree it trusts its Tier One CS workers, trusts that they are the final authority on clicking.

Note that I said ~0 management attention. My line manager once asked me whether I understood the button. Although I did not understand why he asked that question, retrospectively, it must have been because I was anomalous on a weekly report circulated back to him.

The entirety of that calculation.

Me: Yes sir I understand the button.

Manager: And you always had a reason to click the button.

Me: Yes sir I always have a reason to click the button.

Manager: Carry on, Patrick.“How costly was the button?”

I likely cost the company more by pressing it at the low-but-anomalous frequency I did than the company paid me in wages. Very within the model, right.And this is one reason why I, when talking to CS reps, sometimes whether is there a set of facts under which they have personal authority to click a button. Very few businesses specifically anticipate that question in the rulebook.

Hands Off My Phone

Remember that the 5th amendment protects your passwords but not your fingerprints.

So as a good principle, if it is plausible the US Government would try to get into your phone, and you wouldn’t want them to do that, don’t enable fingerprint unlock.

Runa Sandvik: The FBI was able to access Washington Post reporter Hannah Natanson’s Signal messages because she used Signal on her work laptop. The laptop accepted Touch ID for authentication, meaning the agents were allowed to require her to unlock it.

The Signal messages between Washington Post reporter Hannah Natanson and her source were set to auto-delete after one day; but Natanson consistently published articles directly quoting his leaks just days after receiving the information.

Patrick McKenzie: I think relatively few people should have the threat model “Adversary is US government and they will have physical control of my person and laptop while also respecting rules” but if that is you, don’t use biometrics, because they do not have testimonial privilege.

My layman’s understanding of the curious protection for passwords is you can’t be compelled to divulge a password because you can’t be compelled to testify that you own a device. That’s a pretty thin reed, but extremely useful for you and annoying for them, given functional FDE.

The general rule for enthusiastically cooperating with government regulations is that you want a government lawyer to give your lawyer a list of the documents they require in a well-lighted conference room and then to deliver the documents in the same.

The alternative is a conversation with an armed agent of the state while you are mutually quite stressed. That will not tend to redound to your benefit and so, while you can’t necessarily pick whether the state takes a strong interest in you or yours, you can do some planning.

n.b. This was part of the reason Uber had a turn-off-all-access-from-orbit button for their local offices. Some people, when they heard Uber had that plan, were furious that it was trying to stymie legitimate investigations into business practices.

I felt differently.Oh implicit context: The purpose of that button was a local office could e.g. Slack the security team “We’re being raided” and the security team would respond by remote locking ~everything.

Paul Roales: triple click on the side button on an iphone disabled face unlock and then you have to use a password

quick fast before any interaction with anyone officialPatrick McKenzie: Worth knowing that when the feds are serious about this they can start the interaction with a flying tackle or other physical contact to make it difficult with you to actuate devices.

Fun Theory

Let’s face it. Church and synagogue and other religious services are usually boring.

Doing the same exact thing week after week (modulo the sermon) is a tough ask, and it’s a much tougher ask now that we all have options.

Based in Christ: Church attendance has tanked over the past 40 years (though no one wants to admit it or talk about it).

I think a big part of the reason for this is that people simply find church services boring (even the megachurch concert ones). But no one really wants to talk about that either.Andrew Fleischman: The alternatives to church used to be a lot less fun

Sanjay Nadaraja: Not necessarily fun, but distracting and engrossing.

Kelsey Piper: I suspect this is usually why people do less X than in the 1960s for a wide range of X from church to sex to reading to parenting

A bunch of people point out that services are not supposed to be fun. I agree, but fun is not the opposite of boredom. If the service was actually moving you, if you cared about what you were saying, it wouldn’t be boring.

Then you miss out on all the other benefits of having a shared community and ethical system, regardless of what you think of the religious beliefs themselves.

I also saw people complaining about how church used to last an hour and now it is often ninety minutes. Can’t have that. Gotta keep it short and make it count.

Good Advice

Remember to reverse any advice you hear, but especially reverse the lies. Cate Hall highlights ‘the lies I used to tell myself’ and I can confirm they are indeed lies.

The full description is worthwhile, but the list is:

What doesn’t kill you makes you stronger.

When you know, you know.

If it were a good idea, someone would be doing it already.

If it’s worth doing, it’s worth doing well.

If you like your job, you’re doing something wrong.

“All people are insane. They will do anything at any time, and God help anybody who looks for reasons.”

Money can’t buy happiness.

Intuition is fake and rationality solves everything.

There’s some truth in all of them, and there’s a time and a place where each will be the right thing to say in the particular moment, but all eight are also importantly false.

The full negation of all eight would each also be false.

Cate also links to this ‘54 things’ list of claims by Mario Gabriele. She found herself mostly nodding along except for #33. I found it much more of a mixed bag. My instinct is that it is useful to skeptically think about such lists and ask where you do and don’t agree and why, and what the list overall says about the person and thus about the items on the list. Mario also links to several other lifehack lists: Alexey Guzey’s tells you a lot about him, Laura Deming gives us 10 mental models from 2020 that illustrates a very different focus, Nat Friedman presents a mode that you want to be able to visit, maybe quite often, but I wouldn’t want to always live there.

For Your Entertainment

As others have proposed before, what about choosing movies via swiping and then listing which movies everyone agreed upon? This doesn’t optimize because degree of preference matters, but it captures 80%+ of the requirement that everyone be down. I think you want to risk making this a little more complex and having more than 2 choices (e.g. swipe up and down as well for ‘hell yes’ and ‘hell no’ and a ‘hell yes’ cancels out a soft no if someone isn’t abusing it).

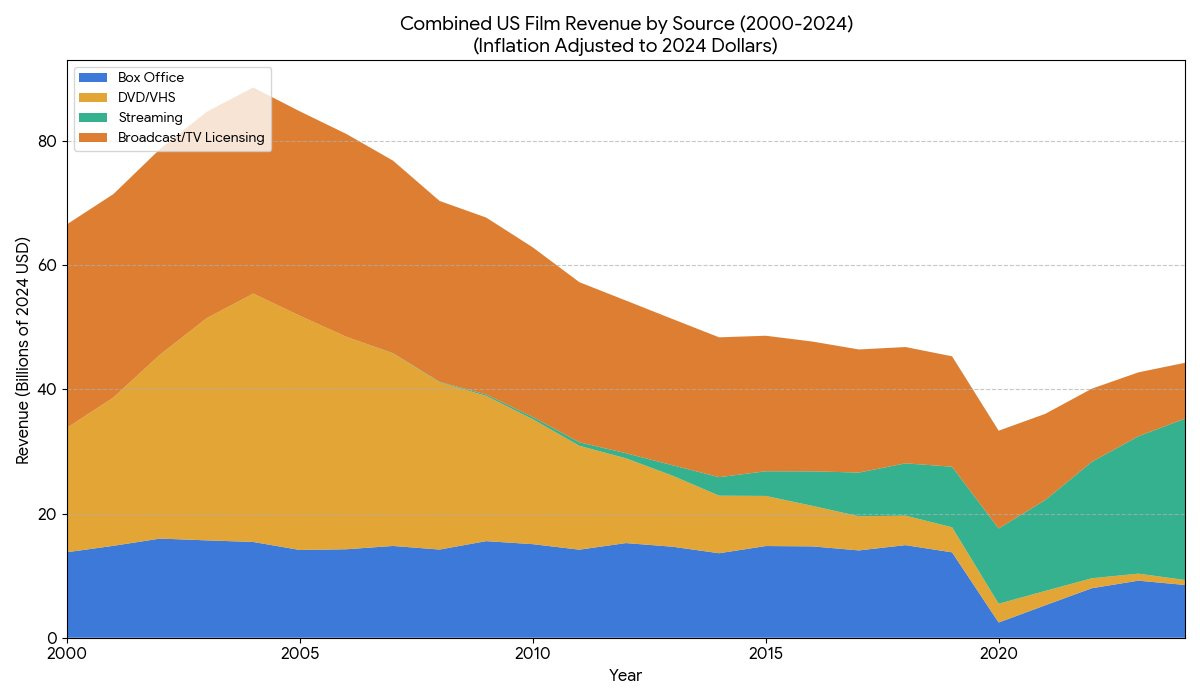

Film revenue has fallen dramatically and streaming as the new DVD or VHS is not making up for that much, although we’re seeing a recovery as streaming continues to grow and perhaps the worst is over.

As I’ve seen a lot more movies both at home and in the theater, I grow increasingly confident people underestimate theaters. Use the big screen, Luke.

Matt Damon explains that Netflix movies have to reiterate the plot 3-4 times because people are on their phones and their action movies need set pieces in the first 5 minutes.

Film students have such terrible attention spans, and so little interest in actual films, that it is increasingly impossible to get them to see a film at all, and good luck getting them to stay off their phones and pay attention. I did not realize how bad things had gotten. What I find most confusing is that these are film students, who want to study film and make film, and they still can’t do it. I do sympathize with the complaint that old movies can be painfully slow, but when a film student literally can’t name a film they watched recently, have only watched Disney films, or can’t sit through a showing, maybe go do something else?

Professors are split as to whether to accept this, or try to help students fix it. I strongly endorse the later strategy.

A common theme of movies set in either authoritarian regimes, or in the past, is that living under authoritarian regimes or in the past kind of really sucked a lot. As Matthew Yglesias points out, everyone everywhere has problems but you’d much rather have liberal democracy problems of family drama and anxiety in the style of Sentimental Value, in a modern liberal democracy, than you would have the problems of Hamnet where your children can’t get medical care (and you can’t communicate with your spouse easily when you have to live apart) or in Secret Agent when you’re in an authoritarian regime.

A very strong endorsement of the memoirs of U.S. Grant, and here’s a great anecdote.

Plur1bus

To not be left behind, I watched the first season of Plur1bus. It is intentionally extremely slow, including an entire first half hour or so that I would have cut outright. If this wasn’t by Vince Gilligan and something people talk about, I don’t think I make it out of episode one. I’m mildly glad I stuck it out.

As others have noted, it cares more about particular characters than its overarching plot. I was disappointed that they did what media often does now, which is take a potentially interesting philosophical or moral question, and then give one side an increasing set of reasons why ‘oh obviously they’re wrong.’ A recent example that isn’t much of a spoiler would be in the new Superman movie.

Indeed, not only have I ‘seen this movie before’ several times, as Carol puts it (upcoming link url itself is a potential spoiler in both directions so if you don’t want to know don’t look), I’ve seen this show before in quite some detail, including remarkably similar catches to tip the scales. Who did it better (so far) depends which aspects you care about.

Gamers Gonna Game Game Game Game Game

Kalshi partners with Lodge Card Club to offer live betting on the outcome of streamed poker events.

They’re also running some rather vile social advertising, of the type usually reserved for scams, in ways DraftKings and FanDuel did not stoop to. Please, stop doing this.

Polymarket user creates a new account to bet on the Super Bowl halftime show, turns out to (presumably) be an insider given he won every bet.

Fond memories of Civilization I. I tried to introduce it to my son because it is very discrete and has lots of cool things in it, as an introduction, but it ended up too confusing and requiring too much investment into knowledge

RIP Kai Budde. We’ll miss you, buddy. He was an amazing friend, teammate and coworker. Always in good spirits to the end. With him, knowing he’s just better than you didn’t sting. We’ve known this one was coming for a while and it still stings. A lot.

Is this a 3D model?: you have posted on Twitter 78,800 times since joining in March 2024 which means you are tweeting somewhere over 100 times a day on average. you should be more concerned with that then playing video games.

0x45: - surgeons who game make 37% fewer errors

- gamers make accurate decisions 25% faster

- 10hrs of gaming slowed cognitive decline by 7 years

- action games improved reading in dyslexic kids as much as reading programs

- 3D gamers scored 12% better on memory testsLiminal Warmth: Playing games have unambiguously improved my planning, strategy, and logistical skills and when younger, vocabulary and reflexes

But setting that aside its also been a pretty fun hobbyJakeup: is eating chocolate a “waste of time”? is frolicking in the meadows? making love to a beautiful woman?

bitch I’m not playing video games because it’s “linked to cognitive performance”. I play them because they’re really fun and the beautiful women are all otherwise occupiedtaoki: everything is a waste of time if you’re brave enough

Someone refusing to lie within a context that explicitly permits lying, such as games like Among Us or Diplomacy, is in my experience strong evidence that the person has a strong aversion to lying. The same goes for other simulated negative actions. As with many such heuristics, this would fall apart if there was reason for someone to actively fake this attribute, but you can usually rule that out and it almost never happens.

I’ve been playing through the Dragon Quest 2D-HD remakes. First up was Dragon Quest 3, now I’m on Dragon Quest 1, as this is the explicitly intended order.

My feeling on Dragon Quest 3 was that it was a fun game as a remake, but it had a few key flaws.

As with many old games, when you fix Quality of Life issues like how you save the game or what happens if you die, or you give too clear indicators of where to go, you disrupt key balancing mechanisms. The barriers, and having to figure things out, are inherent to a lot of the fun, including needing to fight your way to a boss.

The new Monster Wrangler class is basically a ‘you have to look up the info’ class, since it scales with how many monsters you catch, and it is clearly the way you are ‘supposed to’ beat the game given Wild Side. Way too many of the monsters and bosses in the late game will shut you out of casting spells, which forces you to switch over to Monster Wrangler.

It’s way too easy to randomly die in the later dungeons if you’re at levels that keep the bosses interesting, in ways that don’t feel fair.

For Dragon Quest 1, I’m not done yet, but I think it extends those mistakes and is largely a failure, because it loses the elegance of the original and tries to shoehorn in a lot of extra spells and extra story that I feel don’t add anything. I get that the original was basically one long grind, but that’s kind of the point. Also, you spend a lot of time during which healing during battles de facto doesn’t work, which means you just have to unleash and hope you don’t die.

But mostly the game destroys the key tensions in the original Dragon Quest 1, which is that if you push harder you might die and have to go back to the castle and lose half your gold, and also you need to map and figure things out. I’m still going to finish, but it’s kind of out of a sense of honor or obligation than that I’m having that much fun.

Tommy Siegel: every relationship needs one of each, i think

Liv Boeree: no the best is when you’re both green but use that shared love language to make the experience feel like yellow

Sports Go Sports

Successful soccer players tend to have many exceptional cognitive skills.

Discussion of the economics of the NBA trading deadline, as teams respond to their incentives and find loopholes in the rules. They need to hire some of us gamers to design better rules, especially around preventing tanking but also in other ways.

Then there’s tanking, where we all are talking price. Everyone agrees that NBA teams that can no longer compete are under no obligation to maximize their chances of winning more games. But how far should we let them go to lose as many as possible?

What is ethical versus unethical tanking?

Fullcourtpass: There is some “irritation” in the league about tanking teams trading for injured players, per @WindhorstESPN

“The topic of these long-range non-competitive maneuvers was raised at a recent NBA competition committee meeting.”Andy Bailey: Ending flopping and calling travels is a more direct line to a better NBA product, but everyone’s up in arms over tanking. And I find it especially ridiculous that people are trying to make the Jazz the fall guy, as if we didn’t just watch it work for OKC and San Antonio.

David Kenah: The difference -

Ethical tanking - intentionally building a less talented team that won’t win many games even with your best players

Non-ethical tanking - benching your best players for the 4th quarter because they’re winning.Zac Hill: I guess my issue with this construction, even if I do see what you’re saying, is: say the goal is winning not tanking. Isn’t the optimal win one where you a) risk injury for your premiere talent as little as possible while b) developing your weak talent as much as possible?

Zac Hill: “[Tanking] does not bother me. Does your conscience bother you?”

Mark Cuban has an excellent discussion of tanking and also roster design here, and an argument that the NBA should embrace tanking because it enhances rather than detracts from the fan experience.

One thing he points out is the dumb fact that you then have to lie to everyone and say you’re not tanking.

Derek Thompson points out that if landing the Next Top Player is ‘way way way more important’ than winning games today, because the players are generational, and there are tons of games that mostly only give you playoff seeding. So as long as losing sometimes gets you those players, tanking is inevitable. He contrasts with the NFL where individual players are less valuable (less than he makes it out, yes Sam Darnold won the Super Bowl convincingly but it turns out he’s actually Good At Job and the QB is like a quarter of your team, and NFL teams ‘should’ tank way more, but yes).

I see six schools of thought about ethical tanking.

Tanking is ethical, full stop, it is the league’s job to set the rules.

Tanking by the front office is ethical, tanking by the coach or players is not.

Tanking by nonplayers is acceptable, but not by the players.

Tanking by nonplayers is acceptable, but only to the point of indifference to winning or putting a competitive product on the field this year.

Tanking by nonplayers is acceptable, but only to the point of plausible deniability.

Tanking is fine if and only if your fans approve of it.

Tanking is never acceptable, how dare you, sir.

We can all agree that a player actively trying to lose the game is not acceptable, although if they decide to try a new play or be selfish with their stats, well, okay then.

I can see an argument for all six positions. I think for now the answer should basically be #6, if the fans cheer when you tank then the NBA is the one with the problem.

Ultimately the current lottery is half measure. I see a few different ways out of this, shortening the season would help a lot, but fundamentally you need to make it so that teams want to win the game. I see basically two ways to do that.

Method one is financial incentives. Put a financial value on each game. You can buy those top picks if you want, but they will not come cheap. Claude estimates that $3 million per game would mostly do the trick, and you’d have to adjust the luxury tax rate for obvious reasons. But, man, that’s good TV.

The other solution is to take away the incentive to tank entirely. Bite the bullet. All non-playoff teams pick in a fully random order, or something else drastic. You could get creative, and have a loser’s playoff or late season reversed incentive for the top pick in some fashion. Have fun with it.

You could also simply accept that tanking is fine, actually, and let it be in the open.

The Revolution of Retroactive Rising Expectations

Zac Hill: The other thing that happens in this discourse is that people get the timelines all wrong. This is now how the eighties and nineties operated!

ELI5 question from ngomes3824: Why Living in the 80s and 90s Seemed So Much More Affordable

A family of 4 used to be able to live relatively comfortably off 1 modest income in the 80s/90s (own a house, have 1–2 cars, maybe take 1 family vacation a year, build wealth, etc).

What specific factors contributed to the change to today where many (most?) young families need 2 full-time incomes just to pay the bills; and building wealth, such as buying a home, saving for retirement, paying off debt, and simply saving money, seem more difficult to achieve than it did 30–40 years ago?

There’s plenty of answers on why the financial side of things did get harder, I discuss this in The Revolution of Rising Expectations, but a lot of it simply that people are wrong about how things used to be.

Jordan McGills argues that what is driving the middle class feeling poor is that there are too many upper middle class people. He calls this ‘the great decomposition,’ saying the gap between 50th percentile and 80th percentile in particular has risen and bites hard.

I Was Promised Spying Cars

If [X] inevitably leads to [Y] in practice, then you can either choose [~X] or [Y].

Tyler Cowen: And even if you think that spyware could make those cars a security risk in Washington, D.C., due to spying possibilities, I am less worried about their proliferation in Quebec and Nova Scotia. Keep them out of Ottawa if need be.

Yeah, you can’t do that. You can’t have cars that are fine in Quebec and then not legal to drive into Ottawa. You have to pick a side.

That’s the same as you can’t say ‘oh we will build AI that can do [bad thing] we just won’t use it for [bad thing]’ whether that’s autonomous killer robots or deepfakes or whatever else you happen not to like. Doesn’t work that way, especially given open models. You mostly either build it or you don’t.

Prediction Market Madness

Unusual Whales has launched a tool to scour Polymarket for unusual activity and suspected insider bets. Joe Weisenthal predicts this will be a gold mine for spoofing, as in people make trades to pretend to be insiders. My guess is that there will be a lot less spoofing than the equilibrium would suggest, because people don’t do things, and no one will expect in their gut that it will work.

But yes, it will happen eventually. It is cheap to try this, and the gains can be very large, either in the form of ‘I trick people into following and then trade against them’ or ‘I trick people into trading on that basis elsewhere for orders of magnitude more money and I trade against them there’ or even ‘I convince people that [X] is going to happen, and this changes events.’

It will be very funny. The way there wouldn’t be spoofing is if there is already enough ‘natural spoofing,’ as in people who look like insiders but do stupid things for dumb reasons, to make insider bets not trustworthy. But so far we’ve seen that insider bet signals are, while not reliable, actually pretty good.

Vitalik Buterin is worried about the state of prediction markets, as they converge mostly on short term dopamine-heavy bets like sports and crypto.

He points out you need someone to lose money, which means one of three ultimate sources:

1. "Naive traders": people with dumb opinions who bet on totally wrong things

2. "Info buyers": people who set up money-losing automated market makers, to motivate people to trade on markets to help the info buyer learn information they do not know.

3. "Hedgers": people who are -EV in a linear sense, but who use the market as insurance, reducing their risk.

I would add:

Manipulators: People who lose money in order to try to change the market price.

Motivators: People who bet in order to change their incentives.

These are extreme descriptions:

You merely have to be bad enough that you lose money, not ‘totally wrong.’

You can subsidize in a wide variety of ways, AMMs are only the crypto default. And there are reasons other than info to want to subsidize a market.

Hedging includes arbitrage, including statistical arbitrage.

Nut basically yes. Either you have traders who get beat, who are hedging, or who are subsidizing the market, or who are manipulating prices or themselves.

I think it is inevitable that the bulk of the volume will be where there is the best product-market fit, and it will be on places where the information is not so socially valuable, like sports and crypto, over short time horizons.

I also think this is fine, as it serves several purposes.

It draws in liquidity and eyes, which can then be directed elsewhere.

It creates an incentive to draw in eyes or improve reputation, by providing socially valuable markets.

As in, at equilibrium, Polymarket and others should be creating some markets that are money-losing but that function as brand building and advertising. Polymarket should want to be the front page of the information system, where you get the ‘real news.’

On method of subsidy, the advantage of AMMs is that they are predictable, easy to implement and come with various nice assurances. The problem with AMMs is that most of the subsidy often ends up wasted, because you get run over, and make dumb trades, and don’t get the capture much of the benefits of two-way volume. The AMM is a deeply dumb trader. You can and should do better by doing something smart, that can fall back in a pinch on something dumb.

The Lighter Side

Scott Alexander: In a recent article on “the AI apocalypse”, Gareth Watkins of New Statesman condemns me for a statement I made in a SSC post. I described Kelsey Piper’s difficulty interfacing with doctors to renew her Adderall prescription, and said it decreased her effectiveness 20% and therefore “cost approximately 54 billion lives”. He says that “this is the kind of thinking that is considered serious by rationalists [and] why Sam Bankman-Fried was able to justify security fraud.”

I’m proud of my work reminding my friends to take their medications, but this statement was a joke. For example, there are only 8 billion people in the world, and even Kelsey probably cannot save each of them more than six times. I request a correction.

Kelsey Piper: Actually, it’s kind of a Buffy the Vampire Slayer situation where the world faces an apocalypse every month or so and I personally prevent them all.

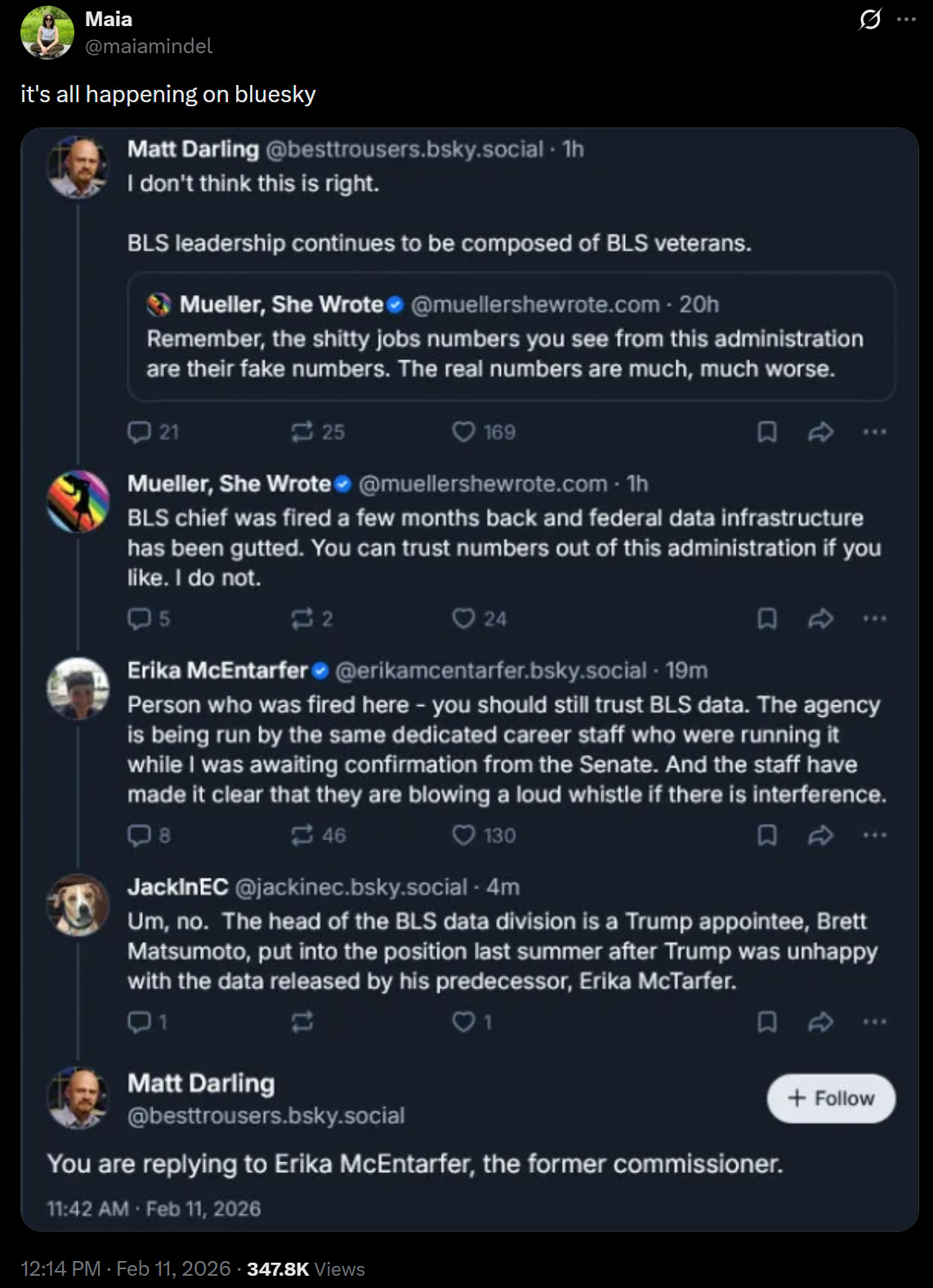

I find it annoying to have to tell people this, and yes, you can trust BLS data.

She’s real, and she’s actual size.

The Perfect Dark Girl: Bought another copy of Perfect Dark Zero today and the dude at the register held it up and looked back and forth between me and it LOL

I do respect, as Dan McLaughlin describes it, the instant classics.

This is a case of the ‘no wife, no horse, no mustache’ principle where you actively don’t want to know what the original tweet was, the mystery will always be better.

Judianna: Just made an addition to my bucket list.

Yes, that picture is AI. No, I don’t care.

I don’t think my wife would fall into this one, but there’s one way to find out.

tom cunningham: Cadillac tasks: I believe many estimates of LLM productivity boosts are over-estimates because people are using them for cadillac tasks: things that would take you a long time unaided, but have only marginal additional value.

Jason Crawford: Isn’t this confusing two different measures of productivity? You can measure amount of code produced or economic value produced—and of course those are not the same, because of diminishing returns. Of course when the code of code is reduced, the marginal tasks will be lower value

Kelsey Piper: today I said to a friend that I was pretty sure I could identify the century that historical battles happened in from a description of the weapons/tactics with all proper nouns removed. then I had Claude design a quiz so I could test this. this made me less productive.

Zac Hill: I just gotcha’d my wife by telling her this story and having her say “omg the things men do in their spare time” and then being all ‘ha-ha’; thank you for the hit of superiority ;)

Times when the apology only makes it better:

Dave: I was telling my sister that I’ve been going to the gym recently and my nephew said “you should go inside when you get there”and I don’t think I’ll ever recover from that.

Re the happiness chart showing the elderly as surprisingly happy, I assume it suffers from the (only quite recently identified) survivorship bias in such charts, viz. the happiness shown at any age is the average of those who survived to that age. Eg the figure for age 75 omits those who were unhealthy enough to die younger than that, who would hence have been unusually unhappy (health being a major factor in happiness).

So the chart is accurate but also kinda misleading. The 90-year-olds it shows as happier than average 50-year-olds are not the same kind of people; the former are unusually healthy & hence happy people. So (to your point) the 90 year olds probably aren’t happier than *they themselves* were at 50.

"Despite the associated tax incentives, rich people mostly don’t borrow money against unrealized gains, that is under 2% of their economic income, whereas the unrealized gains are 29%-40% depending on how you count. The loophole should still be closed, but in practice it does not matter much."

How is borrowing money a loophole? The loophole, if anything, is the stepped-up basis for capital gains on death. THAT is the loophole that should be closed. But it can only really be closed if you get rid of the death tax.